A new year, a new you!

Many of our new training course clients came to us over the past few weeks with a renewed sense of purpose and a resolve to become better at managing their personal investment portfolios. Here’s the advice we’re giving them.

Understand the proper use of passive and active investment allocations.

If you are an individual investor who holds more than a half dozen individual stocks in your portfolio, you are almost certainly cheating yourself out of returns and taking on unnecessary risk.

Countless academic studies and ample high-profile anecdotes have shown that it is virtually impossible for active managers – professional investors with elite pedigrees and virtually unlimited resources – to select a portfolio of investments that will beat a passive investment strategy.

For an individual with work or life commitments to expect to assemble a diversified portfolio of stocks that will do better than a cheap index ETF is the height of folly and hubris.

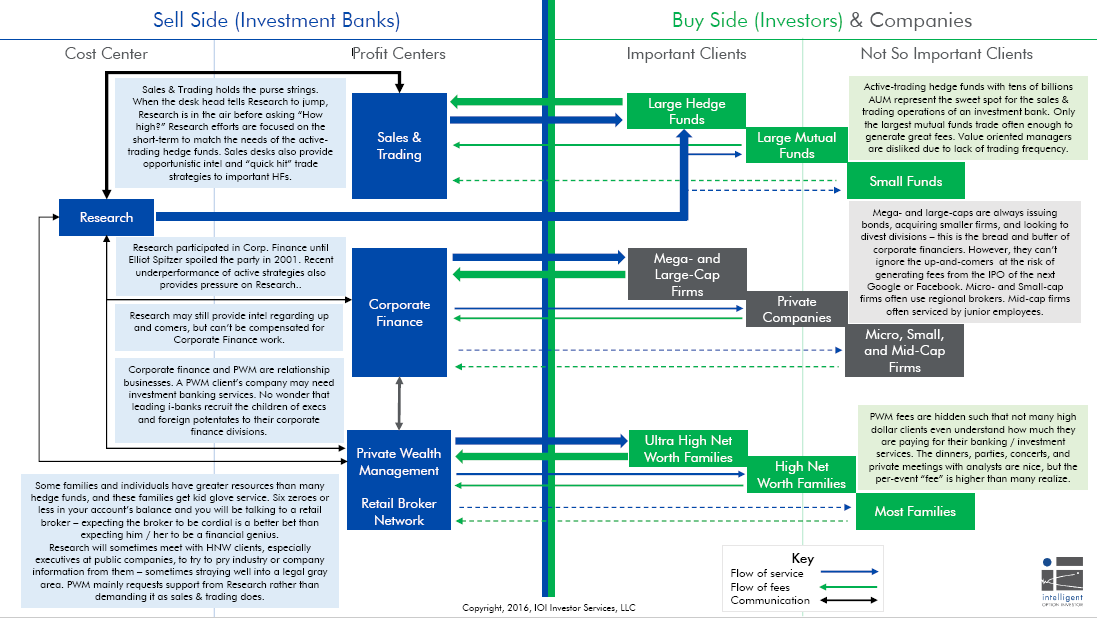

On the other hand, after working for years in this industry, I know very well that the Wall Street incentive structures create a situation in which many fund managers feel scared to break from the investing crowd and thus miss out on great opportunities.

As individuals, we need not worry about how much of a bonus our boss will give us at the end of the year, nor do we have to fret that a certain investment does not fit with the mandate of the fund. We can select any asset from any asset class and our investing time horizons are natural (i.e., Who cares what XYZ stock will do in a year when we have 20 years to retirement.

Because we individuals are free from the structural constraints and skewed incentives that plague professional managers, our individual investments may well outperform the market(substantially) over time. But we can’t do it with 30 stocks (there’s no way for a person to keep up with so many) and we can’t do it if we don’t understand how to confidently and competently assess the true value of a company (more about that in the next point).

The first step in the process of outperforming is simple: Understand what you hold in your portfolio and why. You do that by learning to assess the value of a company.

Understand how to assess the value of a company.

You are watching a three-minute TV news segment as a guest commentator encourages the audience to buy a bicycle shop. Her points?

- “More people are starting to want to get healthy and bicycling is a perfect way to do it.”

- “There is a very low regulatory burden to starting a bicycle shop.”

- “The bicycle shop you buy may turn out to be a huge success just like that other bicycle shop you heard of last year.”

While it seems ludicrous to buy a brick-and-mortar bike shop based on that pitch, how many other investors have you known to buy complex, multinational businesses after listening to some pundit or talking head on a cable business show?

Since the birth of the Internet, investors have been fed an almost unending stream of two things: data and anecdotes.

Data is important, but if you don’t have a framework to analyze it, it’s impossible to know which data points are most important. It’s easy to get lost in a sea of numbers, some of which can tell contrasting or contradictory stories!

Because the data is so hard to understand and sort through without a conceptual framework, the sad fact is that most people base investment decisions on anecdotes scarcely different from the bike shop anecdotes above. Doing so is building a house on sand. When the market falls, the anecdotes suddenly change, and investors without a sound foundation panic and sell – locking in their losses. They get back in only after the anecdotes are happy again – just in time for the next fall.

The great thing is that if you get engaged in your investments, learning to assess value is easy, and by making good decisions, you can make a big impact on your returns.

Understand what risk is and learn to manage it.

Here are a few definitions of investing risk among those in what we call “The Investing-Industrial Complex.”

- Professors: “Random price movement, up or down.”

- Brokers: “Not rebalancing your portfolio often enough.”

- Newsletter authors: “Not having access to their insights.”

None of these definitions have anything to do with true investment risk.

We believe that, for principal investors, risk is the inability to meet an economic need or desire due to a shortfall in available funds.

Who cares if the S&P falls by 4% tomorrow? That is not risk unless you have a highly-levered position betting on a market rise that will wipe you out if you are wrong (this was how Nick Leeson bankrupted Barings).

There is no way to understand how to manage the risk inherent in both passive and active investment strategies if you don’t have a clear, objective view of what your real risks are. In the end, as Warren Buffett says, “Risk is not knowing what you’re doing.”

That’s it! Three simple points that, if diligently followed, are guaranteed to increase your investing confidence and make you a better investor.

This article originally appeared on Forbes.com