After publishing the IOI Tear Sheet on Caterpillar the other day, long-time reader Ben L. wrote a note asking why I featured the 115-strike put option. I am just preparing a ChartBook for Caterpillar and wrote a full section discussing strike price and tenor selection in the ChartBook. I’m publishing that section below and will post the ChartBook later today.

This investment is structured as a long ITM put option, which can be considered as a short position with a hard stop-loss set at the strike price. There are several reasons why we structured the investment in this way:

- Valuation

- Time value

- Market risk

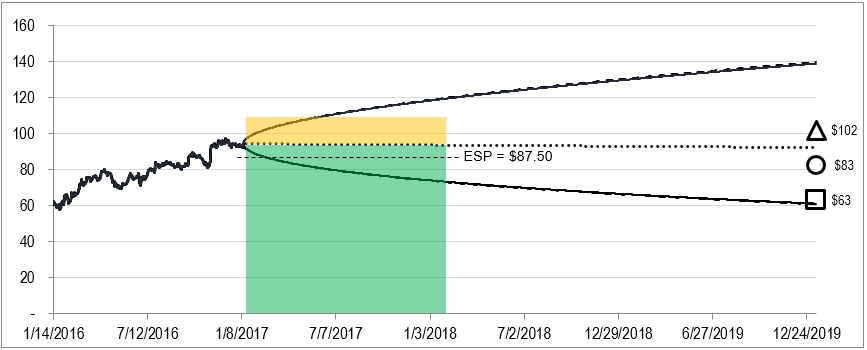

Regarding the valuation, looking back at the figure below, we see that the equal-weighted fair value (i.e. the average of the best-case scenario and worst-case scenario) is $83 per share.

Figure 1. Source: CBOE, YCharts, IOI Analysis

We would like to pick a strike that would allow us a reasonable profit if the stock is trading at the equal-weighted fair value mark when the option expires. This would suggest a strike price at $85 or $90, which, for reasons we discuss below, were unattractive to us.

If one did not wish to set aside a large amount of capital for this investment, as is necessary for the ITM investment, one might make a more speculative investment that the true value will gravitate toward one of the lower scenarios and buy a far OTM put option. We discuss that structure at the end of this section.

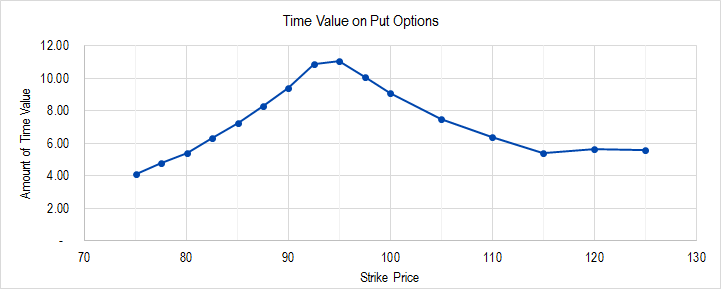

Regarding time value, the chart below shows the time value for each put contract struck from $75 to $125 on the day we published our Tear Sheet.

Figure 2. Source: CBOE, IOI Analysis

Recall that for a positive “expected value” investment (i.e., one that would yield a profit if the stock was at our weighted average valuation at option expiration) we would need to buy the put option struck at $85 or $90.

Time value on the 85-strike put option was $7.25 implying an effective sell price (ESP) of ($85.00 – $7.25 =) $77.75. Time value on the 90-strike option was $9.40, implying an ESP of $80.60. Since both ESP’s are below the expected value, using either of these options would result in a negative expected value investment, which is never a good idea!

In fact, the first positive expected value investment is the put option struck at $95, and as you can see from the chart, the time value of that option is at its maximum (because that was the ATM strike price). Our strike selection of $115 was mainly based upon trying to minimize the time value we were paying while increasing our the dollar return of our investment from an expected value basis.

The put option struck at $105 had $2.10 more of time value than the put option struck at $115. This means that an investor in the $105-strike option would have to realize an additional loss of $210 per contract up front – an increase of nearly 40% over the loss one would realize with the put option struck at $115.

The put option struck at $110 only carried about $1.00 more time value than the 115-strike, so one might chose to conserve capital by buying the 110-strike put option as shown in the diagram below:

Figure 3. Source: CBOE, YCharts, IOI Analysis

Selecting the 110-strike rather than the 115-strike, the ESP is pulled down from $88.45 to $87.50.

Buying an ITM option implies the position will have less leverage than one purchased OTM, and requires the investor to risk a greater amount of capital. However, it is more “forgiving” in that the position can be profitable with a smaller downward move in the stock price.

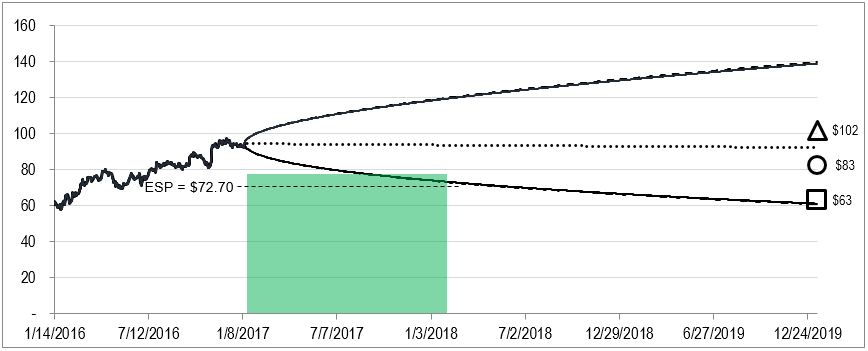

The OTM structure mentioned earlier might take this form:

Figure 4. Source: CBOE, YCharts, IOI Analysis

Here, we have selected the 77.50-strike put option that was asked at $4.80 at the time these data were taken. This would generate a profit if 1) the stock price fell sharply relatively quickly and / or 2) the price declined to one of the lowest valuation scenarios.

It is worth noting that we selected expirations roughly 1 year in the future even though the 2-year LEAPS were also available. The time value was much higher for the 2-year leaps due to Caterpillar’s very high dividend yield. The buyer of a put option basically has to pre-pay the amount of expected dividends, so we wanted to minimize the number of dividends we were paying for while also getting as good a per-day price for time value as possible.

Our final reason for selecting the 115-strike put option was because our Price-to-Sales analysis of market risk suggested that the $115 level was as high as the shares were likely to go. Our calculation simply takes the average of our best-case revenue scenarios over the next five years and multiplies it by (in this case) the top quartile Price-to-Sales ratio over the past 10 years. We do not pretend to know what market prices will do in the future, but believe that this metric provides a structure for considering strike price placement.

Obviously, there are several valuation scenarios above the present stock price and the investment’s expected value outcome is fairly low, so we are considering opening up only a small allocation with a plan to add more if and when the stock price moves up.