A great advantage of having a robust framework to assess investments is that it is easy to figure out where the risk in a particular idea is.

Our recent members-only research work on Netflix is a case in point. Our process homes in on only four fundamental drivers of valuation:

- Revenue Growth

- Profitability

- Investment Level

- Medium-term Growth (which is related to the efficacy of the investments being made in the short-term).

It’s easy for me to get comfortable with a range of values for the first two measures, but the second two measures are unknowable. This uncertainty makes up the lion’s share of the risk related to an ownership stake in Netflix, and makes it uninvestable if you take the word “invest” at its literal meaning.

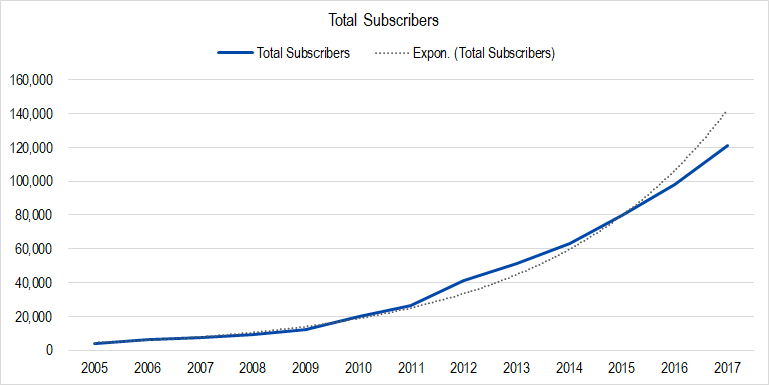

At the end of 2017, the company’s service claimed more than 120 million subscribers worldwide, and while domestic growth has slowed as the market has become more saturated, overseas growth is accelerating.

Figure 1. Source: Company Statements, Framework Investing Analysis

Netflix generated $11.7 billion in revenues in 2017 from these subscribers. We compared this figure to Disney’s studio business (both its TV networks – ABC and ESPN – and its movie studio) – a business that is a close comparable to Netflix’s. Disney’s studios are generating around $32 billion, though much of this is not from subscriptions, but from advertising (TV) and ticket sales (movies). We think that, in the worst case, Netflix will be able to generate as much in revenues in five years as Disney is today, and in the best case, it will generate in the neighborhood of $50 billion. The latter is kind of a stretch; the former is probably a pretty low hurdle for Netflix if its recent subscriber growth holds up.

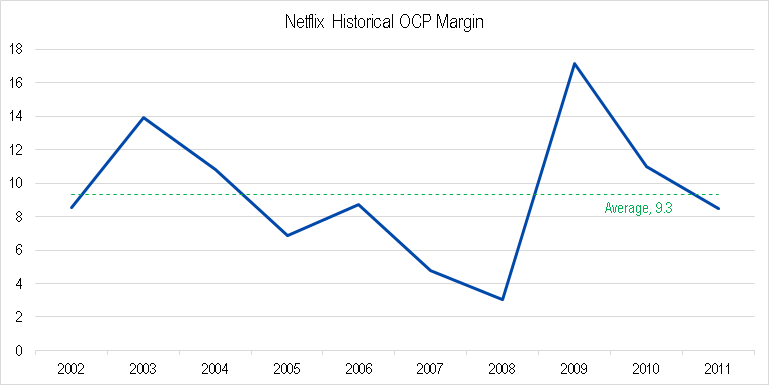

For profitability, we found two “handrails” that we could use to get a hold of the efficiency at which Netflix might be able to convert its revenues to profits: its historical profitability when it was a simple mail-order DVD company and the profits that Disney creates from its studio businesses.

In the days before streaming (which Netflix introduced in the last quarter of 2011), the company had just built a better mousetrap for the DVD rental business. When Netflix was associated with red envelopes, its profitability (using our preferred measure of Owners’ Cash Profits) was in the 10% range (i.e., Netflix was able to convert nearly $0.10 of every dollar of revenues to profits).

Figure 2. Source: Company Statements, Framework Investing Analysis

It’s reasonable to assume that Netflix will be able to generate at least this level of profitability again in the future, and probably a little more, since delivery costs for streaming content are very low at scale.

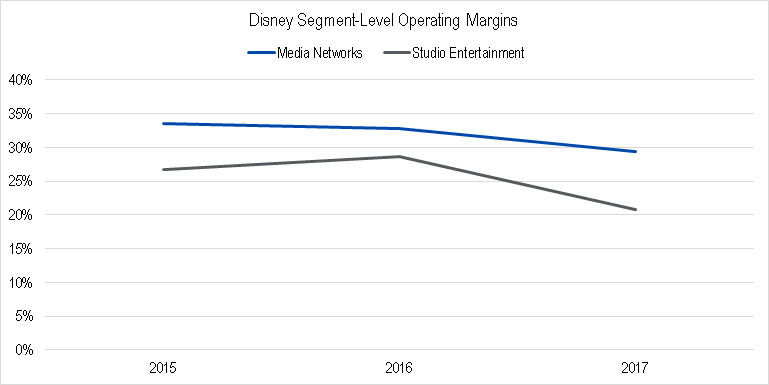

On the high end, Disney is generating operating margins (operational profit as a percentage of revenues) in the 30% range. While Netflix’s business is not quite the same as Disney’s this seems to be a reasonable initial best-case assumption, albeit, likely a bit better than the company will ever be able to generate.

Figure 3. Source: Company Statements, Framework Investing Analysis

Developing an initial idea about reasonable values for these valuation drivers is pretty easy. As time goes on, our understanding of revenue growth and profitability trends will change, and we’ll be able to refine these assumptions a bit more.

However, questions related to how soon the company will be able to generate cash profits, how much it will need to invest before it does, and how long its shareholders will enjoy a period of medium-term cash flow growth are, in our opinion, outside of human ken. I made a few guesses in answer to these questions, but doing so, I grew very aware of the large number of baseless assumptions I was making in order to do so. It was at this point that my ardor for Netflix ownership cooled.

In my opinion, anyone who publishes a valuation of Netflix that does not include a very wide range of possible values (which includes numbers much lower than the present price) is selling you a bill of goods; if they pound the table about their idea – long or short – run rather than walk away. They have deceived themselves; don’t let them deceive you as well!

Investing – by which I mean a rational, clear-eyed assessment of a company’s value followed by the decision to become a part owner in the business – in Netflix is impossible. Risking capital in Netflix is an act of faith, not of rational decision making, simply because there are so many unanswerable questions regarding possible future competitive threats and what effects those threats will have on Netflix’s operations.

Just because Netflix is uninvestable doesn’t mean you can’t invest in it. Buying an instrument offering broad market exposure — a low-cost Vanguard S&P fund, for instance — allows an investor to profit from the resiliency of the economy and the inventiveness of the capitalistic system. Netflix is an example of the kind of resiliency and inventiveness the capitalistic system breeds and to which intelligent investors seek to gain exposure, but it is impossible to know whether the Netflix experiment in particular will end as a success.

Save your hard-earned capital to invest in a company whose value you will be able to rationally assess and whose price is trading for less than that value. This is the hallmark of true investing.