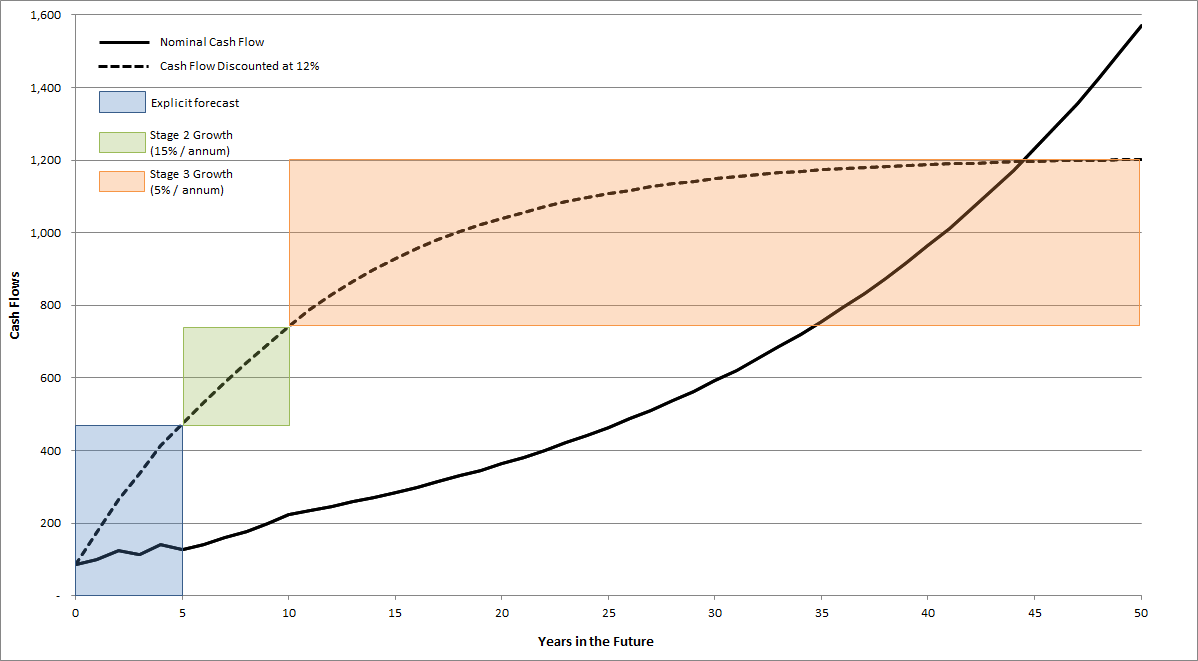

One of the little-appreciated facts about investing is how little the near-term matters to the value of a company. While the Wall Street banks and the media pundits try to tell you that a company beating or missing quarterly EPS estimates by a penny, the great majority of the value of a company is derived from the assumption that it will continue to operate as a going concern for many years.

Figure 1. Source: The Intelligent Option Investor (2014, McGraw-Hill). In the model shown here, 90% of the value of the discounted cash flows (i.e., the value of the firm) is held within Stages 2 and 3 – years 6 through perpetuity.

When analyzing a company, we at Framework pay particular attention to the investments it is making in the present. We know that the investments a company is making now will influence the growth of profits in the medium-term – let’s say from 5-10 years from now.

Corporations understand that investments (i.e., acquisitions, mergers, new businesses) take some time to before they begin adding to profit growth in a real way. Management teams know that if the investments they are making now are successful, current results will hardly see a blip, but medium-term cash flow should show robust growth. Conversely, if a company’s investment program is a failure, medium-term growth will suffer. As such, being able to assess the likely efficacy of a company’s investment program is essential to skillful investing.

For companies involved in large business transitions – companies like IBM and General Electric (two firms in which the author holds bullish positions) – the assessment of the firms’ investment efficacy can be difficult. These companies are selling or abandoning certain businesses while making new or additional investments in others. Cases like this are confusing to markets – which tend to like simple stories with quick payoffs rather than the tenuous possibility of medium-term success – and you often see the shares selling off.

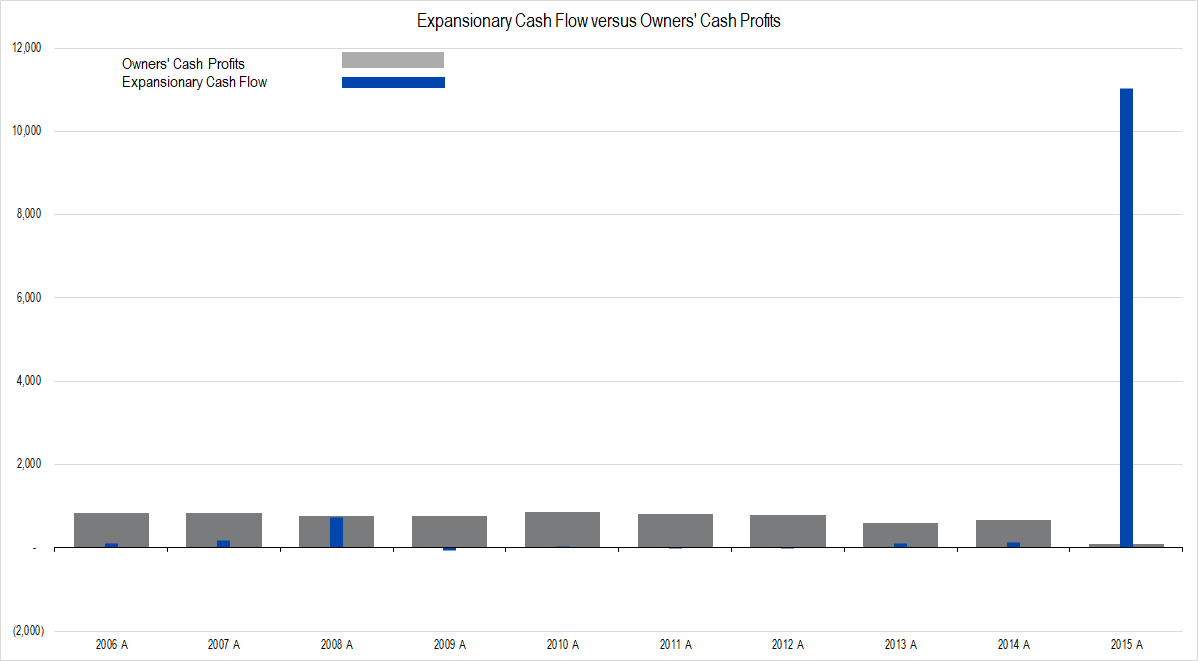

Figure 2.

We believe that these sell-offs create great investing opportunities for patient, intelligent investors. Buying when the price is much lower than the value of the company is the hallmark of what is known as Value Investing.

Worrying Signs

The most worrying signs for a company in my mind are companies that are clearly squandering their owners’ capital in investment projects that are likely to fail. Cisco’s purchase of Flip Video a few years ago is a clear historical example.

Recently, I have been decidedly unimpressed with Zimmer’s acquisition of Biomet. While I understand the pressure for Zimmer to increase its scale, its managers have historically done a poor job of investing, and sank a decade’s worth of its owners’ profits to buy its next-door neighbor. (Disclosure: I hold no bearish position in either Cisco or ZimmerBiomet).

Figure 3. Source: Company Statements, Framework Investing Analysis. The acquisition of Biomet in 2015 (represented by the tall blue column) ate up the previous decade’s worth of profits (represented by the gray columns).

I do not always make a bearish investment in companies fitting the profile of a poor investor, but, at the very least, I recommend against bullish investments.

This framework for understanding growth and value is so powerful that I believe it can be applied to groups of companies and even whole economies as well.

Since November of last year, I have been publishing articles about why I see the Trump administration as being as bad for business as the Carter administration was, and a good part of my reasoning boils down to this point regarding investment.

President Trump has proposed various radical policy realignments related to international trade, domestic manufacturing, border security, immigration, tax reform, and infrastructure spending. Of these, only tax reform and infrastructure spending have the potential to boost growth in the medium term, and then, only if the policies are crafted carefully with this purpose in mind.

After seeing the ludicrous and ill-conceived House and Senate bills to repeal and replace ACA, I have lost faith that tax reform and infrastructure spending plans will be carefully crafted. In my opinion, policy proposals related to taxes and infrastructure are likely be written – not with the goal of moving the US into a position of leadership in the mid-21st century – but rather as a way to provide lucrative subsidies and kick-backs to wealthy Republican donors.

Policies that line the pockets of oligarchs may boost some firms’ stock prices in the short-term, but from the standpoint of being stimulative of our nation’s economic growth in the medium- and long-terms – the terms that matter when value rather than price is analyzed – the policies are indisputably negative.

You don’t have to take my word for it; look what people in the trenches are actually saying:

Certainly, the business leaders that recently resigned en masse from the administration’s industrial councils were concerned about the optics of being associated with President Trump’s statements regarding recent White Supremacy rallies in Virginia. However, we believe that worries among executives about this administration’s stated positions regarding business and national investment, coupled with its cavalier attitude toward policy initiatives and a demonstrated unwillingness to heed expert opinion must have also contributed to CEOs’ decisions.

Another worrisome factor that cannot be discounted is the Trump administration’s attempt – whether through malicious design or thoughtless incompetence – to weaken the structure of the administrative state.

Excessive regulation can and does retard the growth of certain businesses, but confusion regarding the future direction of regulatory action can be equally as damaging. Companies analyze regulatory rules and figure out how to maximize profits within the framework of those rules. If the rules are uncertain, subject to unpredictable change, or if there simply is no government contact person to provide guidance, companies cannot form a coherent operating strategy.

In the opinion of this author (whose ancestors fought both on the American side in the Revolutionary War and on both sides in the Civil War), President Trump’s implicit and explicit support of White Supremacists and their cause is odious and disqualifies him to hold the position of Commander-in-Chief. Even as President Trump’s statements threaten to push back decades of hard-fought civil rights, his implemented and proposed economic policies threaten to retard economic growth for decades to come as well.

Investment matters. President Trump’s ill-conceived, anti-growth economic policies threaten America’s economic future.

This article originally appeared on Forbes.com