Executive Summary

- Caterpillar (CAT) reported 1Q17 earnings pre-market on April 25 and the share price is up pre-market by over 5%. The stock is now trading at our ultimate best-case valuation scenario estimate.

- The firm revised its revenue guidance upward. Its new guidance of between $38 billion and $41 billion this year is equivalent to our worst- and best-case assumptions, respectively.

- Owners Cash Profit (OCP) margin came in at an estimated 8.3% – higher than our full-year, best-case forecast of 6% – largely due to an enormous decrease in working capital. Quarterly working capital changes are volatile, so we will not change our forecast on the basis of this quarterly report alone.

- We have a bearish position in this name, and will seek an opportune time to increase this position.

Background

On 12 January of this year, we published a Tear Sheet detailing a bearish option strategy on the shares of Caterpillar (CAT).

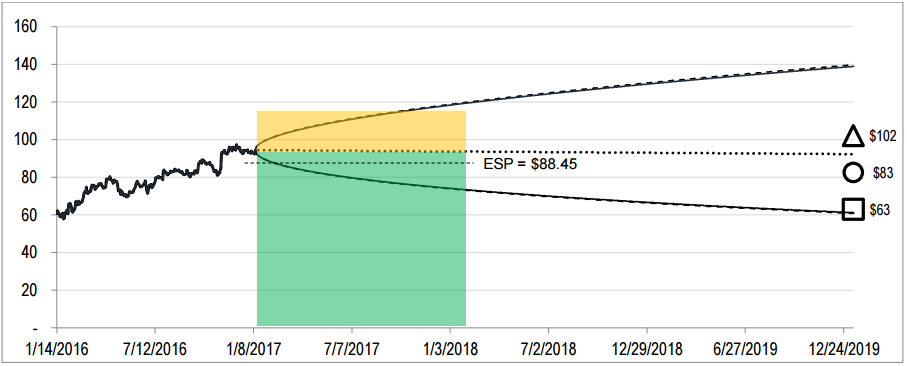

Figure 1. Source: YCharts, CBOE, FWI Analysis. Geometrical markers show IOI’s best-case (triangle), worst-case (square), and equally-weighted average value (circle). Cone-shaped region indicates option market’s projection of Caterpillar’s future stock price (dotted line represents ask price projection, solid line, bid price projection). Shaded region represents the purchase of an In-the-Money (ITM) put option on Caterpillar’s stock. “ESP” = “Effective Sell Price.”

The position had seen some unrealized gains and unrealized losses, and was roughly break-even as of close of trading last week, despite an upgrade of the stock by Goldman Sachs (about which we published this article) on April 5.

Figure 2. Source: YCharts

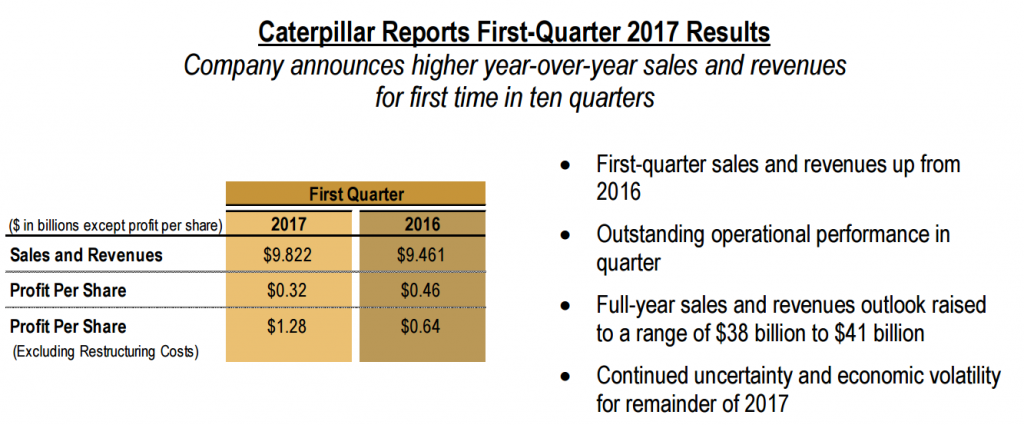

This morning, Caterpillar released its first quarter 2017 earnings report and issued a revised guidance for the full fiscal year. The full earnings announcement can be found on the Caterpillar investor relations site.

Figure 3. Source: Caterpillar 1Q17 Earnings Release

Earnings Analysis

Revenues

Caterpillar management’s upwardly revised yearly revenue guidance of $38- $41 billion matches our original revenue range forecasts for the year of $38.22 billion – $40.90 billion. (Revising our best-case forecast to slightly above $41 billion adds roughly $1 per share to our best-case estimate). We see no reason to change our revenue assumptions based upon this earnings release.

Profits

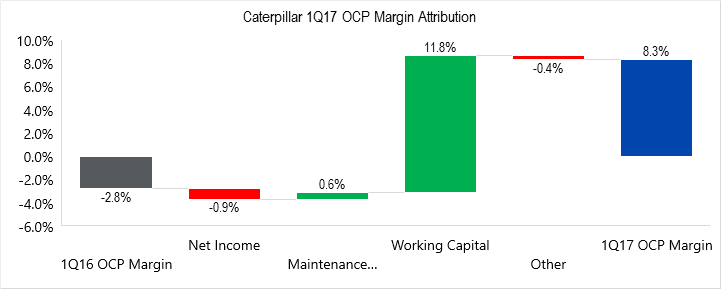

Caterpillar generated an estimated Owners’ Cash Profit (OCP) of $817 million on quarterly revenues of $9,822 million, implying an OCP margin of 8.3%. This compares to an Owners’ Cash Loss of ($265 million) in the first quarter of 2016 – an implied OCP margin of -2.8%.

Quarterly OCP is a volatile figure, since temporary changes to working capital accounts can have a large impact upon OCP. Figure 4 shows that changes to working capital were indeed the overwhelming driver of this quarter’s OCP change.

Figure 4. Source: Company Statements, Framework Investing analysis

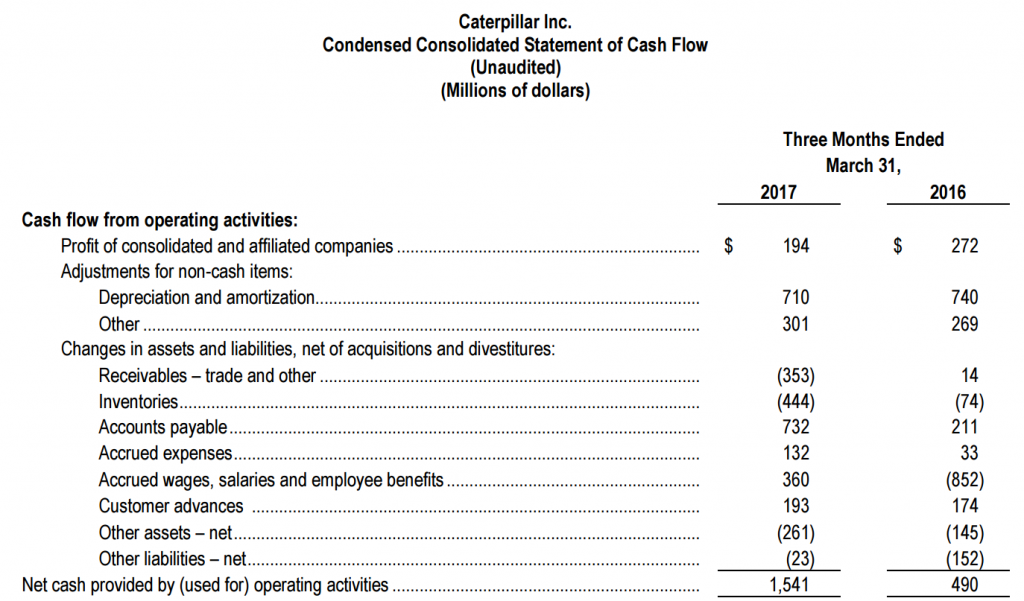

This large increase in cash flow due to working capital mostly stems from a large increase in accounts and benefits payable (an increase in liability accounts counts as a cash inflow), partially offset by an increase in inventories and receivables (an increase in asset accounts count as a cash outflow).

Figure 5. Source: Company Statements

Because the OCP increase seems so clearly to be related to temporary factors, we will not increase our forecasts for best-case profitability.

Caterpillar Investment Level

One quarter is much too short of a time frame over which to judge investment spending for a company. The company has continued to be very conservative in its investment spending during this first quarter, with total capital expenditures below our assumption for expenditures to maintain the business as a going concern.

Slowing capital spending is the kind of strategy that experienced, intelligent managers make to preserve cash during times of uncertainty (note the mention of uncertainty in the figure 1 press release snippet).

Investment Strategy

The unrealized loss on our position is frustrating. That said, when placing capital at risk, there is no way to avoid market risk.

The only important risk to a well-capitalized investor should be valuation risk. While one quarter’s worth of data is usually too little on which to base a long-term judgment, we are satisfied that the firm’s operational performance is largely in line with our forecasts.

Companies that report well and whose stock advances as a result tend to continue to have positive returns for several days after. We will wait for a few days and increase the size of our bearish position (again using an ITM put option) on an opportunistic basis.