A reader of The Framework Investing just wrote Erik with a good question about what the book calls “The most useful of the Greeks”–Delta. Many people have heard the term “delta hedging” and have at least a vague sense of what that is, but not a lot make the connection between delta and the probability that a stock will be at or above a certain stock price at expiration. See the following exchange to learn more about delta and its cousin, “Gamma” and how to visualize thesse measures.

Question from Leishing L.

Hi Erik,

I actually just started reading your book. I had some option trading experience, so jumped right to Chapter 7 of your book! I have a few questions:

1) on p.155, you mentioned you web application for BSM cone, but I can’t find any URL in the book for that web application. I guess it’s on

www.intelligentinvestor.com, but can you point me to the right location? Do I have to register/subscriber in order to use that Web App? Do you have any online resources associated with this book?

2) on p.151, you talked about “Delta”. You emphasized its importance because it’s the probability that the stock will expire above the strike

price. My understanding is that this is not the original definition of?”Delta”, but many people use it as “expiration probability”. However I

heard that mathematically “Delta” and “expiration probability above that strike price” sometimes might not be even close. What do you think? Also,

practically how reliable can we use Delta as “expiration probability?

My questions might sound naive, but if you can clarify, that would be great.

Thanks a lot in advance,

Leisheng

Erik’s Response

Hi Liesheng,

Thanks for your mail–happy to help out.

On your first question, about the tools, there is a link on the IOI website, but you can also get to it through www.IOITools.com. Right now, there is a two-week trial period followed by a low-priced paywall. The tools are pretty primative, and I’m working on 1) replacing the paywall with advertising banners for low-function tools and 2) building higher function tools behind a more expensive paywall.

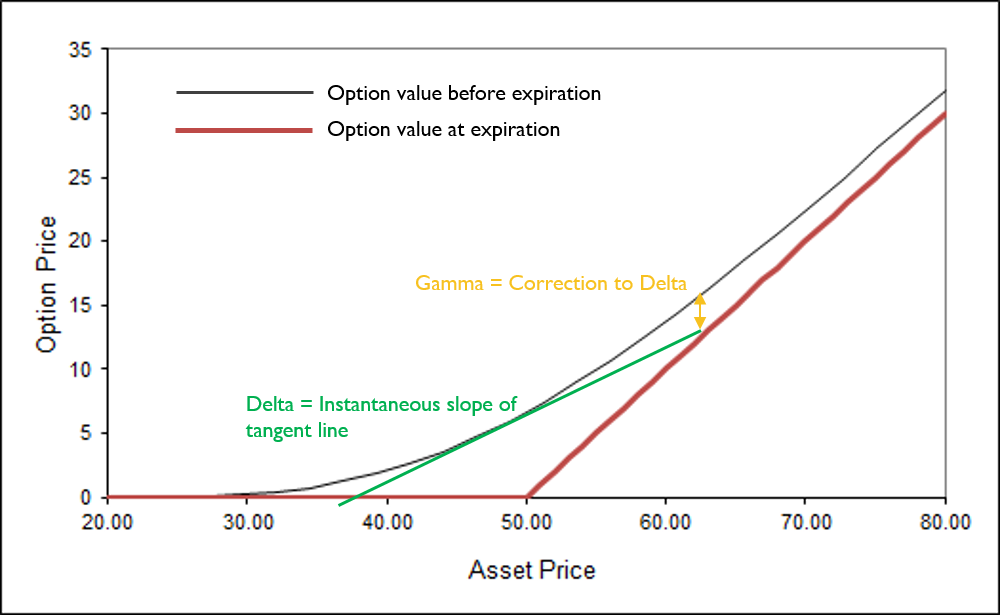

On your question about delta. Delta is formally mathematically defined as the first partial derivative of option price with respect to underlying price. However, it is also represents the number of stocks you would need to hold to perfectly hedge a short option position. (If you have Hull’s book, take a look at p. 210 — I’m using the 5th edition or just look “Delta” up in the index if you have another edition). This latter sense is where the term “delta hedging” comes from, and delta is also sometimes called the hedge ratio.

Delta is a good instantaneous?estimate of the proper hedge ratio and the hedge ratio is showing exactly what the probability is that a stock will finish above (calls) or below (puts) the option strike price. Market makers rely upon this to hedge their positions, so if the delta did not work in this way, the derivative market would be in tough shape.

I mentioned this was the instantaeous estimate. You can think of it as the tangent line to the price curve of an option before expiration.?If the price of the underlying moves quickly, the delta will no longer be correct because delta is a straight line and the value of the option is a curve. A straight line can only describe the slope of a curve at a specific point, so if the stock price moves quickly (called in finance a “discontinuous jump”) the delta estimate will rapidly change. The correction term for delta is known as “Gamma”.

Even for people who have experience with options, I think you will get a lot out of reading the first part of the book. Here, I explain how option pricing models work, both in terms of forecasting future stock prices and in pricing options.

Thanks again for reaching out. Hope you continue to enjoy the book!

All the best,

Erik