For a new business, the most difficult part of understanding what it is worth is making reasonable assumptions about how quickly cash flows will grow during the medium-term and how long that medium-term growth period will likely last.

This question is especially pointed for Netflix, which is strongly and cash flow negative at present. However, because its revenues are growing quickly, if and when the company reaches scale, its profits and cash flows could grow very quickly. This is essentially the bet that the market is making with its present valuation of Netflix — eventually, it will reach revenue scale and will be a very profitable enterprise.

This article looks at what is necessary for this scenario to play out at Netflix. Those of you interested in this name should also refer to our Netflix Valuation Model.

Base Assumptions

One assumption that the Framework Valuation Model implicitly makes is that a company is profitable at the end of the near-term (a/k/a “Explicit Forecast”) period.

For mature firms, making this assumption usually does not require too large of a leap of faith, but in the case of Netflix, my confidence is lower. This is not to say that Netflix is a bad firm, but its “Streaming Video Network” incarnation is very new, and new businesses take some time to generate profits.

I found an article on a third-party research service suggesting plausibly that Netflix could turn cash flow positive by 2022. To simplify the valuation analysis, I took this to mean that Netflix would have an OCP margin of above 0% by 2022. (There is a way to create a model that does not require this simplifying step; if you are interested in this, let’s discuss during an Office Hour session.)

In our model, we have assumed an OCP margin of 2% and 1% for best- and worst-case profitability in 2022 — year five of our Explicit Forecast period.

With this done, we must think about what potential Netflix has to generate profits when its streaming business model matures.

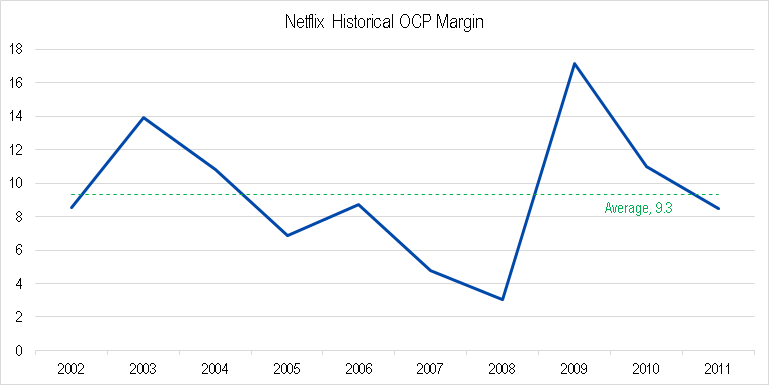

For mature firms, we mainly judge our conception of profit potential from historical figures. Netflix, in its pre-2012 incarnation as a mail-order DVD rental company did generate a fairly steady profit on an Owners’ Cash Profits basis.

Figure 1. Source: YCharts

I have not researched this carefully, but I imagine that the big jump in 2009 represents the tendency for Netflix results to be “counter-cyclical.” When economic conditions are good, moviegoers are happy to shell out money for a theater ticket; when times are bad, they would rather stay in and watch movies on their TV.

This historical analysis provides one potential “handrail” by which we can start to bound the capacity for Netflix to generate profits.

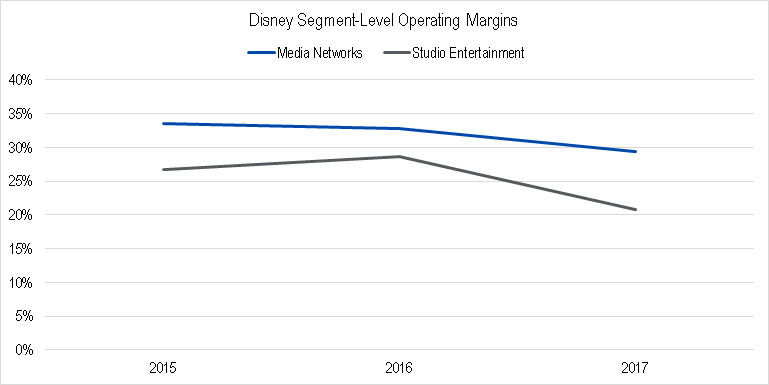

Another way to get an idea about profit potential is to look at what a mature, well-run firm in a similar industry is generating. As it happens, a company that Joe analyzed — Disney — runs several businesses that overlap with Netflix, so we looked to Disney’s segments for guidance.

On an operating profit basis, over the last three years, Disney’s Media Networks and Studio Entertainment businesses have generated on either side of 30% margins.

Figure 2. Source: Company Statements, Framework Investing Analysis

Seeing this, I decided to give Netflix the benefit of the doubt and assume that, once the business matures, it would be able to generate 30% OCP margins in the best-case and 11% OCP margins in the worst-case.

This assumption makes sense versus historical experience — Netflix should be able to generate slightly better profits from streaming because there are no product or shipping costs — and from comparison to a competitor.

If you believe these assumptions are too rosy, you can play with the “Best-case medium-term growth” and “Worst-case medium-term growth” rates on the “OCP Calculations” tab of the model (cells B15 and B16, respectively).

We assume that the company can meet these targets after 10 years of achieving profitability — just at the end of our medium-term period.

Medium-Term Growth

(Before continuing, please be aware — this is very wonky. I’m happy to talk about the calculations and assumptions during Office Hours.)

Using these base assumptions about profitability, we are nearly done with making our medium-term growth assumptions already. We have already assumed that Netflix’s profitability is going to grow from 1%-2% OCP margins in 2022 to 15%-30% OCP margins in 2032, so that sets a base level for growth rates during that time.

As discussed in the Framework 102 coursework, the crucial metric for valuation is not medium-term OCP growth, but medium-term Free Cash Flow to Owners (FCFO) growth; however, if we assume that investments will grow in proportion to profits, the two growth rates should be the same.

We used Disney as a guide to estimate what Netflix will need to spend on investments as a proportion of profits. While this may be a good comparable when Netflix is a mature company, it certainly leads to an untenable assumption about FCFO in the near-term. The problem becomes obvious when looking at the model’s FCFO graph.

Figure 3. Source: Company Statements, Framework Investing Analysis

Clearly, Netflix is not going to suddenly swing FCFO-positive in 2022, so our published intrinsic value range is too high by several billion dollars.

Assuming that you can get past this willful inaccuracy, the growth rates for FCFO during the medium-term, just looking at margin expansion, will be 31% per year in our best-case assumption and 27% per year in our worst-case one.

Figure 4. Source: Framework Investing Analysis

The calculations here are a little torturous, but within the lined box, you’ll find what we are assuming OCP margins at maturity to be under different assumptions. For example, if 2022 OCP margins are 2% and margins expand at the best-case rate for 10 years, the ending OCP margin will be 30%. If 2022 OCP margins are 1% and margins expand at the worst-case rate for 10 years, the ending OCP margin will be 11%.

Thirty-one per cent or 27% for 10 years is pretty quick, but even these projections implicitly assume that revenue growth stays the same as those projected for 2022.

From my comments regarding the revenue analysis and modeling, you will recall that I thought our best-case revenue growth projections were too high. Even our worst-case projections implied that Netflix would be nearly as large as Disney’s network and studio business in five years.

As such, I was hesitant to continue to assume very rapid growth of revenues in the medium-term. In my mind, Netflix’s revenue growth will, at some point in the future, be checked by a competitive response from studios like Disney and Sony, both of which are preparing streaming options of their own.

With this in my mind, I decided to assume that Netflix would be able to expand its revenues at the same rate as we have assumed Disney will be able to expand its FCFO during the medium-term: 7% and 5%, best- and worst-case.

Figure 5. Source: Framework Investing Analysis

In columns B and C, we show best- and worst-case revenues assuming that 2022 revenues (Y5) are as I have projected them and that the growth rates are as shown in row 24.

Columns D and E show what our margin expansion assumptions imply in terms of OCP margin.

Columns F through I show what the OCP will be for each combination of four (revenues and profits, best- and worst-case). The numbers in row 39 show the 10-year compound annual growth rate (CAGR) using our assumed 2022 best- and worst-case OCP assumptions as a base.

For the medium-term growth assumptions in the model, I simply took the maximum and minimum values from these CAGRs.

Figure 6. Framework Investing Analysis

In a Nutshell

If you have come this far, you are probably impressed by the extent to which we have had to pull numbers out of the air to complete this valuation.

Indeed, it might be possible to sharpen my pencil a bit with these assumptions — rather than using our standard model, create a firm-specific one manually.

However, as someone who has seen a lot of models, I am sensitive to how sensitive the models are to very small changes in assumptions. Will medium-term growth rate last for 13 years rather than 10? If so, the valuation will be materially different. Will Disney and Sony, for instance, discontinue licenses sales to Netflix or make sure that movies and programs they produce will be delayed before being released to Netflix while simultaneously dropping prices on their own streaming services? This could completely stop Netflix in its tracks!

In the end, I believe that investing in Netflix is a “religious” choice. Either you believe the story or you do not.

If Netflix’s stock price continues to rise for some time, those who believed in the Netflix story may eventually sell and pat themselves on the back for being so far-sighted. The contrary is also true.

Looking at Netflix, I understood how Buffett must have felt in 1999. I don’t understand the value and do not feel confident in investing, one way or another.

There is one last, interesting question about Netflix’s “Content Streaming Obligations” that I will address in another post, since this issue is often raised by Netflix bears.