The shares of a company that I covered while I was managing Morningstar’s semiconductor research group — Microchip Technology MCHP — have taken a big hit over the last few months.

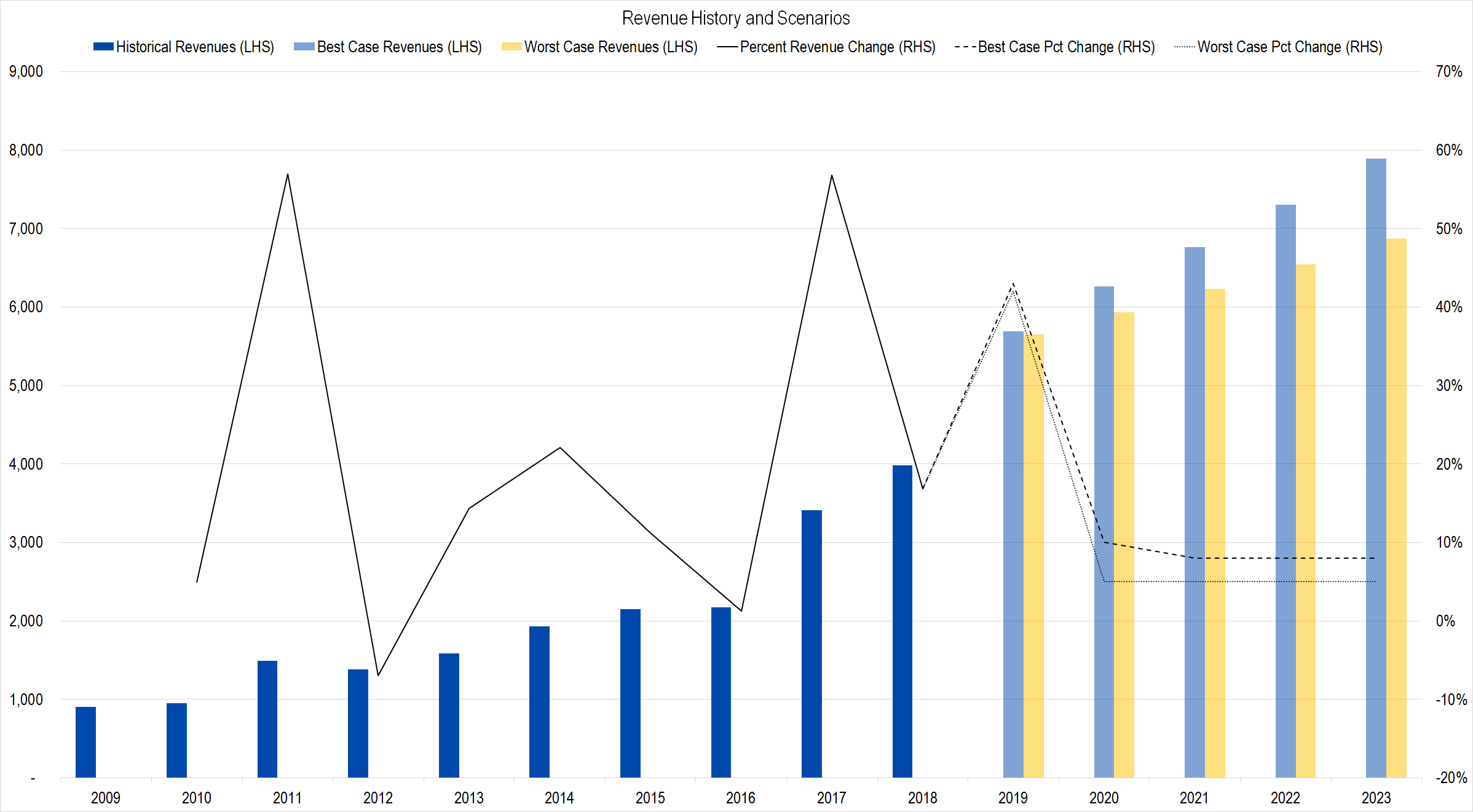

Figure 1.

With the steep stock price drop, I wanted to take a closer look at the company’s valuation for a possible investment. I have an email out to Microchip’s management, but my initial impression is that the stock would need to fall further before an investment would be attractive.

Valuation Overview

Since writing an intro article about Microchip last week, I have been working through Microchip’s latest financial statements, conference call transcripts, and IR presentations.

The more I read, the more questions I had. I was surprised to see that the company has made a significant strategic shift over the past five years, now consistently spending more on acquisitions than it had historically.

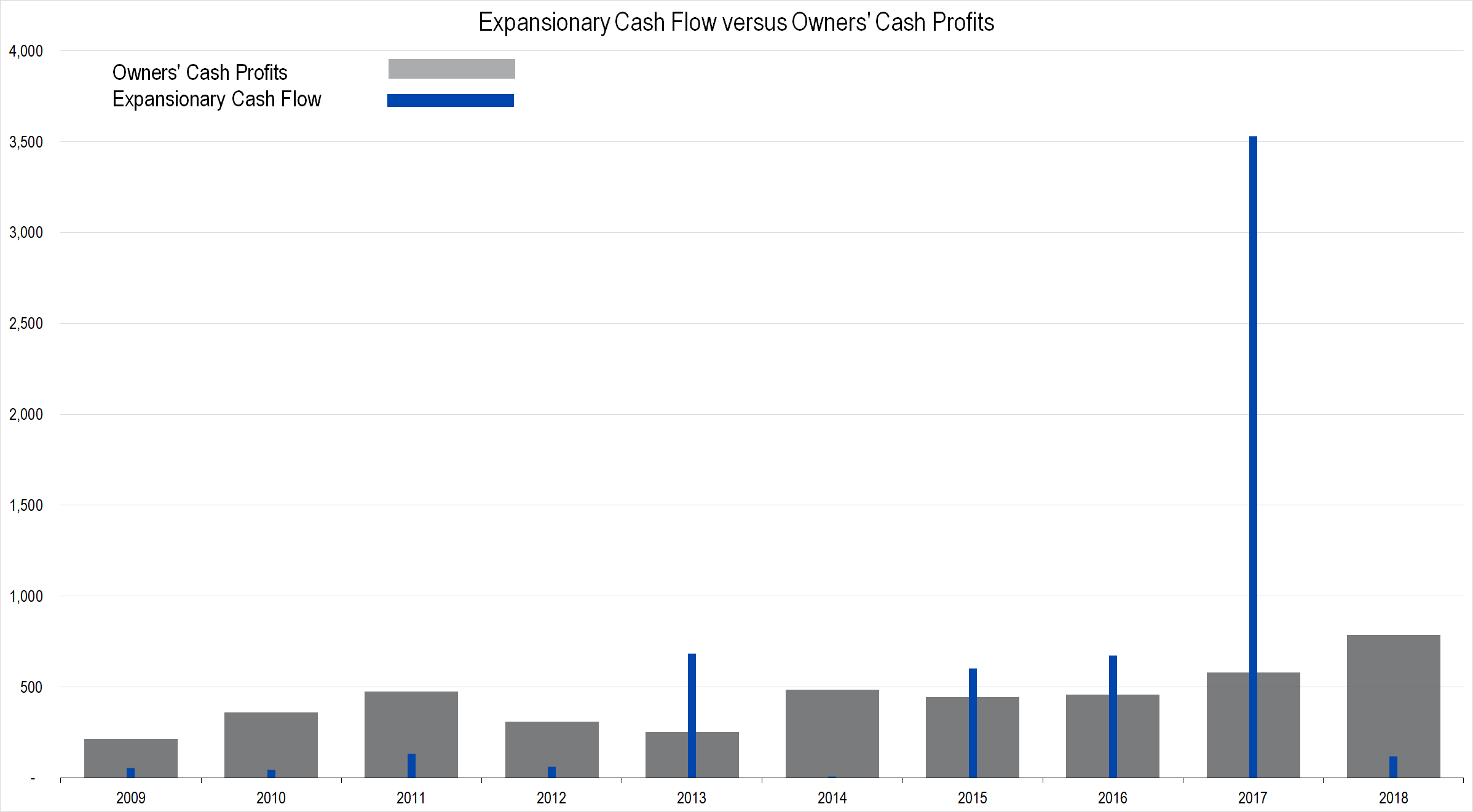

Figure 2. Source: Company Statements, Framework Investing Analysis

In the figure above, you can clearly see that since 2013, Expansionary Cash Flow has been above Owners’ Cash Profits in four out of six years. (Microchip’s fiscal year ends in March of the year, so FY18 is the fiscal year ended on March 31, 2018.)

FY19 has seen an even larger acquisition, with Microchip spending a net of around $8 billion on a former competitor, MicroSemi. Including 2019 in our count, five out of the last seven years, Microchip would have invested significantly more money than the profit it was generating on behalf of owners.

Over the last 10 fiscal years, Microchip has generated an aggregate of $4.4 billion in Owners’ Cash Profits. From 2013-2018, it has invested an aggregate of $5.6 billion on expansionary projects, and this figure does not include the money spent this year on MicroSemi.

Revenues have shot up as a result of this spending.

The average revenue increase since 2013 was 20% and this year, Wall Street consensus is that it will generate revenue growth in the low 40% range (as shown by the dashed and dotted lines in the figure above).

A result of the boosted revenue growth is that Microchip is now the third largest manufacturer of microcontrollers (read my previous article to see the kinds of applications in which microcontrollers are used), behind Renesas and NXP.

Acquisitions take a long time to integrate, so one line of questioning that I have for management revolves around the time needed to effectively incorporate its acquisitions into its business model.

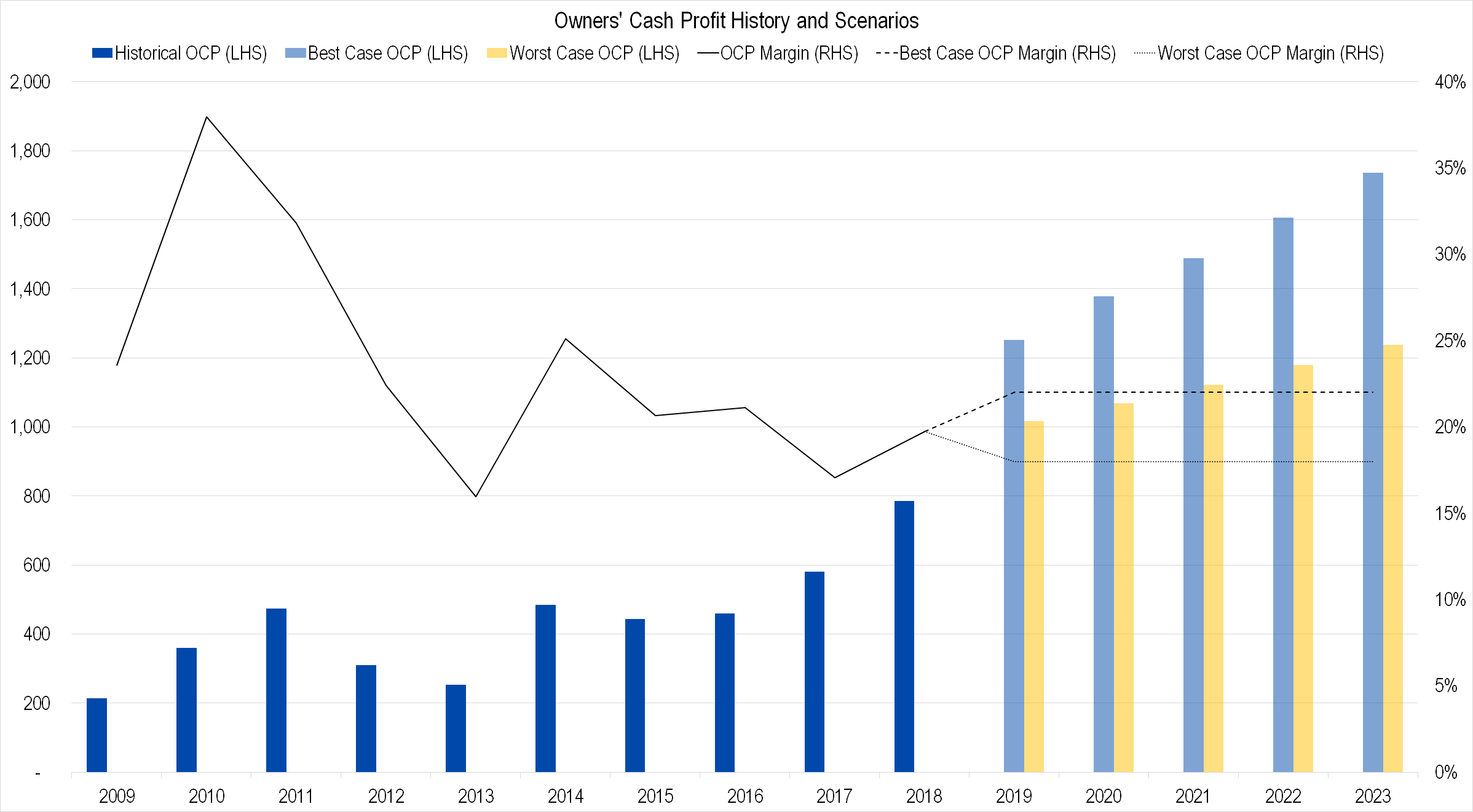

Another result of the acquisition activity is that Microchip’s historically high profit margin has drifted downward.

Figure 4. Source: Company Statements, Framework Investing Analysis

On its conference calls, Microchip management talks about aggressive profitability goals, but especially because of the large number of acquisitions recently, I remain circumspect (as you can see from my best- and worst-case OCP margin assumptions in the figure above). This is another line of questioning about which I intend to follow up with management.

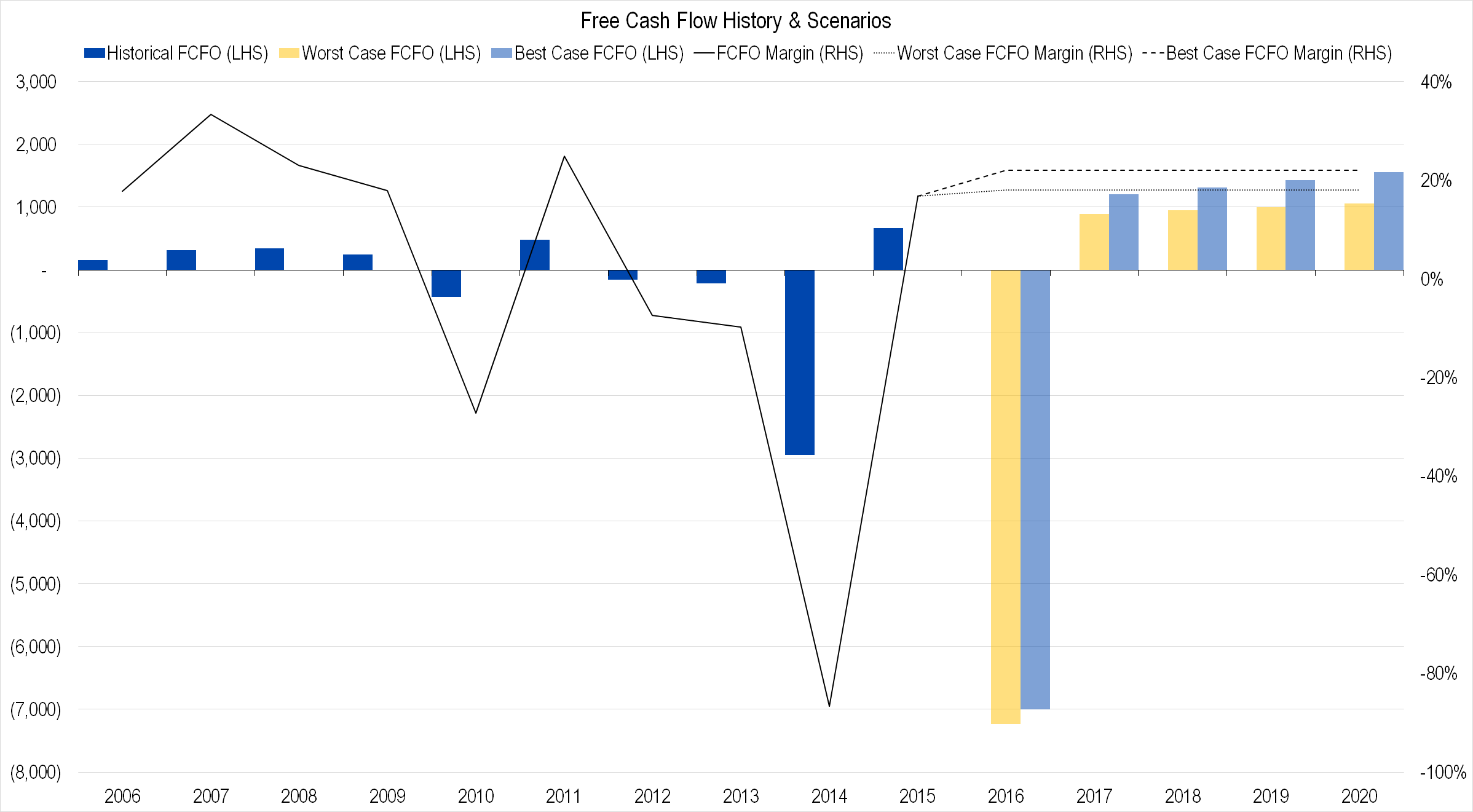

Factoring in the purchase of MicroSemi and assuming about $175 million in annual ECF in the period after that, we get the following graphical representation of Free Cash Flow to Owners for Microchip.

Figure 5. Source: Company Statements, Framework Investing Analysis

Because Microchip’s technology is front-and-center for the Internet of Things (IoT) revolution, I have assumed that the company’s cash flow will increase by 12% per year during the medium-term (FY2024-2028) in the best case and 7% in the worst case.

The 12% figure was the average 5-year rolling growth rate of OCP for the company during our historical 10-year period (i.e., the average of five observations).

This assumed growth rate may, in fact, be too low. If the firm does catch the IoT wave and it is able to continue to find synergies from its acquisitions, the actual growth rate might be considerably higher. This is another line of questioning I would like to pursue.

First-Pass Valuation

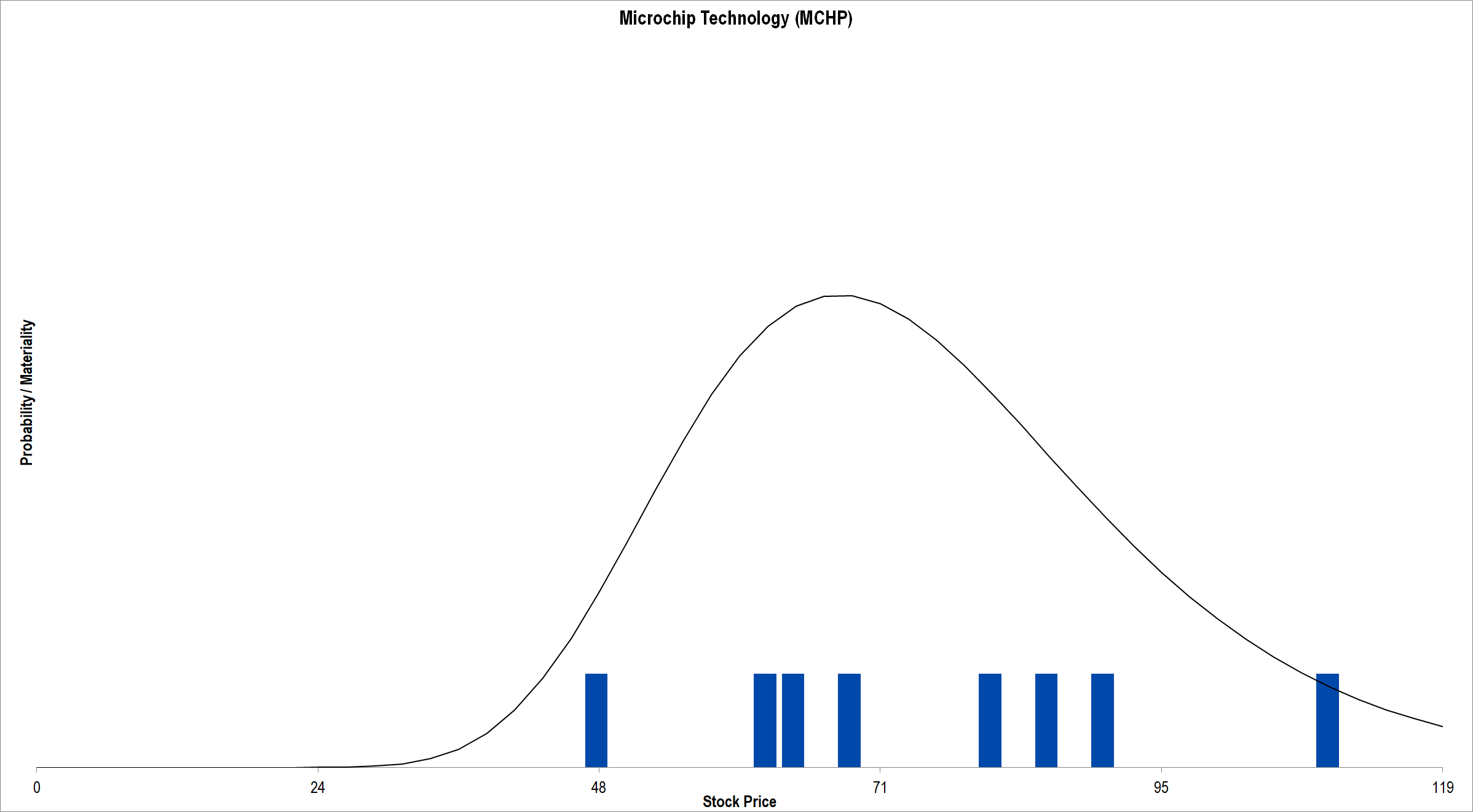

The end result of these assumptions is an average fair value estimate of just 10% or so higher than the firm is trading for today.

Figure 6. Source: CBOE, Framework Investing Analysis

I will update our valuation model and post another article after I have had the chance to speak with management and think more about the reasonability of my assumptions.

Framework Integrated Valuation Model – Microchip (MCHP) ![]()