Greenland’s Kangerlussuaq icesheet (Wikipedia)

It is 7:30 in the morning and you are on the freeway heading to work. Traffic is moving along smoothly, and your mind turns to matters other than commuting – the jerk at the head office, your dry cleaning that will be ready in the evening, your kid’s dental appointment…

Suddenly, you glance up in horror to find the sight of brake lights filling your field of vision.

The natural human reaction is to widen your eyes, slam both feet on the brakes with all your strength, and prepare yourself for the accident that you are now – regardless of religious conviction – praying will not occur.

Faced with the same situation, no one on earth would close their eyes, jam their foot down harder on the accelerator pedal, and nonchalantly adjust the volume of the radio.

Strange as it may seem, the counterintuitive reaction is the one that we as a species are undertaking right now in the face of climate change.

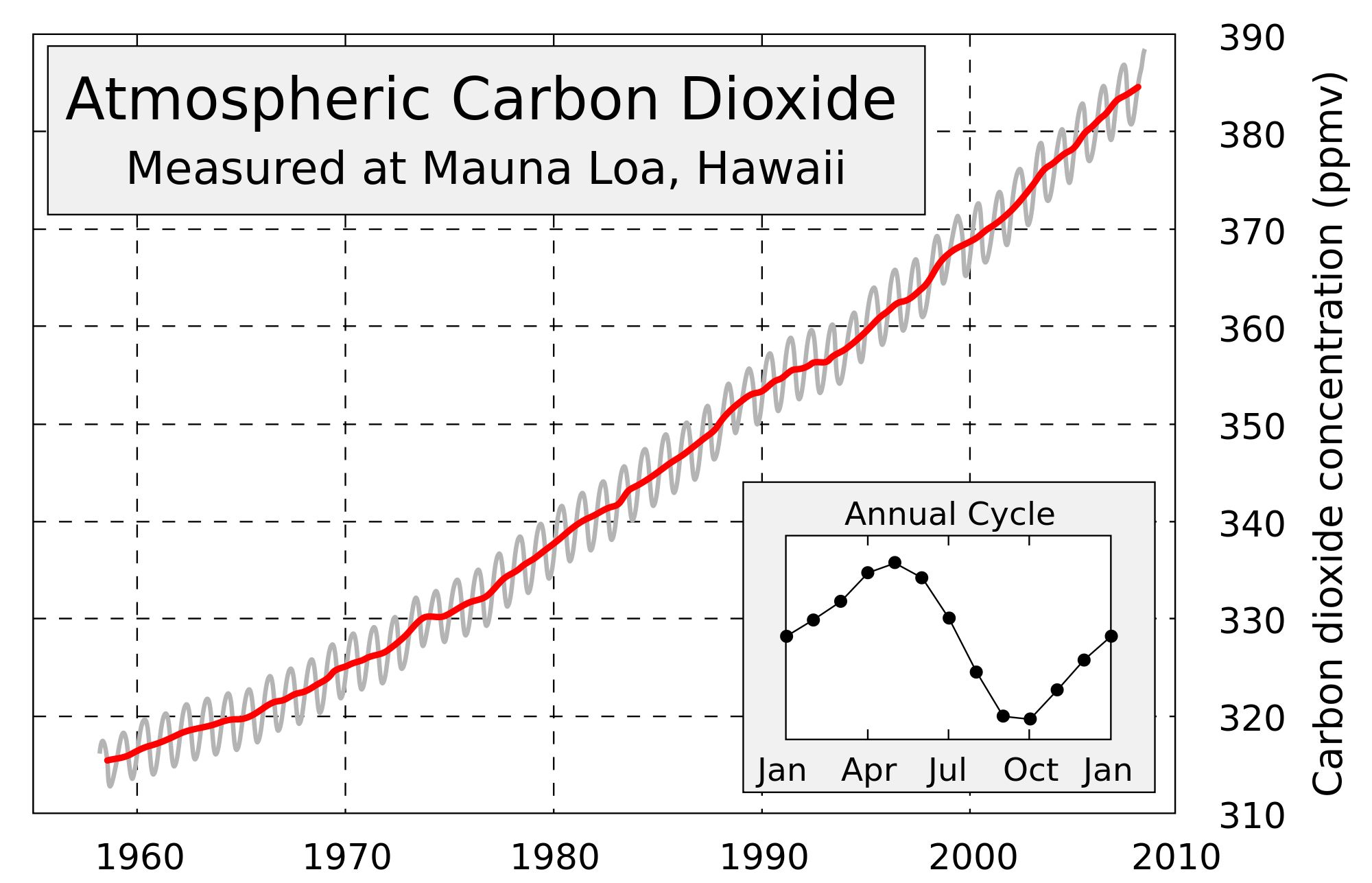

The latest dose of climate reality came yesterday, in the form of three academic papers. The message of a pair of them can be summed up in one of their titles: Global energy growth is outpacing decarbonization. The contentions of that study were backed up by the findings of the other – namely that, after a three-year hiatus, global atmospheric carbon levels started to increase again in 2017 and were charging ahead in 2018 at a frightening pace.

For non-scientists like me, the New York Times coverage of these papers is very approachable and includes an excellent graph of carbon output by geographical region – I highly recommend reading it.

The third paper finds that the pace at which the Greenland ice sheet is melting is ‘off the charts’ compared to the last 350 years.

According to Dr. Luke Trusel, the study’s primary author:

Melting of the Greenland Ice Sheet has gone into overdrive. As a result, Greenland melt is adding to sea level more than any time during the last three and a half centuries, if not thousands of years…

For those of you thinking that these studies have nothing to do with investing, think again.

Melting of the Greenland ice sheet directly impacts the value of companies like publicly-traded The St. Joe Company JOE, a developer of Florida real estate featured in an earlier article. I’ll run the risk of repeating myself and say again that, as best as I can figure, JOE’s assets are worth a lot closer to zero dollars than its presently-traded $900 million.

The WindMark development is a few minutes away from the spot that Hurricane Michael’s eye made landfall. Scientists believe that all of St. Joe’s beachfront property will be underwater due to the effect of rising sea levels.

That’s a small cap name, but imagine the potential legal liability to be borne by the owners of ExxonMobil XOM, whose own senior scientist, James Black, knew in 1977 that the climate was being influenced by the burning of hydrocarbon fuels.

In 1978, Black warmed that doubling CO2 gasses in the atmosphere would increase average global temperatures by two or three degrees Celsius and that mankind had a window of ten years or less (in 1978) to take action to prevent the rise.

What percentage of ExxonMobil’s present $327 billion market capitalization is at risk of legal action over the next 10 years?

A diver swimming over the corpse of a coral colony

That’s the bad news: the investment paradigm on which the value of assets like these teeters is a bug waiting for a windshield.

The good news is that there are innovative companies on the verge of opening up an entirely new paradigm.

Yesterday, I spoke with an influential investor in alternative energy firms. One of the companies in which he is invested, a Canadian firm called Carbon Engineering, is the brainchild of a Harvard scientist David Keith. Carbon Engineering, which has also received funding from Bill Gates and oil baron Murray Edwards, has found a way to pull carbon out of the atmosphere and convert it into fuel that can be used in current transportation mainstays – gas-powered cars, trucks, and airplanes.

This is a truly revolutionary technology and company, about which I will write a longer piece soon.

A CGI representation of a Carbon Engineering collection facility

Another firm in which the alt energy investor has placed capital is the Nevada-based firm Fulcrum Bioenergy, which has teamed with several large partners to commercialize its process to convert household waste to transportation fuel.

Fulcrum Board members Tom Unterman, Lee Bailey and Jim McDermott, Nevada Governor Brian Sandoval, Fulcrum President and CEO Jim Macias and Storey County Manager, Pat Whitten break ground to commence construction of the Sierra BioFuels Plant (PRNewsfoto/Fulcrum BioEnergy, Inc.)

Looking at the next 12 months, these ventures seem risky. The value of their intellectual and tangible assets is linked to such inscrutable factors as the price of Californian Low Carbon Fuel Source (LCFS) credits and the price spread between crude oil and natural gas.

However, if you extend your time horizon out by a mere 10 years, the risk of these ventures begins to look negligible compared to their potential to create wealth on behalf of their owners.

The “monkeys-on-crack” investment paradigm popularized by bubbleheaded CNBC hosts frames 10 years as an eternity, but for those of you not held under the sway of that form of insanity will realize that a 10-year investment horizon is a natural one for a 55-year old investor looking to retire at 65.

Open your eyes. The future of the investment world is being shaped by a completely foreseeable cluster of events that French-cuffed trading desk millionaires will someday rue as “Black Swan” events.

As the alternative energy investor memorably told me “Science doesn’t care what trading desks are saying.” Neither should you if generating and preserving intergenerational wealth is important to you.