Executive Summary

- The share price of US grocery giant, Kroger, is down sharply this morning on a disappointing earnings announcement.

- Reported Cash From Operations was negatively affected by the payment of $1 billion in pension funding costs, and OCP margin is roughly half of our forecasted level.

- We had originally thought that a bond replacement transaction in Kroger might be attractive, but because of the large OCP shortfall, have decided to look more closely at the valuation before publishing a recommendation.

Background

When I checked my pricing screens today, I was surprised to see the stock price of the US’s largest grocer, Kroger KR, down by more than 10%.

We have published several reports on Kroger and published an updated model in June of last year. Framework’s prior work on Kroger (including our most recent valuation model) can be found on the Articles page.

I thought that the large drop might present a good opportunity for covered call / short put writers. ATM puts (K = $23.00) were trading at a price of $1.83 / $1.85 per share, offering a yield of ($1.83 / $23.00 =) 7.9% over just more than four months (133 days).

The Effective Buy Price for this transaction would be ($23.00 – $1.83 =) $21.17. At this EBP, the $0.50 / share dividend works out to a yield of just under 2.4%.

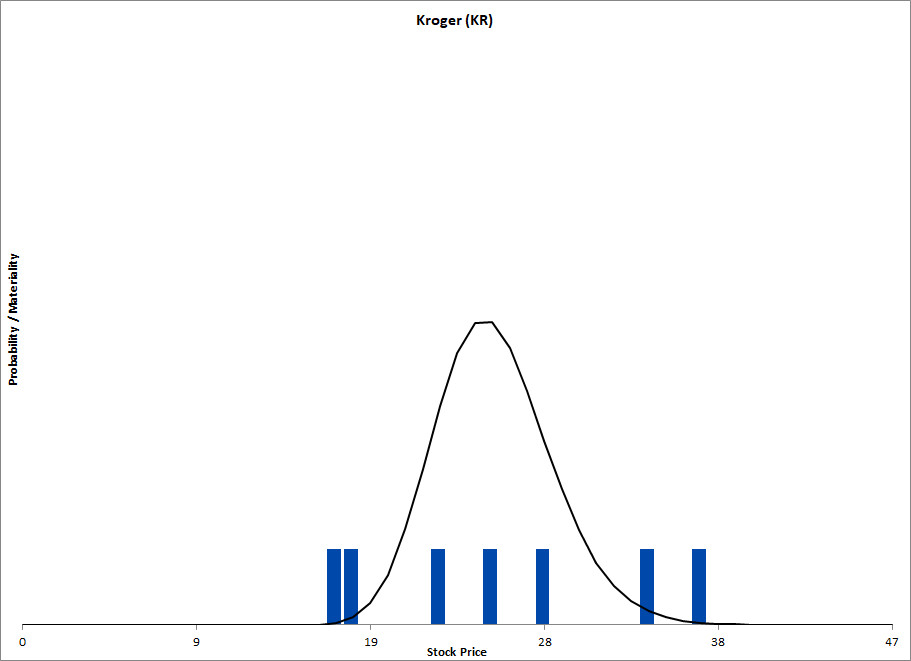

Figure 1. Complex Valuation Range for Kroger on 6/15/2017. Source: CBOE (pricing), Framework Investing Analysis.

As the valuation range in the above diagram shows, our most recent valuation saw a most-likely valuation range between around $23 / share and $28 / share, with valuation tails on both the down- and upside of that.

We want to take another look at our valuation model and read what the company has to say about ongoing pension liabilities. Our suspicion is that the company will use tax savings under the 2017 tax laws to boost its company-sponsored pension fund, meaning that in the short-term, owners will not see benefits from a lowering of the statutory rate.

We will update the Framework community shortly.