A reader has been following IOI Members’ recent work on Under Armour (UA / UAA) and asked a good question about the difference in profitability between the domestic and international segments.

This data is available in the firm’s annual reports, and we have compiled these data in the IOI Integrated Model that we distributed to members. As such, it’s an easy matter to graph it out. The answer to the reader’s question was a bit more complex and interesting than I had expected at first.

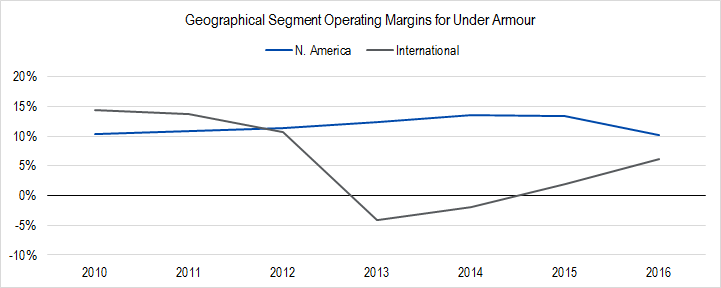

Figure 1. Source: Company Statements, IOI Analysis

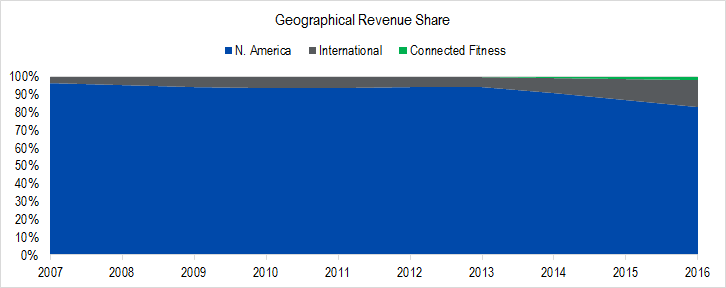

The International segment was more profitable for several years early on, but suddenly dropped to a loss in 2013. I suspect that this drastic change was due to costs associated with Under Armour building out its marketing and distribution platforms in overseas markets at this time. Looking at a graph of revenue share, we notice that International’s share of total revenues markedly increased in 2014, the year after the operating profit drop-off.

Figure 2. Source: Company Statements, IOI Analysis

To know the story for certain, we will have to do a bit more digging in the financial statements and conference call transcripts, but we think the scenario described here is a plausible working hypothesis.