Executive Summary

- Express Scripts (ESRX), a company about which we have done extensive research, tonight announced that its largest client, Anthem (ANTM) would likely not renew its contract set to expire in 2019.

- Shares of Express Scripts fell heavily on this news after hours.

- We do not see a bullish investment opportunity in Express Scripts, and urge readers not to be tempted by “high vol” or analyst opinions about the company being a “bargain.”

Background

Long-time reader, Wilson M. sent a mail through this evening letting me know that Express Scripts (ESRX) was trading below our most recently published worst-case valuation and asking me if this price drop might present an investment opportunity.

Figure 1. Source: Interactive Brokers

I have written extensively on Express Scripts starting in 2015 as it was a large holding of my father’s when he passed away, and I wanted to figure out whether my family should continue to hold it. My conclusion was that we should not, though it took a year or more to come to it.

In our 2016 ChartBook on Express Scripts, we observed that while the company had built the dominant PBM (Pharmacy Benefits Manager) for the last decade, it seemed to be wrong-footed for the upcoming one. Specifically, it looked to us that PBMs were either shifting to a model that included a retail pharmacy (e.g., CVS Caremark) or which were incorporated into an insurer (e.g., United Health) and that it seemed Express Scripts was left dangling – especially after Walgreens Boots Alliance sealed a PBM agreement with a competitor.

In the 2016 update, we also pointed out that the PBM business was a zero-sum game, so that any business gained by one party necessarily represented a loss to another.

The final nail in the coffin for us occurred at this year’s Grant’s Conference, when Gilchrest Berg (a Julian Robertson protégé) called Express Scripts out as a business that should not exist in its present form, or at least not at its present profit level.

I had already trimmed the position in my family’s account significantly since publishing the 2016 report, and sold off the rest after meditating upon Berg’s comments.

Tonight, my fears about Express Scripts’ business model turned out to be justified. The company announced that it would likely lose its largest client – Anthem (ANTM) – in 2019; Anthem generated nearly one-fifth of its revenues in the last quarter. This is one of the rare financial announcements which qualify as material information about the valuation of a stock.

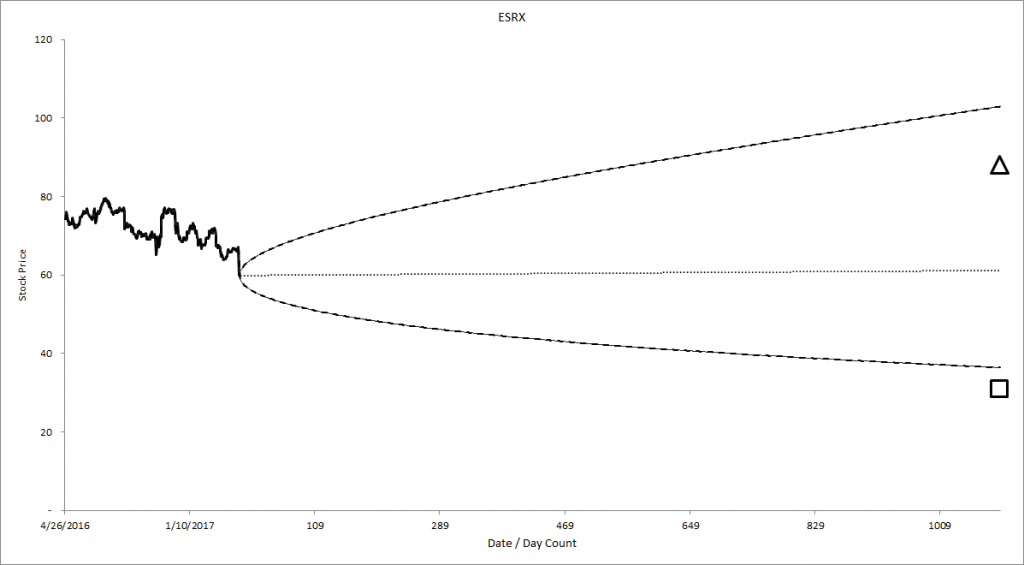

In the ChartBook, regarding our worst-case valuation scenario – one in which Anthem pulled its business in 2019 – we wrote:

In the case of Express Scripts and considering the Anthem suit, amortization of intangibles may need to be viewed as a real item of maintenance capex. If we do this, the average profitability over the last five years is closer to 2% than the present 4%. Making an appropriate adjustment to our explicit forecast generates a fair value range significantly below the present one – implying an average valuation of around 30% below the present market price with seven out of eight scenarios showing a capital loss.

This worst-case scenario will likely happen – Anthem will likely pull its business, showing that the amortization of “client relationships” should be considered part of Express Scripts’ cost of maintaining its business as a going concern.

Thirty percent lower than our prior worst-case $61 fair value works out to $42 per share. However, when I reran the numbers, the calculated worst-case fair value estimate (assuming a 15% revenue drop in 2019 and OCP margins averaging 2% per year) was only $31 per share.

Figure 2. Source: YCharts, Framework Investing analysis

The valuation above is only an approximate one and might change if I sharpened my pencil a bit. That said, I believe there is a real risk that other of Express Scripts’ clients will also pull their business in the wake of the Anthem announcement, so any pencil sharpening I might do would likely be an exercise in false precision.

Option prices will certainly be elevated tomorrow after the open, and implied volatility levels are likely to be sky-high. Do not be tempted to accept downside exposure (i.e., short put or covered call “bond replacement” investments), no matter how attractive the premium seems. The after-hours price of $57 per share is significantly higher than our back-of-the-envelope worst-case valuation scenario.

Also, the last I heard, Morningstar had listed Express Scripts as one of its Conviction Buy ideas, but I would also urge our readers to avoid the behavioral and structural biases likely wrapped up in that recommendation.