Since posting our June Covered Call Corner spreadsheet last week, I have been busy making transactions, a total of five bond replacement investments. Three of these investments used covered calls, the remaining two used short puts.

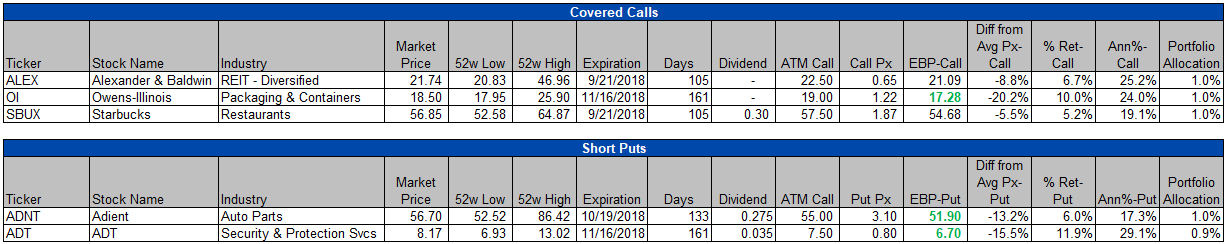

The details for each of the transactions are shown in the figure below.

Figure 1. The green numbers all highlight Effective Buy Prices that are lower than the 52-week low price recorded by the stock.

As you can see, I aimed at a 1% allocation to each of the ideas. In all, 14% of the portfolio is allocated to bond replacement investments from the May and June 2018 Covered Call Corner screens. The portfolio also has a 4.1% position in the IBM investment recommended in our last Tear Sheet, which I consider to be a hybrid between a concentrated investment and a bond replacement one.

Due to price changes and the progression of time, annualized yields if all the shares are called away increased somewhat. The allocation-weighted average annualized yield is just under 23%.

We think that period returns are a better way of thinking about potential yields. If all our stocks are called away from us, the allocation-weighted averaged period yield will be just under 8% over an average tenor of 133 days — just under four and a half months.

In addition to these transactions, I also entered into a 1% position in Spirit Realty Capital SRC, the company about which I posted the other day. In addition, I also entered into a bond replacement investment in Spirit Realty in an allocation representing another 25 basis points of the portfolio. The blended Effective Buy Price of this position is around $7.71 / share, and I may add to this position as I do more research on it. The shares are yielding over 9% per year in dividends, and the period return on the short puts is in the 8% range (25%+ in annualized terms).

Robert Ruggirello, CFA attended an industry conference on REITs this week and attended the Spirit presentation. I have yet to review the video, but Robert did ask a question on my behalf — thanks, Robert! Another REIT that Robert liked was one in which we transacted today — Hawai’ian property company Alexander & Baldwin ALEX. ALEX does not pay a dividend, but the market in which it operates is very attractive, and Robert is interested in doing more research. I have a long family connection to Hawai’i, and I know a little about the company myself, so may increase the size of this position as well.

One company on the Covered Call Corner list that caught my eye in particular was ADT — the security monitoring firm. This name interested me since it seems it is getting into Internet of Things (IoT) in addition to security monitoring, so I may do some more analysis on this company too.