In two recent research articles, A Closer Look at Microchip and Microchip Valuation and Model, I laid out the reason why I think Microchip Technologies MCHP is significantly undervalued at its current market price.

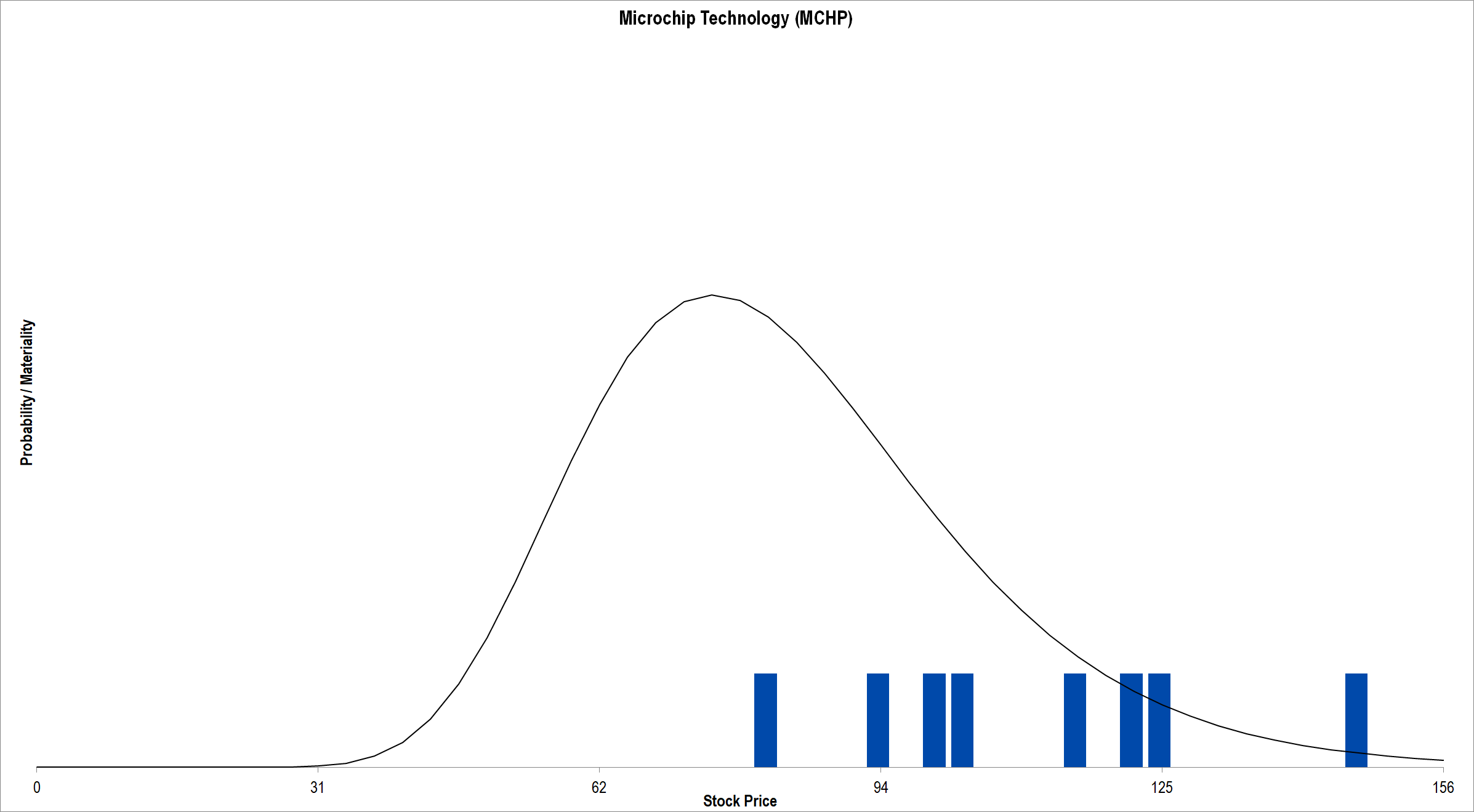

Here is a graphical representation of my estimate of Microchip’s valuation range detailed in the valuation article. Thursday’s closing price of $73.41 lies to the left of all eight valuation scenarios.

Figure 1. Source: CBOE (data), Framework Investing Analysis. The present stock price lies just left of the left-most valuation scenario, meaning that all valuation scenarios fall above the present stock price. The average of all scenarios is $112 / share, representing a 49% rise from its present price.

This article lays out the risks I see to an investment in Microchip, and offers three possible investment structures that can be mixed and matched according to an individual’s interest in the firm.

Risks

Trade War

Americans use a lot of products that contain Microchip’s chips. However, fully 85% of FY 2018 revenues were generated in foreign countries. About half of Microchip’s foreign sales were to customers based in China and Taiwan (at a proportion of around three-fourths to one-fourth, respectively).

To put this another way, Microchip is tied into the global supply chain of electronic goods, and the heart of that supply chain lies in East Asia.

President Trump’s announced trade policy usually differs from the trade policy that is actually enacted, it’s true, but were the present administration to embark on a trade war with China — placing tariffs on products coming from China — Microchip’s sales could suffer.

Another issue is that because so large a proportion of Microchip’s revenues are generated in foreign jurisdictions, the company consistently pays a single-digit tax rate.

Microchip is a $5 billion revenue company, and this is probably not large enough for it to suffer political heat in the same way mega-cap companies like Apple (which also pays very low taxes) might. Microchip might be caught up in the political backdraft if were one to occur.

Government Budget Crisis

In FY 2018, Microchip had virtually no sales to U.S. government agencies. However, upon acquiring Microsemi, a material portion of its sales will be generated by government contracts.

While government contracts — especially those related to defense — are usually safe from long-term demand shocks, a change in long-term policy or a short-term budget impasse could cause problems for the company. Problems of the former sort are certainly more important from a valuation perspective than those of the latter sort, but the latter sort might end up affecting the company’s share price.

Also, dealing with the U.S. government is not like dealing with an electronics price distributor. Because this is a new client relationship for Microchip’s management, there is always some uncertainty about how deftly they will be able to jump through various bureaucratic hoops.

Apple Supplier

Every time Apple makes an announcement related to iPhone sales that the market views as disappointing, Microchip shares fall. Microchip is listed as an Apple supplier, so even though its sales into Apple are likely not a very large proportion of total sales, because Microchip’s name is on the supplier list, people feel compelled to sell Microchip’s shares.

Microchip’s CFO, Eric Bjornholdt, told me that no single client represented more than 3%-4% of total sales, and the 2018 financial statements disclose that Microchip’s top 10 clients only represent 11% of revenues.

Microchip might sell a display controller or something to Apple, but I cannot find any mention of a Microchip chip in Apple teardown articles, and that data point, combined with the low customer concentration mentioned above, makes me think that buying Microchip on an Apple-related dip would be a good strategy.

Chip Cycle

There are a lot of people invested in semiconductor companies who don’t make a distinction between the many types of chips being manufactured, so lump everything into the same category.

News that the DRAM market is oversupplied ends up sending down the market price of analog chipmakers, even though the business drivers between the two types of chips are very different.

Over the last few months, I believe the reason that Microchip tumbled from the $100+ range to the $70 range was at least in part because memory manufacturer Micron’s stock price fell during this time. Micron’s revenues are aligned to mobile phone shipments, the demand for equipment to mine Bitcoins, and server upgrade cycles — fields in which Microchip has very little exposure.

According to a recent Microchip presentation, its revenue by end market is broken down in the following way:

Figure 2. Source: Company Presentation

Of course there is some overlap with other chip firms, but there is much more overlap with U.S. automakers, housing starts and durable goods sales, and industrial capital expenditures.

If chips fall heavily due to market perceptions of weak demand for servers and Microchip is dragged along with them, buying on the dip is probably warranted.

U.S. Recession

Well, it’s finally happened. The yield curve inverted. This is not a great sign, as an inverted yield curve is the bond market’s way of suggesting that equity market participants don their crash helmets.

When the U.S. falls into a recession — and I think the likelihood is good at this point — consumers will stop buying vacuum cleaners, barking robotic dogs, and fancy digital thermostats for a while. Microchip’s sales will be negatively affected by this because a large proportion of what it sells ends up in as part of consumer products.

That said, if U.S. consumers do what they have always done before in history — bounce back from a recession by buying more stuff — Microchip’s revenues should end up falling within our best- and worst-case ranges when averaged over five years.

Integration Strains

Microchip’s acquisition of Microsemi has, as mentioned in previous articles, stretched the financial and managerial capacity of the company. It will take a few years — by Bjornholdt’s own admission — to fully integrate it, and there is always the risk that this integration will be tricky.

In addition, the company borrowed a good amount of money to acquire Microsemi, and its leverage ratio is much higher than it has been in the recent past. Higher leverage, coupled with a U.S. recession, would mean that the company would probably have a hard time retaining as high of a profitability level.

Microchip is a very profitable company, so I am not worried about its solvency, but a drop in demand coupled with fixed financial payments for interest would necessarily bring about lower profitability.

While there may be some “unknown unknowns” as Donald Rumsfeld once famously said, the risks above are those that seem most salient to me observing Microchip right now.

Possible Investment Structures

Long Stock

With an asset as clearly mispriced as this, buying the stock is certainly the first investment structure one should consider.

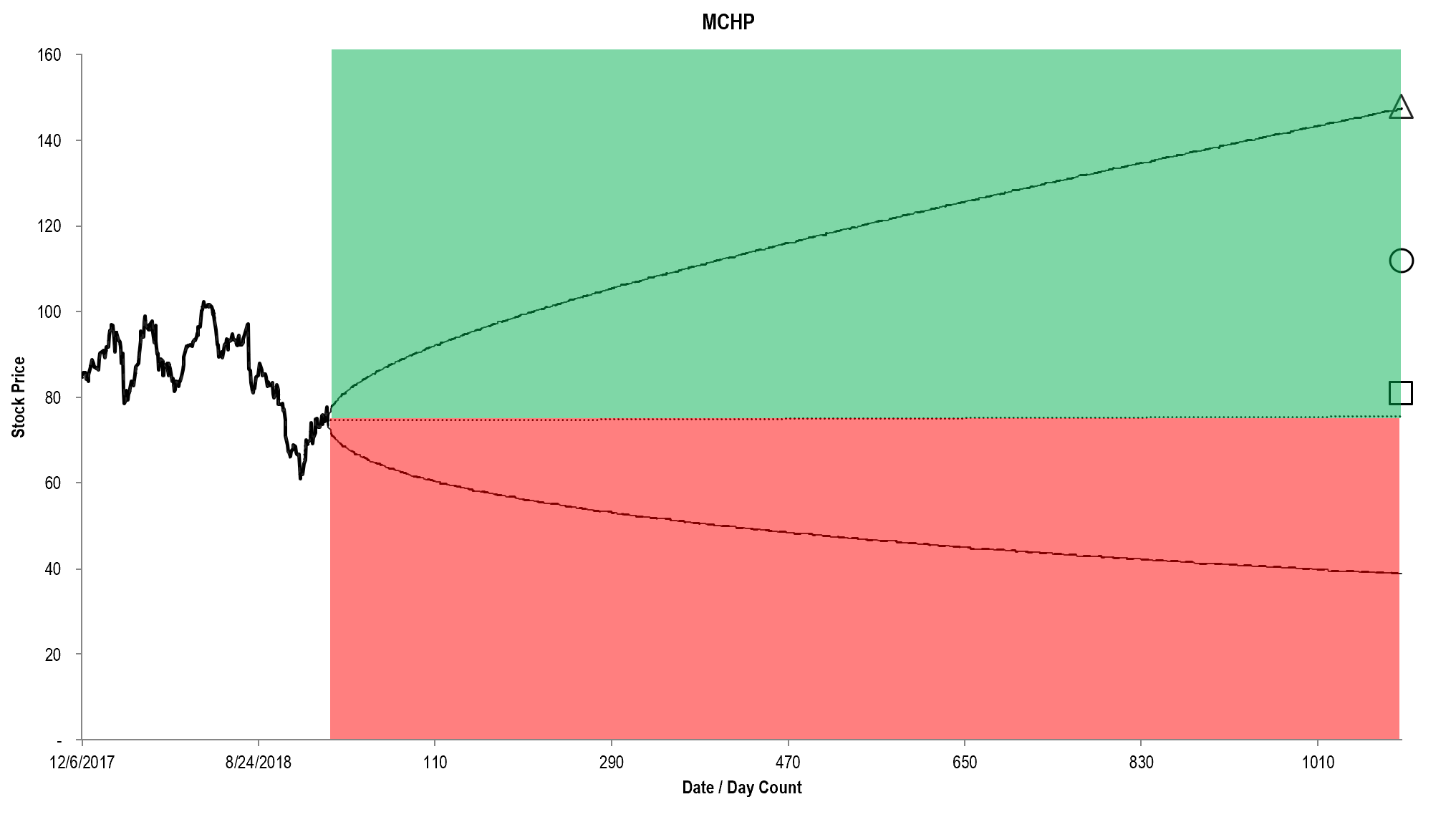

Figure 3. Source: YCharts, CBOE (data), Framework Investing Analysis

Note that our best-case valuation agrees well with the option market’s best-case price projection. This does not mean that Microchip’s upside is not undervalued, however. Note that the average valuation — what we will consider the most-likely value — is much higher than the stock’s forward price.

The implied volatility I used to create this BSM Cone is actually the synthetic “IV30” figure, which represents the average IV over the last 30 trading days. The IV30 value in this graph is 38.5%.

The company is trading for a present dividend yield of about the S&P average — just under 2%. I have already entered this investment (at Monday’s price, unfortunately), allocating relatively conservatively at just 2.25% of my growth portfolio.

Long Diagonal

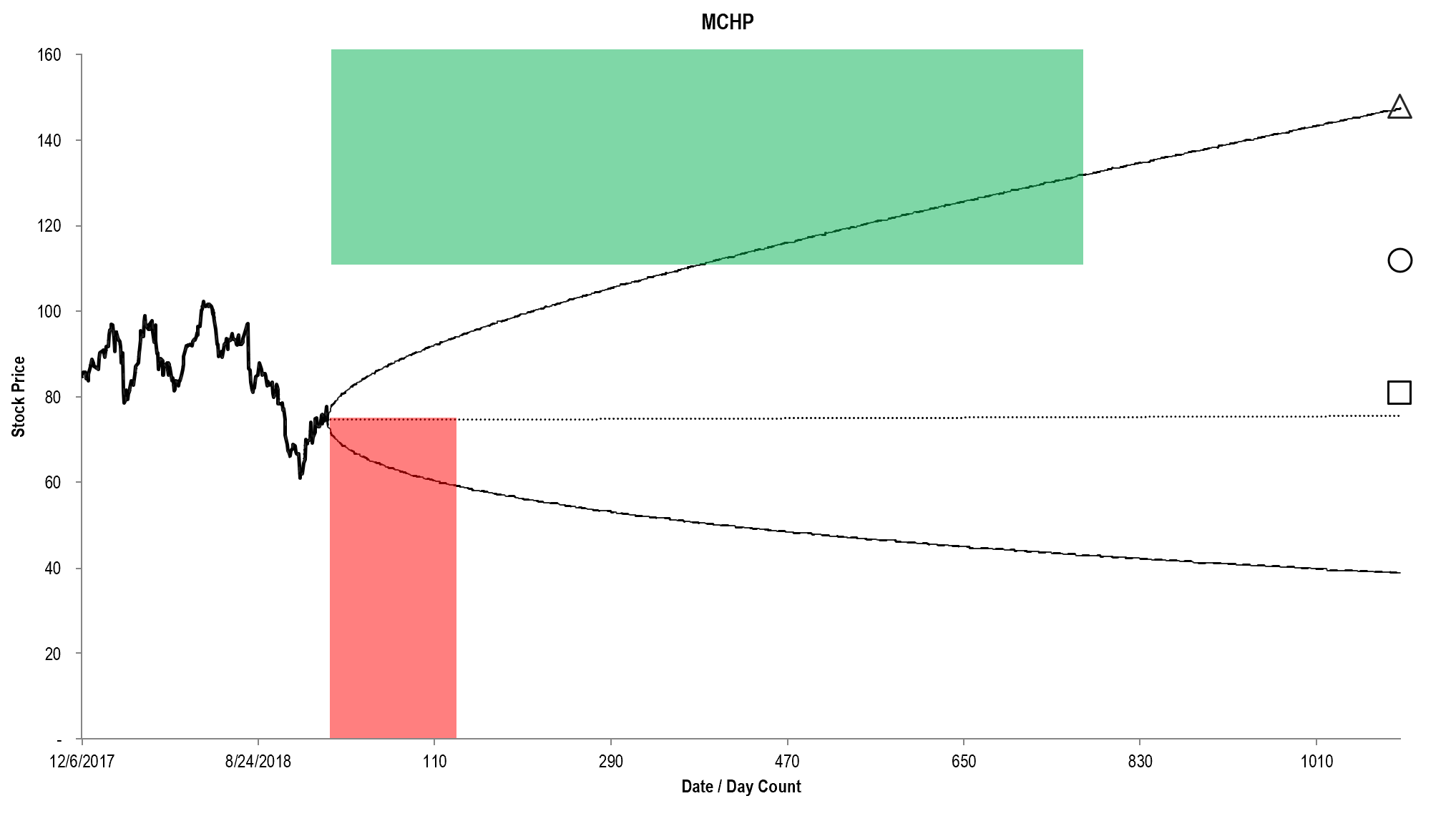

An investment I call a long diagonal (that the rest of the option world calls a split strike combo) can be used singly or in conjunction with a long stock position in Microchip.

Figure 4. Source: YCharts, CBOE (data), Framework Investing Analysis

During market hours today (12/6/2013), the put option struck at $72.50 (ATM) and expiring on April 18, 2019 was trading for $5.85. The call option LEAPS expiring on January 15, 2021 and struck at $115.00 was trading for $3.10.

Receiving $5.85 for the put option more than completely subsidizes the $3.10 put option — offering an investor a net credit of $2.75. This places our Effective Buy Price for the structure at ($72.50 – $2.75 =) $69.75 / share.

I selected the 115-strike call because that strike is close to the average valuation case of $112 / share. My intention would be to close the position once the stock nears the strike price — generating a return from the change in time value rather than from the change in intrinsic value.

This is a very highly-levered structure and I would consider it to be “spice” for an investment meal rather than a main course.

Of course, an unlevered structure — a short ATM put — is also possible. Because the upside seems undervalued, this would not be my preferred choice, but considering the risk of a general market downturn, it is also a reasonable structure to consider. A short put would generate premium income of $5.85 and an Effective Buy Price of ($72.50 – $5.85 =) $66.65 / share.

Levered Long

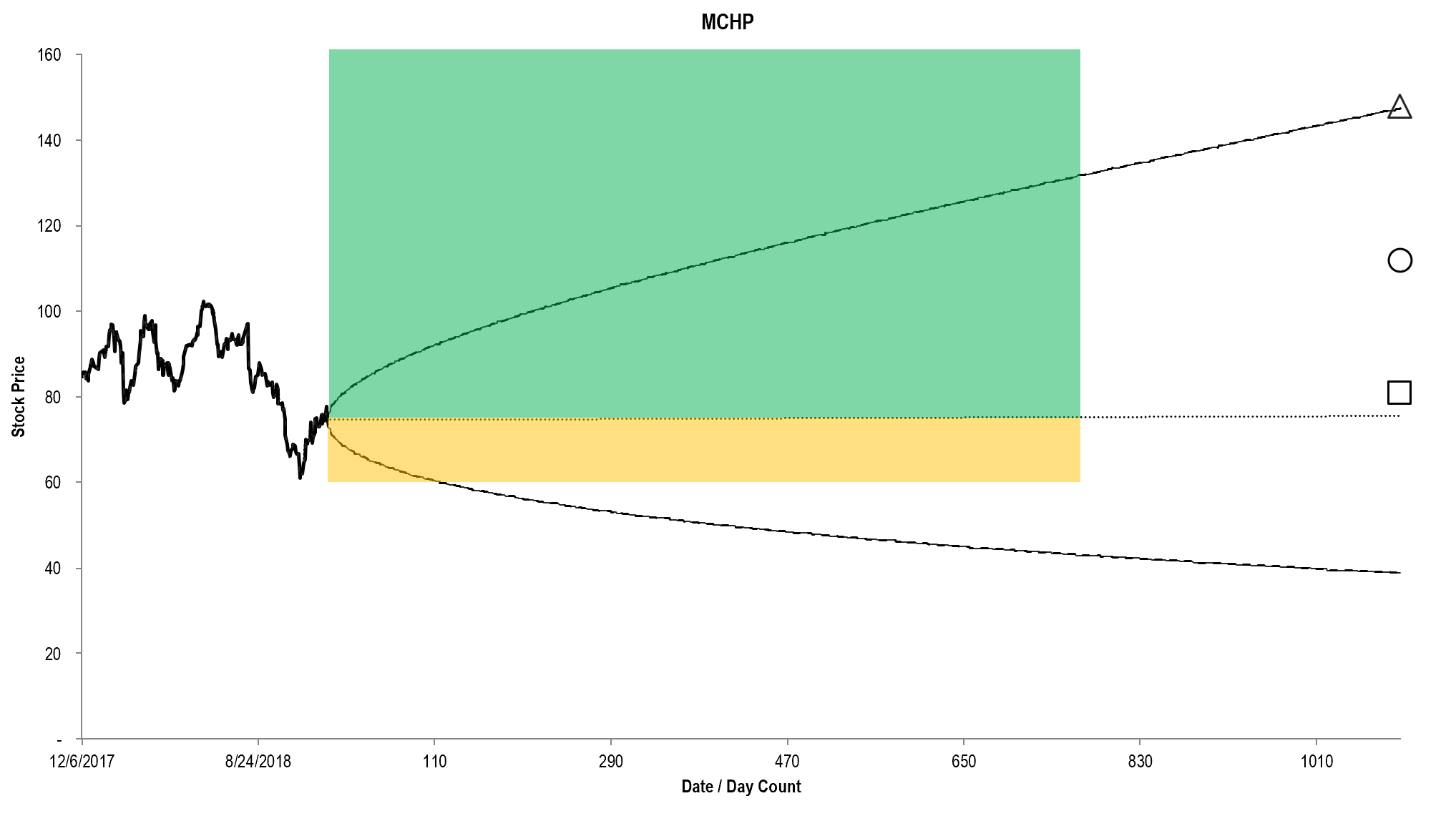

Figure 5. Source: YCharts, CBOE (data), Framework Investing Analysis

This structure allows an investor to accept less downside exposure while having nearly perpetual upside exposure. Unfortunately, the high implied volatility at present makes this a relatively expensive structure.

The LEAPS call expiring in January 2021 and struck at $60 / share was trading today for $22.20. This price represented $12.50 of intrinsic value and $9.70 of time value.

The $9.70 of time value works out to an implied interest rate on a “virtual loan” of the $60 strike price of 7.3%. Considering the inverted yield curve, this value seems wildly too high to me.

For the time being, I will be content to own a small position in the shares and I may revisit the Levered Long position if and when the market takes a tumble.