Even before U.S. equity markets performed a subtle imitation of Wile E. Coyote on Wednesday, I had been looking at a chip company I covered as the head of Morningstar’s semiconductor research team – Microchip MCHP.

Microchip’s stock price has had a tough run of it over the past few months.

Figure 1.

Since hitting a closing high of $103.31 on June 6, Microchip’s stock price has fallen by 36% as of Wednesday’s close.

By the look of that chart, you would be forgiven for thinking that Microchip was caught in one of the many cyclical downturns that is so common among chipmakers. Or perhaps – like one of the big CPU makers – you might think that Microchip has just a few big customers and that it lost a big supply contract to a competitor.

Microchip is classified as a chipmaker, so most people naturally think it must be the same as Intel or AMD or Micron; however, Microchip shares few similarities with these chipmakers. In contrast with many people’s impression of semiconductor companies, Microchip’s business displays very little tech cycle variation and it has so many small clients, it doesn’t know where its chips wind up!

The fact that the Microchip baby seems to be in the process of being thrown out with the semiconductor bathwater suggests the stock might offer a good investment opportunity.

Microchip sells microcontrollers. Microcontrollers power unsexy products like vacuum cleaners, garage door openers, and children’s toys, not sexy ones like ultra-portable laptops or high-power servers.

Participating in an unsexy business is great. It means that Microchip’s end demand tends to be much less fickle and much steadier than that of sexy chipmakers selling application processor chips for the latest Samsung or Apple device. Another advantage of being in an unsexy business is that the capital spending required to support it is orders of magnitude smaller than the spending needed to support a sexy company like Intel or Micron.

I have just started reacquainting myself with Microchip’s business and it will take more time to complete a valuation analysis of the company. However, in the reading I have done so far, I can see more positives than negatives.

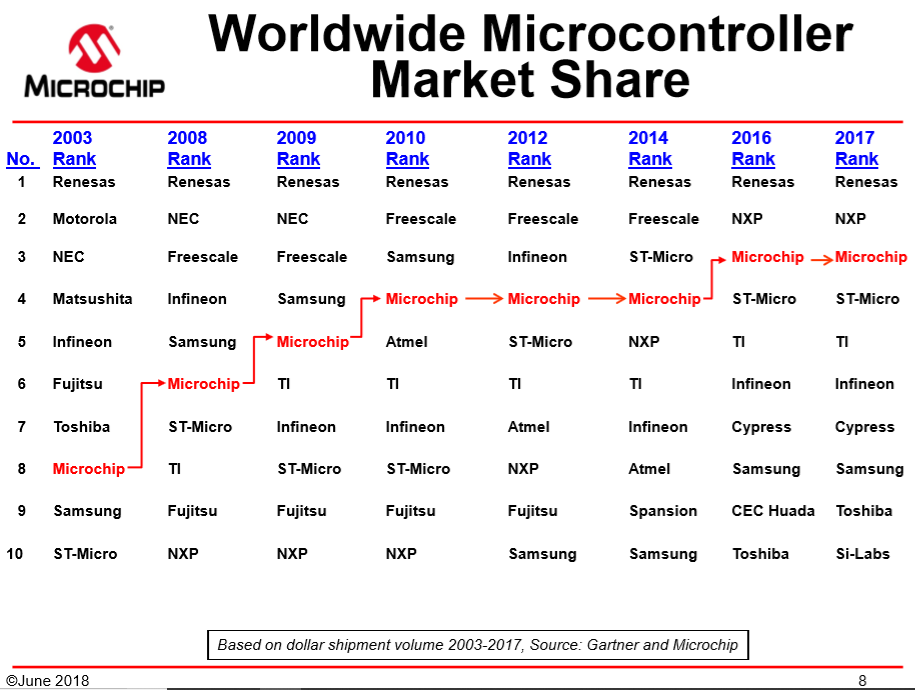

The strongest positive is the potential for Microchip to experience structural demand tailwinds. Microcontrollers have a great role to play in the ubiquitous connectivity of devices known as the Internet of Things (IoT). Microchip has a strong competitive position – it is the third largest microcontroller manufacturer behind Japanese Renesas and European NXP.

Figure 2. Source: Microchip Technology Investor Relations

Another positive is that historically, the company’s management has been good at acquiring underperforming assets at reasonable prices and straightening them up. Microchip’s most recent fixer-upper – purchased for $10 billion earlier this year – was the U.S. chipmaker, Microsemi.

Microsemi has some attractive businesses – especially in the aerospace and defense markets – but it also has some issues. With the acquisition, Microsemi’s issues have become Microchip’s.

According to Microchip’s CEO, Steve Sanghi, after buying Microsemi, he realized that the company that he had been very aggressive in shipping products to distributors – a practice known as “channel stuffing”. Because of the channel stuffing, Microchip’s post-acquisition revenue growth will be slow in the short-term, and its cash flows will likely be worse because due to the increased inventory levels.

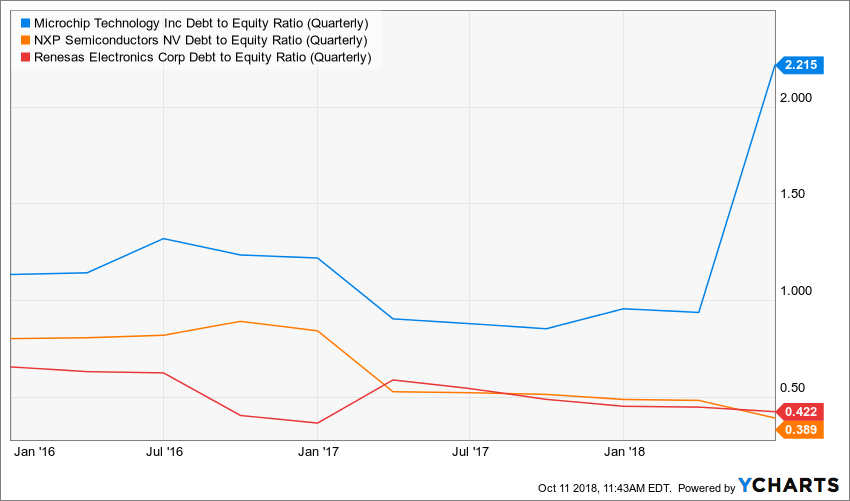

In addition to the operational issues related to the acquisition, there are also financial ones. Specifically, Microchip issued debt to buy Microsemi, so now carries more leverage than it has historically and more leverage than its closest competitors.

Figure 3.

The company has announced that every spare dollar of cash flow generated is going to used to draw down the extra debt, but still the added debt burden is still an issue that I will have to consider in my valuation.

I’ll be publishing a valuation of Microchip to Framework members soon. Additional market falls may well provide investors a good chance at investing in a strong, if unsexy business.