In our recent series re-analyzing Union Pacific’s valuation, we included a brief section discussing taxation but deferred making a final analysis until the tax reform bill was finalized.

Now that an omnibus bill has passed both houses of Congress, we have taken a close look at the rules and attempted to assess the likely effects of the new law on Union Pacific’s accounting earnings and on its Owners’ Cash Profits (OCP). Of the various changes in the present tax reform bill, we thought two were the most important: a lowering of the tax rate and a lowering of the amount of interest expense that can be used as a tax shelter. Because of the way the latter rules are stated (any net interest expense exceeding 30% of pre-tax income is not tax-deductible) and the fact that Union Pacific’s interest payments are a relatively small proportion of its pre-tax income, we believe the main effect of the change in tax regulations will stem from the lower statutory rate.

In short, we believe the effect on accounting earnings will be enormous and immediate, whereas the effect on Owners’ Cash Profits will probably be negligible.

Accounting Profits

A corporation keeps two sets of books — one for the shareholders and one for the tax man. The purpose of the former is to make the firm look as wildly profitable as possible and the purpose of the latter, to make it look as unprofitable as possible.

Differences in the way the profitability is calculated in each of these books (mainly related to differences in allowable depreciation rates) give rise to allegedly temporary differences between taxes owed and taxes paid. A good, if somewhat dry, explanation of this process is covered in this Wharton professor’s online video. A skillful accounting team can make sure that these temporary differences are essentially never reversed, so they become effectively permanent.

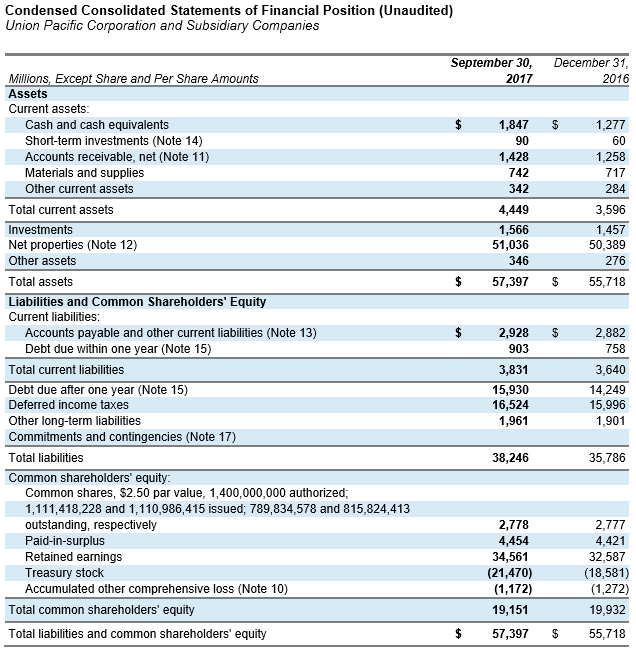

When the company pays less in cash taxes than it should owe, a “deferred tax liability” arises in acknowledgement that someday, these deferred taxes will need to be repaid. At the end of the third quarter of 2017, Union Pacific had a deferred tax liability of $16.5 billion, which equates to 29% of the firm’s assets and 86% of the firm’s equity.

Figure 1. Source: Company Statements

With the tax rate change from a statutory rate of 35% to one of 21%, we believe that Union Pacific’s deferred tax liability will be reduced to roughly $9.3 billion — a difference of $7.2 billion. This difference must be offset by higher shareholder’s equity to keep the balance sheet in balance, which means the company should recognize a one-time, non-cash increase in income of $7.2 billion. $7.2 billion works out to nearly two years’ worth of the firm’s net income, so this year’s income statement will look as though the company generated this years’ income plus nearly two more.

(This situation is precisely reversed for firms with large deferred tax assets, like money center banks, which will take an enormous non-cash charge because a good bit of their asset base has disappeared with the flash of a legislator’s pen.)

Because the tax change law will be passed this year, we believe this changes will show up in fiscal year 2017 earnings. Last year’s earnings worked out to $5.07 per diluted share, so by this reasoning, 2017 earnings will likely wind up somewhere around $15.00 per diluted share, give or take a bit.

Note, that even with the huge increase in earnings per share, the gain is a non-cash one. As owners, we care more about how much cash the company is generating, which leads us to a discussion of Owners’ Cash Profits.

Owners’ Cash Profits

The Statement of Cash Flows starts from the jumping off place of the firm’s Net Income – which is, of course, equal to income net of everything including tax expense.

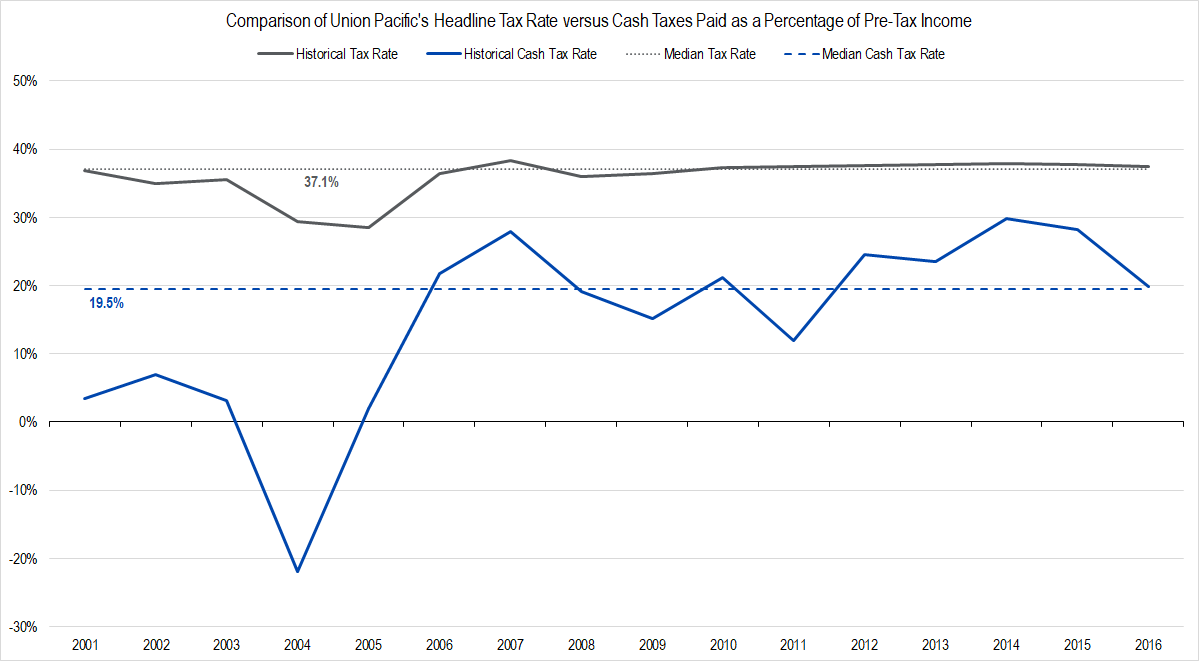

However, because Union Pacific pays less in cash taxes than the tax expense it publishes on its Income Statement, the Net Income figure on the Statement of Cash Flows is too low. The difference between the statutory rate (termed the “headline rate” in the graph below) and the cash rate is, in Union Pacific’s case, large and notable.

Figure 2. Source: Company Statements, Framework Investing Analysis

The median tax rate over this period is 37.1% compared to a median cash tax rate of 19.5%. You can see that the cash rate fluctuates much more than the headline rate does, and when business is especially good, the cash rate extends up to around 30%.

Because the company charges more for tax expense than it actually owes, on the Statement of Cash Flows, the firm adds back the difference as if it were a cash inflow (on the Benjamin Franklin principle that a penny saved is a penny earned).

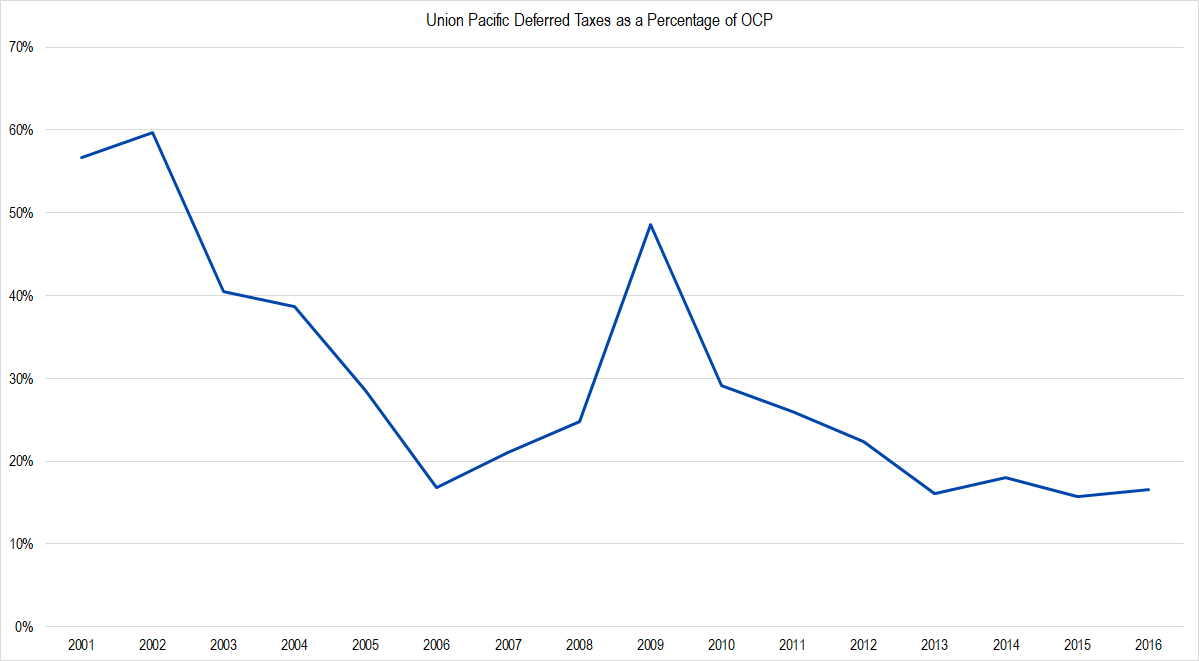

This tax mismatch add-back is pretty substantial as a percentage of OCP.

Figure 3. Source: Company Statements, Framework Investing Analysis

The last few years, the add-back has contributed from the mid- to high-teens percent of OCP, but that figure has been much higher in the past.

This means that the very large difference between the headline rate and the cash rate is boosting the profits of the firm when considered from a cash basis. When the statutory rate is lowered, we do not believe that the firm will recognize as large of a difference between the tax expense line on the Income Statement and the cash rate paid to the IRS; it follows that the cash boost from the difference will also subside.

At present, it looks from figure 2 that the company has been paying an effective cash tax rate of about 1.5 percentage points below the new statutory rate, so — over time — the new lower statutory rate may actually wind up hurting Union Pacific owners more than it helps them.

Tax expense on the income statement will be much lower, which will boost Net Income, but because there is not as great of a difference between the headline rate and the cash rate, there won’t be as much of an add-back on the Statement of Cash Flows (i.e., reality).

Conclusion

Taxes are not easy and major changes to the statutory rate do not happen very often. We were guided in our analysis by this academic paper, published in 2011, that analyzed the balance sheet and earnings consequences for large US firms supposing the statutory rates dropped from 35% to 30%.

We are going to contact Union Pacific’s investor relations department to confirm our understanding of the impacts of the tax change with them, but these are the impacts as far as we can tell at present. It’s worth noting that even the academics who published the above-linked study had to check with each of the companies to confirm their calculations before publishing their paper.

If our understanding of the situation is correct, the valuation we published earlier this month will still be roughly correct. We will revisit the valuation and publish an updated investment strategy once we have confirmed our understanding of the changes.