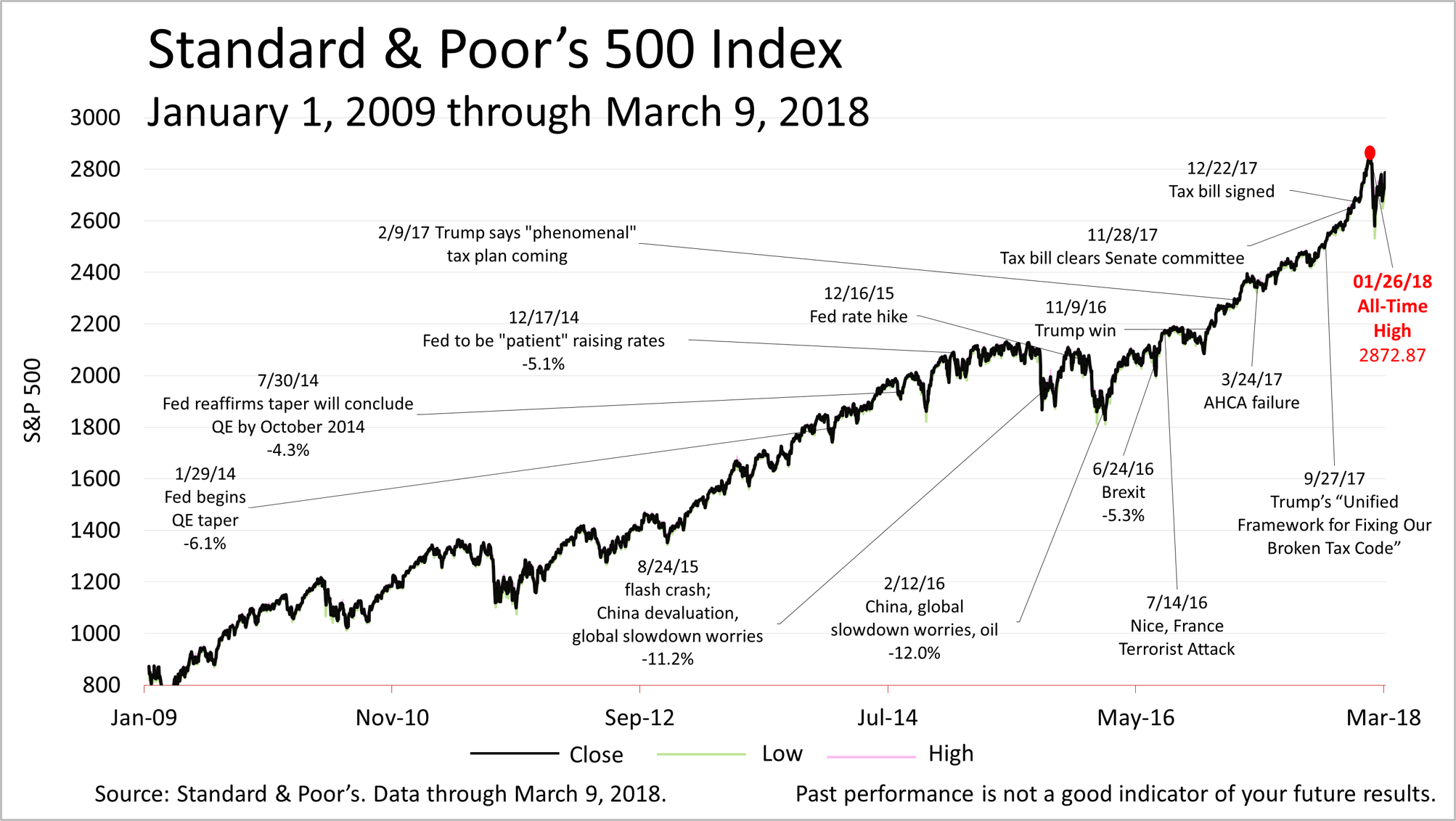

Over the last month we have seen the sometimes dramatic return of price volatility to US stock markets. Interestingly, volatility impacts in other asset markets have been more muted. This speaks to a growing set of multivariate effects on stock prices vs. other asset classes. While all financial asset prices have inflated thanks to central bank policies, stock prices have been impacted by more severe supply / demand imbalances, particularly from the impacts of passive indexing strategies, that have led to higher prices and potentially a clouding of real price discovery. We can argue whether stock prices simply capture those effects or are showing signs of an asset price bubble until the cows come home. What we can say is that there are variables affecting stock prices as a whole today that we’d largely been able to ignore before the 2009 financial crisis.

With volatilities up and price to value ratios appearing stretched, we posed the question of how to think about portfolio allocations in this environment to a few of our professional investor members during Office Hours on Friday, March 9. Robert Ruggirello, CFA and Sheila Chesney, CFP, are both investment fund managers and they joined Erik and I to talk about their portfolio thinking and answer member questions. Here below are some of the key insights from that conversation and a few thoughts on how you might apply those to your portfolio.

On the Market as a Whole:

We don’t know where prices go from here generally, so we need to be looking for pockets of value. No one wanted to hazard a guess as to where market prices were / are relative to value here or where the macro environment was headed. All the participants felt strongly that any opinion regarding macro issues was pure conjecture and that collectively we could not make allocation decisions based on that. There was a general feeling that prices were ahead of value but that the markets can stay crazy longer than we can stay solvent – particularly given central bank-led distortions. So, the appetite to be actively short the market here was low. The point was made that insurance, via bought puts, is currently very cheap relative to perceived exogenous risks.

On Cash Levels:

Generally, both Robert and Sheila are net sellers into strength here – raising cash where price to value ratios have converged. This is consistent with FWI’s positioning as well. For Robert, cash from asset sales is being deployed for rebalancing underweight areas. For both Sheila and Framework, cash from asset sales only gets deployed when an undervalued asset is apparent. Collectively, we all see rising cash levels and are actively de-risking portfolios where it makes at this stage. So, where are these managers looking for value?

On Where to Look:

Alternative asset classes, real assets and unloved value were far and away the predominant hunting grounds for our professional managers. Robert likes the real estate space (his fund specializes in analyzing this asset class), particularly some of the REITs in transition. Real estate and REITs have struggled of late due to perceptions on interest rate hikes. Robert and his team have gone back and done research to show there’s no correlation between higher interest rates and REIT’s returns performance. He singled out Gramercy Property Trust (GPT) and STORE Capital (STOR) as showing signs of being undervalued. Real estate has shown an ability to act as an inflation hedge despite being sensitive to interest rates. Further out in the alternatives space are REITS on timber like Potlatch Corp. (PCH) which are benefiting from continued housing strength and perception that capital investment from corporations will rise in the coming months. Robert’s team is also looking to add exposure to other commodity classes and merger arbitrage. He will be back to us on these two asset classes as they uncover the best ways to gain these exposures.

Sheila’s thinking is focused on taking advantage of undervalued business and long investment holding horizon effects bolstered by the participation of investors with a track record of outperformance. In the media space, she likes Discovery (DISC-A, DISC-B, formerly Discovery Communications). While the price has run up a bit in recent months, telecom and media titan John Malone was a buyer around $20/share. For Sheila, that price serves as a floor for a company that has materially strengthened the quality of its content assets over the last five years. She also likes small chemicals distribution specialist Nexeo Solutions (NXEO). This small cap company flies a bit under the radar but has become one of the leading chemicals distributors in the world by providing value added solutions and logistics to it’s more than 28,000 customers. Her final idea is a “blank check” company headed by Fairfax’s Prem Watsa. Fairfax India (OTC: FFXDF) is another small, under the radar company applying Watsa’s value driven investment approach to his native India. It is one of the only actively managed pure play India investment funds. Ms. Chesney likes it for the proven quality of its managers and the long run time horizon it can leverage. If you like volatility and asset concentration with long time horizons, Sheila suggested checking out Senvest Partners (TSO: SVCTF), a hedge fund that trades publically on the Canadian exchange. This manager buys deeply out of favor companies with strong underlying businesses and waits patiently for them to turn. If Senvest cannot see the stock price of an opportunity at least doubling over the next 5-7 years, they will not establish a position.

For Erik and I’s part, we’ve been looking into out of favor GameStop (GME) and Oracle (ORCL) this week. We also have UnderArmour (UA, UAA) and Harley Davidson (HOG) on our list.

Both Robert and Sheila are active users of the Framework core model and both have modified the base model for their specific portfolio interests and asset classes. In fact, Sheila wrote about her Framework experience last week. You may remember that Robert and Erik worked on a real estate specific core model together last spring for Realty Income (O). Robert and Erik will be publishing more combined work on the REIT sector over the coming months. Sheila has offered to publish her firm’s watch list (Framework favorite Interactive Brokers (IBKR) is on it!) on Framework’s website and you’ll see that as well as portfolio and watch list from Framework coming in the next month.

In Summary, we don’t know what the market will bring, but by sticking to our valuation FRAMEWORKs and looking in currently unloved places, we can indeed find value. This allows us to add dollars to idiosyncratic risk vs. adding marginal dollars to the US passive side of our portfolio in an overvalued market environment.