[This article originally appeared on Forbes.com]

Professional investors love railroads. Warren Buffett bought Burlington Northern Santa Fe outright in 2010 and Bill Ackman still owns 9 percent of Canadian Pacific after realizing huge profits on a larger portion of the shares that he had amassed in 2011.

Value Investors see these titans of the investing world succeeding in their railroad investments and naturally wonder if they should get on board as well. Our recent valuation of America’s largest railroad by miles of track and by market capitalization – Union Pacific (UNP) – suggests that the train has already left the station.

The valuation method we use (see other examples for Oracle, Ford and National Oilwell Varco) and teach in our training sessions focus in on the only three factors which can influence cash flow: Revenue growth, profitability, and medium-term profit growth.

Metrics of two out of the three key valuation drivers at UNP are fantastic. Revenue growth has been good and that profitability is phenomenal and trending upward; however, the last crucial element of value creation – medium-term growth – looks weak. The end result for UNP is a stock that is priced for regulatory and business perfection.

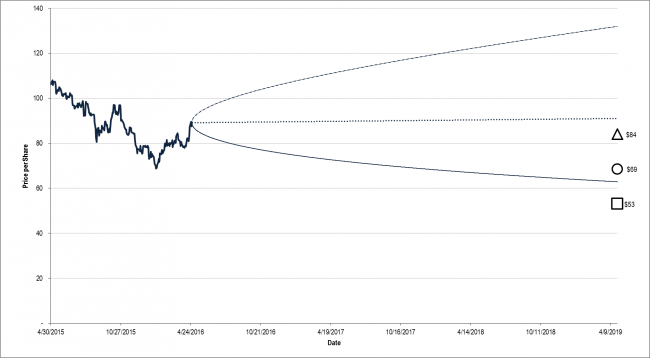

Figure 1. Source: CBOE, YCharts, IOI Analysis. The cone-shaped lines represent the range that the option market sees as UNP’s most likely future price. The triangle on the right represents IOI’s best-case valuation estimate and the square, our worst-case one. By our reckoning, the firm is overvalued at present levels but this valuation opinion is nuanced – please see the article for details.

Revenues

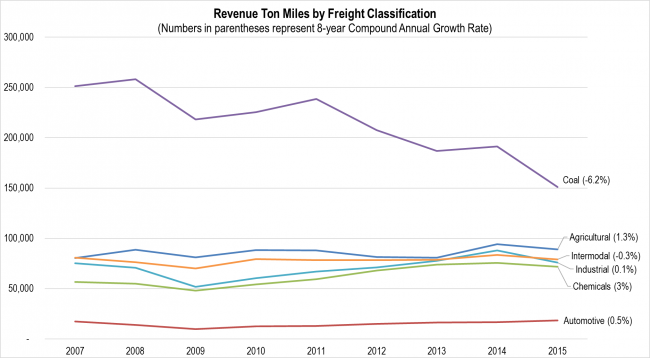

Revenues have increased at a compound annual growth rate of 3.8% over the last 9 years – truly remarkable for a company whose largest freight category (Coal) is facing a demand environment in secular decline and other categories’ tonnage is flat.

Figure 2. Source: Company Statements, IOI Analysis

The reason for the discrepancy is the pricing power UNP has over its shipper customers thanks to

- its monopoly / cozy duopoly (with BNSF) position and

- regulators that seem motivated to encourage the financial health of railroads at the expense of the financial health of shippers.

Successive administrations have made a tacit policy of regulating these monopoly / duopoly service providers with a light hand. There are two major railroads east of the Mississippi and two major railroads west of it with few signs of competitive pressure in either region. In this environment, railroads have been able to vigorously increase fees in the face of flat or declining volumes. In our view, railroads represent organs of economic policy rather than free market entities.

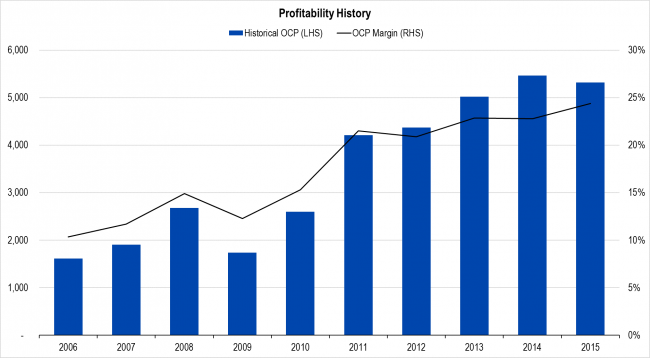

Profitability

Profitability at UNP is phenomenal. I looked longingly at UNP’s Owners’ Cash Profit (OCP) margins of the mid to high 20% range thinking of my beloved Tech giant IBM, which generates significantly less profit per dollar of revenue.

This profitability has been enabled by the company renegotiating its contracts with shippers, charging significantly higher rates that have been unchecked by regulators. The “legacy” contracts have been replaced by new ones and the rate of increase has slowed in all categories but coal – the last contracts to reprice.

Figure 3. Source: Company Statements, IOI Analysis

Medium-Term Growth

With a weakening demand environment and legacy contracts replaced with higher rate ones, the best chance for UNP to expand profits in the medium term is through efficiency increases. While this may be possible to some extent, we believe the lion’s share of efficiency-related profitability increases is behind it. Our best-case scenario for medium-term profit growth is 7% per year.

Valuation

IOI uses a discounted cash flow (DCF) model to value companies. DCF models have common weakness that the same cash flow projections will yield widely different valuations depending on the discount rate used. We reject the “orthodox” view of discount rates (which Buffett partner Charlie Munger also rejects and has referred to as an “obscenity”) and instead discount future projected cash flows using a standard discount rate “yardstick” of 10% for large capitalization companies.

The use of this discount rate implicitly assumes that the company is operating in a competitive environment. To the extent that UNP is benefitted by the regulatory environment and competes in a “gentlemanly” way with its regional duopoly partner, we do not believe that it operates within a competitive environment.

In effect, we consider UNP to be a government supported enterprise. We are unsure of what discount rate to apply to its future cash flows because we have no way to know how long the regulatory environment will remain benign. With a discount rate of 9%, UNP’s shares are fairly valued. With one of 8%, they are a screaming buy. We are unwilling to speculate about which of these is the “right” rate to use, so are pleased to value the company with our standard yardstick of 10%.

We believe the firm is overvalued using this common yardstick. Present shareholders run the risk of holding the stock during an unpredictable regulatory transition, but we cannot assess how likely that transition is to occur. As for ourselves, we would be more interested in investing if UNP’s shares were trading at roughly half its present price.

Much of the research for this analysis was done by a graduate of our valuation training programs. Here is a page that has more information about our next IOI 100-Series training course, to be held in San Francisco, California.