An institutional consulting client had asked me for my thoughts on reasonable modeling growth rates. Some analysts try to forecast a “realistic” looking series, whereas others (myself included) prefer simply to make straight-line estimates.

In our recent Office Hour sessions where we have been building a valuation for Under Armour (UA / UAA), the topic of growth rates has come up a few times, and we have talked about how to model reasonable ones, so I thought it was worth writing about in more detail.

The discussion below is about cash flow growth rates during the medium term, but the same arguments can be made for revenue and profit growth as well.

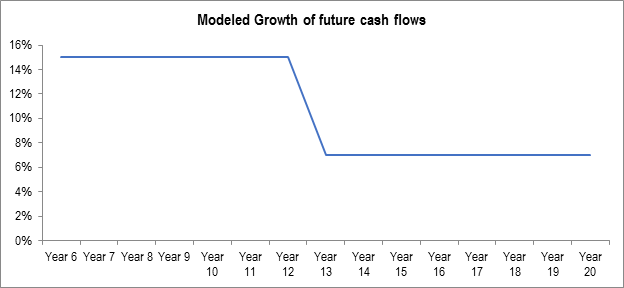

In many models, the transition from one valuation stage to another show some quantity decreasing (usually) or increasing in a step function. If we were to graph this, it would look a bit unnatural and, some may think, unreasonable:

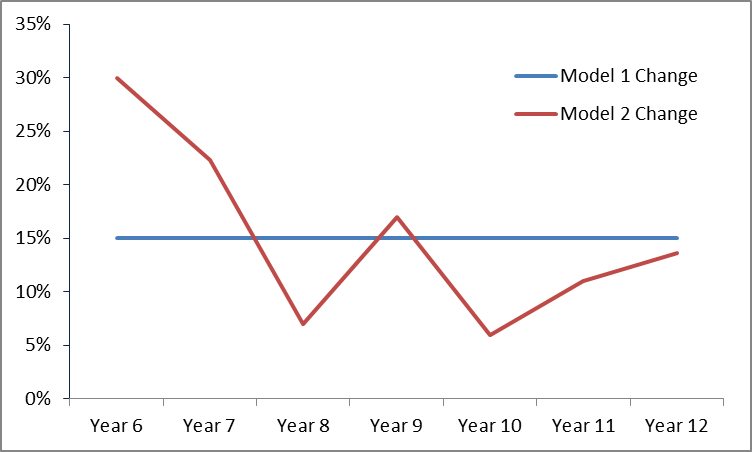

Step functions like this are seen in the revenue and cash flow series of companies, but most people like to think of more smooth transitions between one state and the other, or believe that such straight-line growth rates are unreasonable in the first place. Let us, however, look at two different models of cash flow growth. Both end the Year 5 explicit period generating cash flows of $1,000; for Model 1, I have made the same “unrealistic” straight-line assumption as pictured above; for Model 2, I have set growth rates to be “realistic”—varying from year to year and slowly trending downward. Here is what the two growth rates look like on a graph:

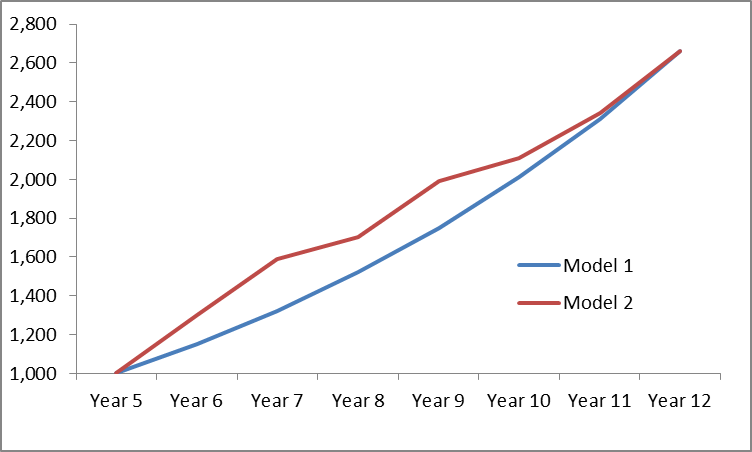

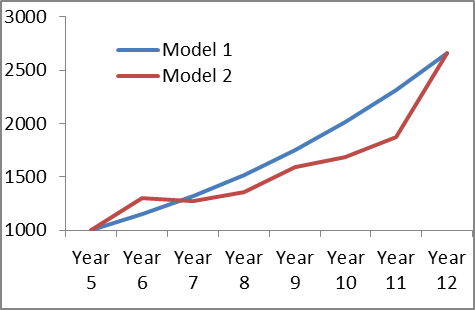

However, if we now graph the cash flows generated every year, here is what we see:

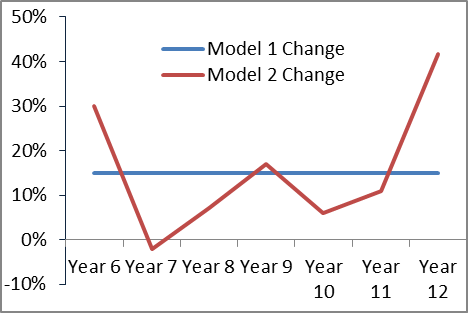

Here, we can see that during the time covered by these graphs, the company generates slightly higher cash flows under Model 1 than Model 2. However, both models end up at the same cash flow figure in Year 12, which is the year we use as a base to calculate the value of the perpetuity. In addition, Model 1 is highly sensitive to year-to-year assumptions. Were our “realistic” forecast to include a drop in cash flow in one year, followed by a sharp rebound the next, net cash flow generation over the period might indeed be higher in Model 1 than in Model 2, as shown below.

The point of this discussion is that while an analyst’s mind might reject straight-line assumptions based on an average growth rate on an intuitive basis, in actuality, it is probably not a bad approximation after all in many cases. What’s more, attempting to factor in specific drops or rises in future cash flows past a period which an analyst has good visibility (recall that we are dealing with the stage 2 growth here) can hardly be said to yield marginal improvements in valuation accuracy that would offset the amount of time spent in dreaming them up.

The moral of the story is to spend mental time and energy thinking what a reasonable growth rate will be over the entirety of the above-trend period and waste as little as possible making falsely precise forecasts of something about which you have little basis for rational belief.