Oracle ORCL — a company we have followed for several years and made good returns in through sensible structuring — reported fourth quarter and full fiscal year results after market hours on Tuesday. The numbers were good, compared to what sell-side analysts were expecting, and guidance for fiscal year 2019 (which started on June 1, 2018) was positive.

Despite that, the stock price fell heavily on Wednesday due to what I believe was disappointment in the way the company reports its revenues. While the stock price is now in the range I had mentioned in an earlier article would be an attractive entry point for the stock and Oracle’s actual results are in line with our March 28 valuation forecasts, I am increasingly frustrated with the company due to how it interacts with owners and am considering closing the investment.

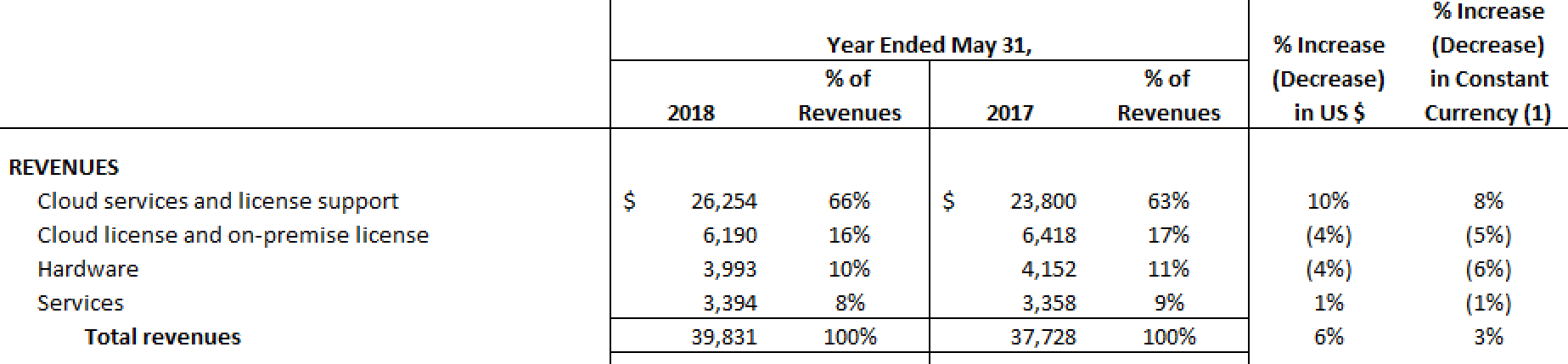

Figure 1.

In terms of the operational metrics, the firm generated $39.8 billion of revenues in FY2018 — 6% higher than FY2017 revenues — a figure that was helped by overseas sales and a weakening dollar. In “constant dollar” terms, the firm was able to generate a year-over-year revenue growth of 3%.

Figure 2. Source: Company Statements

We had adjusted our FY2018 revenue projections to the firm’s guidance (which included guidance on foreign exchange effects) back in March, and actual revenues predictably came in very close to our best-case forecast.

More importantly, the next four years of our explicit forecast see annual revenue growth between 2% and 5%. These estimates are made on a “constant dollar” basis, considering the firm’s ability to meet its demand environment. The firm announced that currency is working against its revenues so far this year, but that it expects a year-over-year increase for FY2019 compared to FY2018. This guidance seems to triangulate well with my forecasts.

The firm was able to convert $14.2 billion of its revenues to Owners’ Cash Profits during the year — a margin of 36%. This is well within the range of our best- and worst-case forecasts of $15.2 billion and $13.5 billion — representing a margin of 38% and 34%, respectively.

On the basis of these figures, our valuation seems right on target, so writing puts on the company at this level would be a sensible thing to consider.

That said, there are two things that are reducing my ardor for Oracle; one of these issues is clearly a concern for the market as a whole.

First concern is that the company drastically changed the way it reports its revenue breakdowns, mixing revenues from Cloud with revenues from on-premise licensing. This strikes me and the market in general as an attempt to obfuscate the successes and failures of the Cloud and License business. I and other analysts are usually suspicious about reporting changes, since it makes it harder to understand the continuity of the business over time and is often done to sweep some problem under the rug.

This concern probably resonates especially strongly with the market, due to a recent downgrade of the stock by JP Morgan, which contends that, according to its customer surveys, Oracle is losing ground in the Cloud space.

Oracle makes the points that 1) it splits out and divulges Cloud revenue in its quarterly and 2) that with its new “BYOL” (Bring Your Own License) plan, the line between on-premise (i.e., licensed) software and Cloud software is blurring. This explanation, in itself, is reasonable, but the triangulation with the customer research and the sudden reporting change makes it easy for an analyst or owner to draw a negative conclusion.

The other concern I have, but which the rest of the market is certainly ignoring, is the amount of anti-dilutive stock buybacks the company is doing and what effect this has on the company’s Free Cash Flow to Owners.

The company has not yet issued its quarterly report to the SEC, and the numbers it released in its earning announcement do not provide enough information for me to make a firm calculation. However, the information I can see makes me worried that the company is continuing to issue its managers and employees so much stock that it is creating a real economic drag for owners.

In FY2017, we estimate that Oracle had to spend around $1.8 billion buying back shares that it had issued management, nearly double of the trailing five-year average of $1.0 billion. Our expectation has been that as Larry Ellison stepped away from the CEO role, that these expenditures would lessen, but from what we can see from the financial statements, stock issuance may have actually increased this year compared to last year’s already high levels.

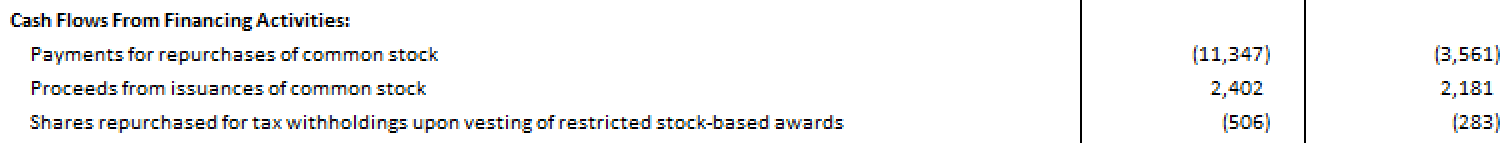

Figure 3. Source: Company Statements. Left-hand column is FY2018; right-hand column is FY2017

Focus on the second and third line items above. Proceeds from shares issued have increased by about 10% and shares repurchased for tax withholdings, by 79%. Granted, stock buybacks have also increased by a factor of nearly four (see the first line item above), but if the company is issuing many more shares to management, the end result still might be a net negative to owners.

If the company has indeed spent the same amount on antidilutive stock buybacks in FY2018 as it did in FY2017, the company will have spent roughly 29% of its OCP on Expansionary Cash Flows, exceeding our forecasts of 21%.

In addition, our model assumes that the company will gradually reduce the proportion of profits dedicated to expansionary projects from its historical aggregate rate of roughly 50% to around 40%. If the firm really has really made a structural increase in the amount of shares issued to employees, this assumption is unwarranted, and our fair value will come down.

For this reason, I will await the filing of the 10-Q and will make a decision about whether a revised valuation points toward a continued investment in Oracle’s shares.