Oracle reported third quarter results for fiscal year 2017 on March 16th and the share price jumped over 6% the day after the announcement was made.

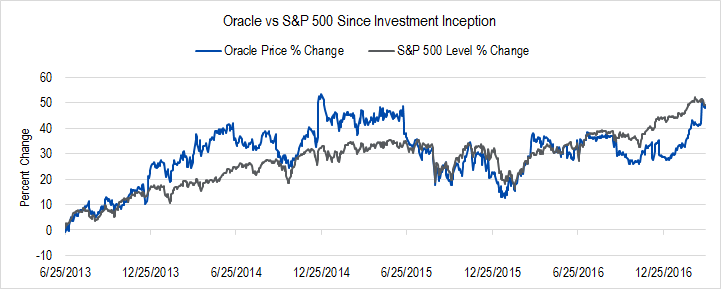

Since we first recommended an investment structure in Oracle, the firm’s stock has just kept up with the S&P 500 index, but the option structures we have used to invest in the company have allowed us to wring more than double Oracle’s stock returns over this time. This kind of return enhancement is precisely what we mean when we talk about “tilting the balance of risk and reward in your favor.”

Figure 1. Source: YCharts

We have analyzed the third-quarter earnings release with an eye to whether or not there was information material to our estimation of the company’s valuation range.

Here is what we found.

Executive Summary

- The news is mixed, and the valuation uncertainty of this firm has increased.

- Positive points:

- Cloud revenue increases very strong

- Overall revenue increase was just at the midpoint of our long-term best- and worst-case forecasts

- The vitally important “Software Updates” business’s revenues are steady

- Negative points:

- Profitability has slipped and may continue to weaken as the company focuses more on Infrastructure-as-a-Service (IaaS)

- Investment spending that decreases Free Cash Flow to Owners is likely to increase

- Neutral point:

- Hardware revenues continue to fall

- We have decided to hold off on revaluation until we get more information that will allow us to better assess Oracle’s IaaS initiative.

Revenues

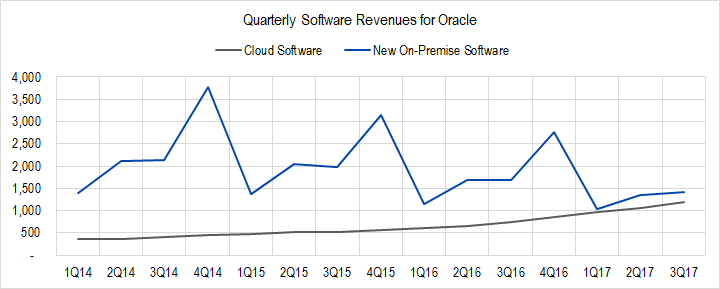

Figure 2. Source: Company Statements, IOI Analysis

From the graph above, we can see both the strong seasonality of Oracle’s business (Oracle’s fourth quarter spans the March-May timeframe), the decrease in revenues from On-Premise Software (this represents the software the customers own and run on their own servers), and the increase in Cloud Software (this represents the software and sometimes hardware the customers rent from Oracle).

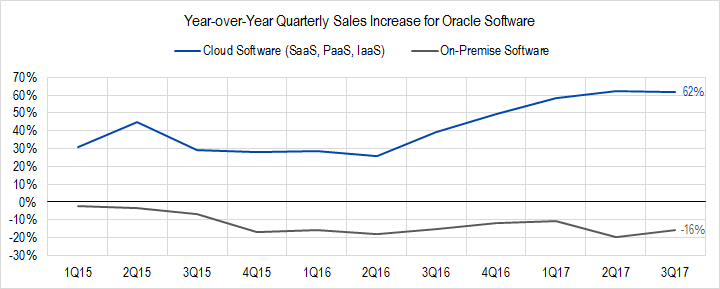

Figure 3. Source: Company Statements, IOI Analysis

Cloud Software sales represent roughly 40% of total new software sold. 40% of revenues growing at a 60% clip means a revenue tailwind of 2.4 percentage points. This is offset by the 60% of On-Premise software shrinking at around 16% – an implied 0.9 percentage point headwind. Overall, revenue was up 2.0% in US dollar terms and up 3% in constant currency terms – just at the midpoint between our 0% worst-case forecast and our 5% best-case one.

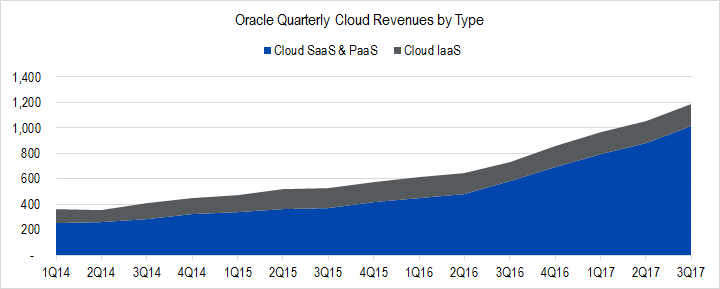

Figure 4. Source: Company Statements, IOI Analysis

The company’s recently-announced strategy to compete with Cloud infrastructure giants Amazon’s (AMZN) AWS, Microsoft’s (MSFT) Azure, and Alphabet’s (GOOGL) Cloud is off to a slow start. The gray bar above representing IaaS revenues is that which is directly competitive to the above leaders’ services. Note that even though the Cloud SaaS (application software) and PaaS (databases and “middleware”) portion of revenues has been increasing at a good clip, IaaS has been pretty steady.

Company managers announced that there will be several significant deals announced soon in IaaS, and we will be watching for that news closely.

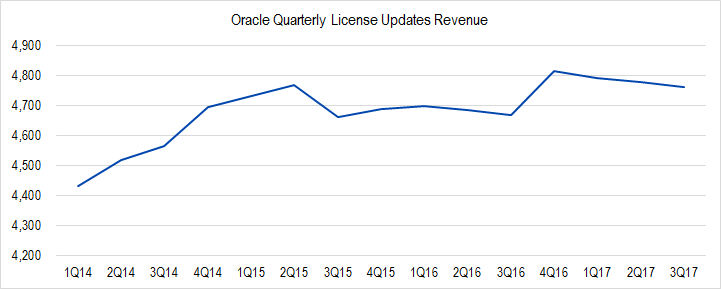

Figure 5. Source: Company Statements, IOI Analysis

The critically important business segment of “License Updates” is holding steady and represents 65% of the company’s software-related revenues. Long-time readers will know that margins on this business are extremely high – in the 80% plus operating margin range – and we look at this business as a key pillar of Oracle’s business model. (Here are our historical articles and reports on the company.)

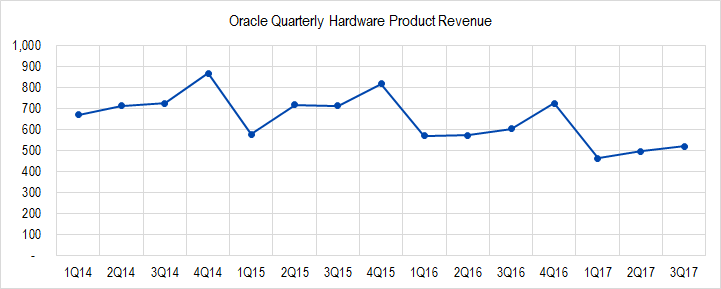

Figure 6. Source: Company Statements, IOI Analysis

Hardware Product revenues, which had been showing signs of some resiliency, now show a clear trend of falling. While we would prefer not to see Oracle suffering from a revenue headwind, the firm’s new strategy on building an IaaS offering revolves around the firm essentially renting servers to clients along with software. A positive datapoint would be if the firm’s IaaS business increased in size at a quicker clip than Hardware sales fall. Hardware Products is a $500 million per quarter revenue line; Hardware Support is another $500 million line; IaaS represents a $200 million line.

Profits

Figure 7. Source: Company Statements, IOI Analysis

Oracle’s profitability has slid over the past few quarters for several reasons. First, the acquisition of NetSuite caused costs to rise. Second, the push to build the IaaS business is expensive and requires hardware purchases; these purchases boosts depreciation charges, so lowers OCP. Third, Oracle acquired NetSuite revenues, which may not yet be aligned with Oracle’s pricing regime.

During the first three quarters of FY 2017, Oracle generated an OCP margin of 33%, which is lower than our worst-case estimate. However, on a trailing twelve-month basis, the OCP margin jumps to 36% (recall that the fourth quarter is a very profitable and high revenue quarter for the company). 36% is well within our profitability range – closer to our best-case assumption of 37%.

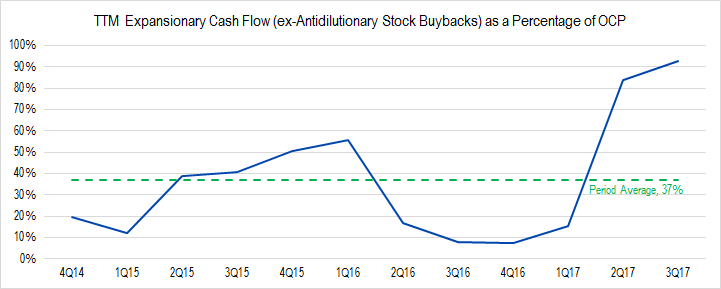

Figure 8. Source: Company Statements, IOI Analysis

The acquisition of NetSuite boosted investment spending in 2Q17, but the firm has also been spending more on Capex in excess of maintenance capex, and we think the investment level will need to rise for the company to compete against Amazon and Microsoft’s Cloud offerings, especially.

We were not able to assess the degree to which the firm has increased or decreased spending on Anti-dilutionary stock buybacks during this fiscal year. This information will be published in the annual statement, scheduled to be released this summer.

We would like to see the firm cutting down on issuing stock – especially to Larry Ellison, who represents for us the poster boy of excessive stock compensation. However, we ruefully admit that this is not likely to happen. As such, Free Cash Flow to Owners margin will likely decrease.

Overall

The company’s sustained Year-over-Year growth in Cloud revenues is good news, and we see why the market was cheered. We believe that the positive market reaction was at least in part due to the announcement that several “large” IaaS deals would close in the near future. If the company can successfully growth the gray IaaS band in figure 4 at as good a clip that the blue SaaS/PaaS band has been increasing, the company will likely generate some much more robust revenue growth after a long flat period.

The company is attempting to compete in the IaaS space with several large, well-funded firms that have years’ worth of a head start. This business is expensive to buy into and, by itself, not terribly high margin. We believe that Oracle is attempting to create “stickiness” through this Cloud infrastructure offering that will allow it to continue to generate revenues from its core software business. This business has not yet created much value for shareholders, but we think the strategy has merit, and want to see whether the commercial uptake increases as promised.

The combination of greater uncertainty regarding revenues, profits, investment level, and medium-term growth all mean that the valuation risk regarding Oracle has increased in our eyes.