On June 16, 2017, long-time Framework member Carey C., encouraged me to pull together a Tear Sheet for Kroger KR, whose stock price had fallen heavily, first due to market disappointment related to its first quarter earnings report, then to market surprise about Amazon’s announcement it would acquire Whole Foods Market.

The Tear Sheet we published then highlighted selling a put option struck at $22 / share to receive a premium of $1.90 / share. The put option we highlighted expired last Friday (October 20, 2017), and because the shares were trading below the $22 strike price on expiration, investors in this strategy are now owners of Kroger at an effective buy price of ($22.00 – $1.90 =) $20.10 / share.

Kroger stock’s current market price is $21.51, so an investor in the June bond replacement who sold shares today would realize a gain of ($21.51 – $20.10) = $1.41. With $22.00 of capital at risk in the transaction, the period return (129 days) of ($1.41 / $22.00 =) 6.4%. Annualized, this return works out to 19.2%. This return is a bit below our initial expectations of a 9.0% period return because the option expired In-the-Money.

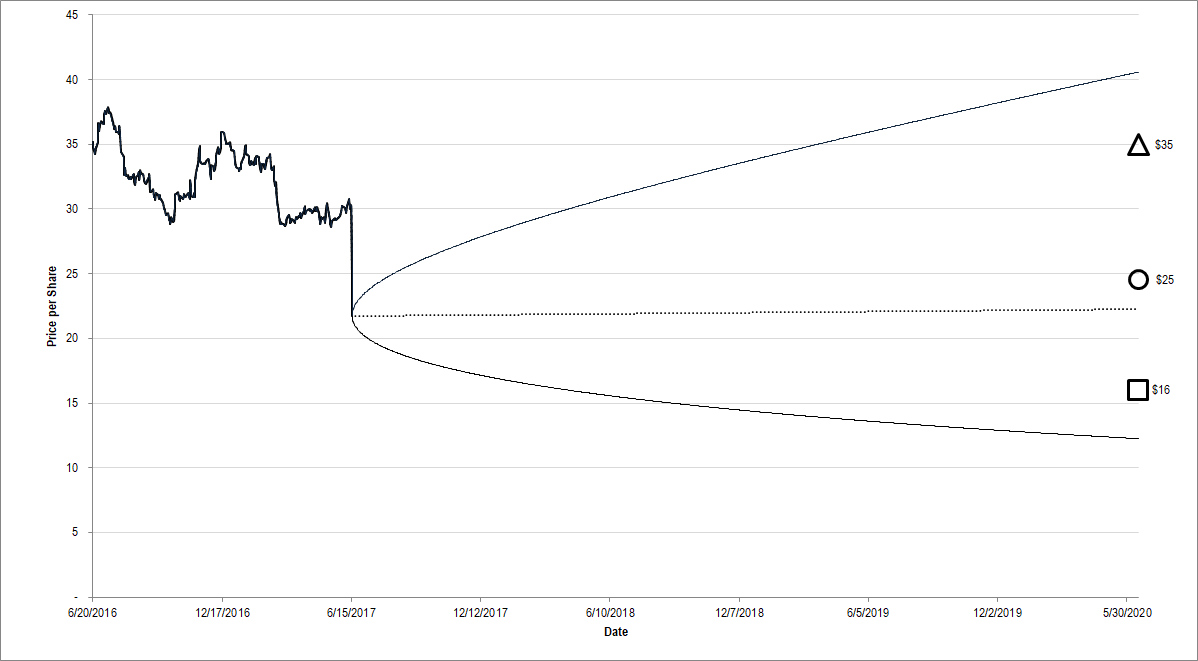

Implied volatility at the time when we highlighted this “bond replacement” investment (see our video explanation of bond replacement investments) was very high. This meant that the option market was pricing in a significant likelihood that Kroger’s stock price would drop below our worst-case valuation estimate.

Figure 1. Source: CBOE, YCharts (data), Framework Investing Analysis. Geometrical markers show Framework’s best-case (triangle), worst-case (square), and equally-weighted average value (circle). Cone-shaped region indicates option market’s projection of the company’s future stock price. Note how the bottom of the BSM Cone lies around 20% below the square icon representing Framework’s worst-case valuation scenario.

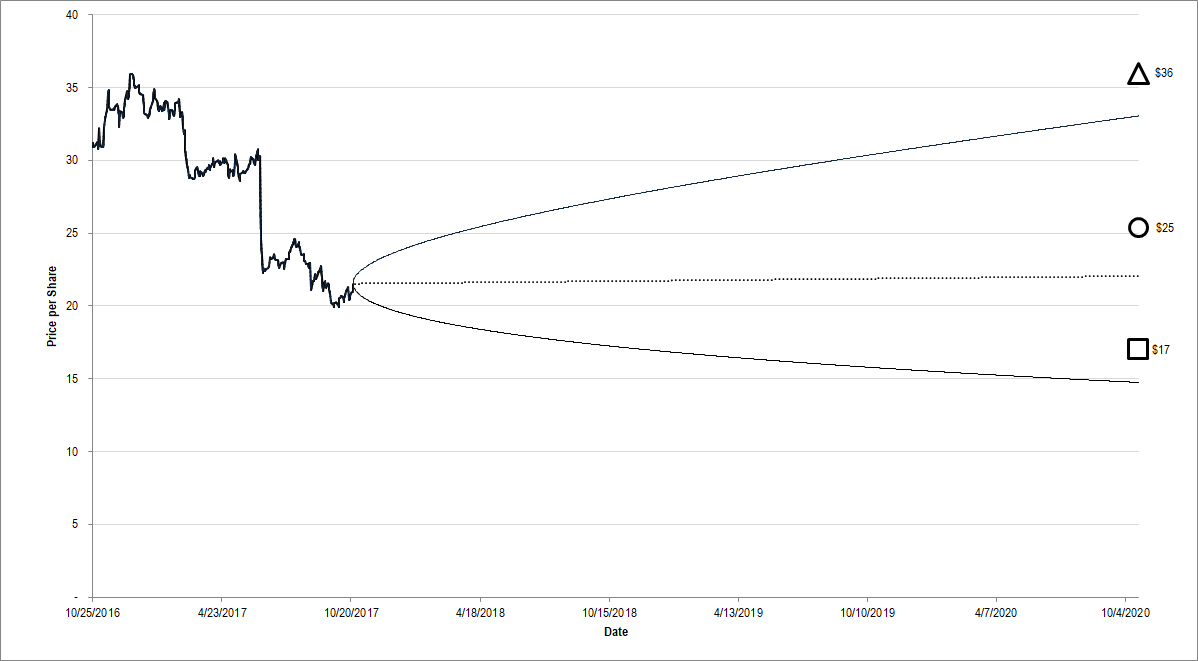

In the intervening four months, cooler heads have prevailed and implied volatilities have shrunk considerably.

Figure 1. Source: CBOE, YCharts (data), Framework Investing Analysis. The increase in best- and worst-case fair value scenarios relates to time value of money calculations and we consider them immaterial. The bottom of the BSM Cone now lies around 10% below that of Framework’s worst-case valuation scenario and our best-case valuation scenario now lies outside the BSM Cone’s boundary.

We characterized the June bond replacement investment strategy as “Low Conviction” because our worst-case valuation scenario lay below the market price at the time. Option pricing was rich enough that our investment providing short-term downside insurance to frightened investors seemed appropriate, even though we were taking on valuation risk in the process.

With implied volatilities now much lower and the stock price within around 10% of our most-likely fair value scenario, we do not believe there is the opportunity to extend this bond replacement investment by selling calls on the underlying shares.

We will outline several other potential investment strategies in Kroger in a separate article.