The biggest financial story of our lifetimes was published this week. Wall Street paid it no heed.

True, markets have declined modestly for a few days, driven by – pundits say – general worries about increasing long-term Treasury yields, trade frictions with China, and / or weakness in emerging market economies.

These issues are, however, small potatoes.

The biggest financial story of our lifetimes is the report published Monday by the Intergovernmental Panel on Climate Change (IPCC) that found it likely that if drastic action – the magnitude of which has “no documented historic precedent” – were not taken, the global economy would experience severe disruption by the year 2040. (The failing New York Times published a good article summarizing the report.)

Before you pooh-pooh my contention that the IPCC report represents the most important financial news of our lifetimes, consider this chart of Walmart’s WMT forward price-to-earnings (P/E) ratio over the last six months.

Figure 1.

Over this time, Walmart’s forward P/E ratio averaged 18.5x. This means that the earnings the company is likely to generate over the next year only represents (1 / 18.5 =) 5.5% of the total value of the enterprise, as assessed by the market. Or to frame this in different terms, 94.5% of Walmart’s perceived value depends on the assumption that the company will continue to generate ever-increasing earnings in perpetuity.

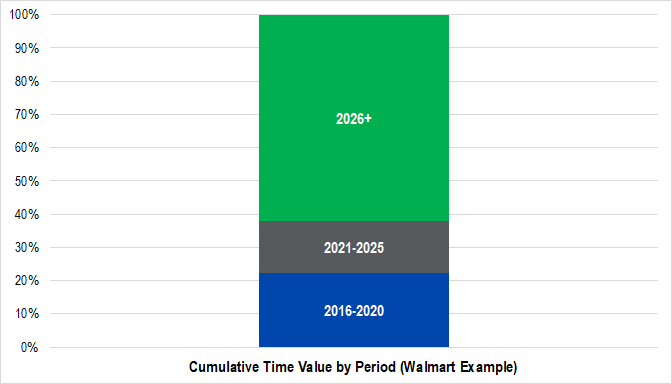

From a fundamental standpoint, I valued Walmart in August of 2016 at $91 / share. In that valuation, 16% of the valuation ($14.56 / share) stemmed from my projections for the company’s cash flow growth between the years 2021-2025; another 62% ($56.42 / share) stemmed from my projections for the company’s cash flow growth starting in 2026.

Figure 2. Source: Company Statements, Framework Investing Analysis

The time difference between 2026 and the IPCC date of 2040 represents only fourteen years – well within the investing lifetime of someone like my daughter, who was born at the turn of this century.

I picked Walmart as an example because I knew that it was furthest from being an outlier in terms of the value of various parts of its future assumed cash flows (try the same calculation with Amazon, whose most recent forward P/E ratio was 99x).

The dirty little secret of Wall Street analysts is that every company’s value is determined not by whether the company misses or beats EPS guidance in the next quarter – the issue that 99.9% of all analysts direct their focus. Rather, company values are determined by the simple assumption that the company is a “going concern” and will generate a perpetual income stream for its owners.

The prospect of catastrophic effects from climate change – while distant in the terms that elected officials, investors, and the public conceive of them – represents a very real threat to the value of real and productive assets simply because most of those assets’ values are tied to the going concern assumption.

The most recent (fake) Nobel Prize for Economics was awarded to William Nordhaus of Yale and Paul Romer of New York University for the former’s work on the economic effects of climate change and the latter’s work on the value of governmental incentives in technology development.

The fact that the Nobel was awarded on the same day as the publication of the IPCC report might be a coincidence, but if it is, it is a convenient one.

Global warming has the very real potential to drastically change the rules of the game that investors have been playing for the last 100 years. The IPCC report makes it clear that the rule change has a good chance of occurring within my lifetime. Anyone with an ownership claim on a long-lived asset – whether that asset is a lake house, an ETF, or a stake in an international retailer – faces a real risk of an enormous loss.

This is the biggest financial story of our lifetimes. It is time to pay attention.