General Electric announced on Tuesday, January 16 that after reviewing assumptions regarding the firm’s legacy insurance operations, it would need to reserve more cash to pay future claims. You can find a copy of the announcement, presentation slides, and a recording of the presentation on GE’s Investor Relations website.

We have not revised our valuation for GE and will need to incorporate this information into our new valuation. This article offers an explanation of the insurance business and the economics of this announcement and digs into the issues we believe are most important. The firm also made some comments related to the Capital business in general, and we will briefly address those comments as well.

GE’s NALH Business

Through the 1980s, GE built an insurance and reinsurance business and actively ran it until 2006, when most of the business was sold and one bit was retained to “run off” (meaning that the company retained its economic exposure to prior business, but did not accept new business).

Reinsurance is the business of providing insurance to insurance companies. An insurance company will sell a policy to an end customer, then finds another insurance company to assume the economics of the policy. The insurance company becomes basically a bookkeeping entity, passing through most of the premium revenue to the reinsurer and serving as a conduit for clients to submit claims.

Reinsurers, it turns out, sometimes also buy reinsurance from what is known as a retrocessionaire.

GE sold most of its insurance businesses before the financial crisis, but retained a business called North American Life & Health (NALH), within its GE Capital business.

65% of the policies that NALH insures are for long-term medical care. Roughly 35% are for structured settlement annuities (e.g., a plaintiff wins a lawsuit that specifies an yearly amount be paid to them; GE receives a lump sum from the defendant, invests that, and pays the annuity to the plaintiff). The remainder is reinsurance for life insurance policies.

The profits of any insurance company have little to do with actual cash in- and outflows in any single period. Actuaries calculate what payouts are likely to be made and when for each dollar of premium received in a given year based on a statistical analysis of demographic and other factors.

GE management claims that because it saw an unexpected uptick of claims in its long-term medical care insurance in 2017, they realized that the actuarial assumptions on which prior earnings had been recorded might not be correct. In effect, managers started worrying that its assumed costs were higher than the costs it would ultimately have to pay.

Some portion of the mismatch relates to increasing life expectancy of insurance customers who reach a certain age, some relates to increasing medical costs for long-term care, and some relates to the fact that the investments GE holds to be able to pay these claims over time (mostly A-rated bonds) are not yielding enough to keep up with medical cost inflation.

In order to service the insurance claim, GE now estimates that it will have to reserve a total of $15 billion of additional cash over the next seven years, the first $3 billion of which will be reserved in February 2018. To reserve cash means that cash is moved to a special reserve account that functions like an escrow account — that cash is reserved for the purpose of paying claims, which are treated as a liability.

The increased claim liability, meanwhile, is treated as a pre-tax cash expense. As such, its payment confers a tax shield to the company. Because statutory rates were lowered at the end of 2017, the tax shield GE will receive by reserving the cash is reduced.

Because of the additional cash payment into reserve, GE Financing, which had been paying dividends to the Industrial part of GE, will suspend those dividends for “the foreseeable future.”

The Financing business has $31 billion in cash on its balance sheet now and will pay the February reserve out of that cash. Rating agencies have not downgraded GE, nor have they lowered their outlook on the company as a result of the announcement.

Most Important Issues

In my mind, the most important issue is the extent to which General Electric’s financial projections can be relied upon. This restatement and reassessment is a very large one, and it is hard for us to believe that the change in this business occurred so rapidly as to force it. More likely, we believe, is that the company has seen a decline in the profitability of the business for some time, but has managed to strong-arm its auditors (KPMG) into buying into its actuarial assumptions and projected costs, even as it was obvious that business conditions had been worsening.

Overlay this incident on the fact that the company’s projections for revenues and cash flows in the Power business changed drastically and rapidly last year, and it is difficult to say why an investor should accept the company’s pronouncements and forecasts with anything more than suspicion.

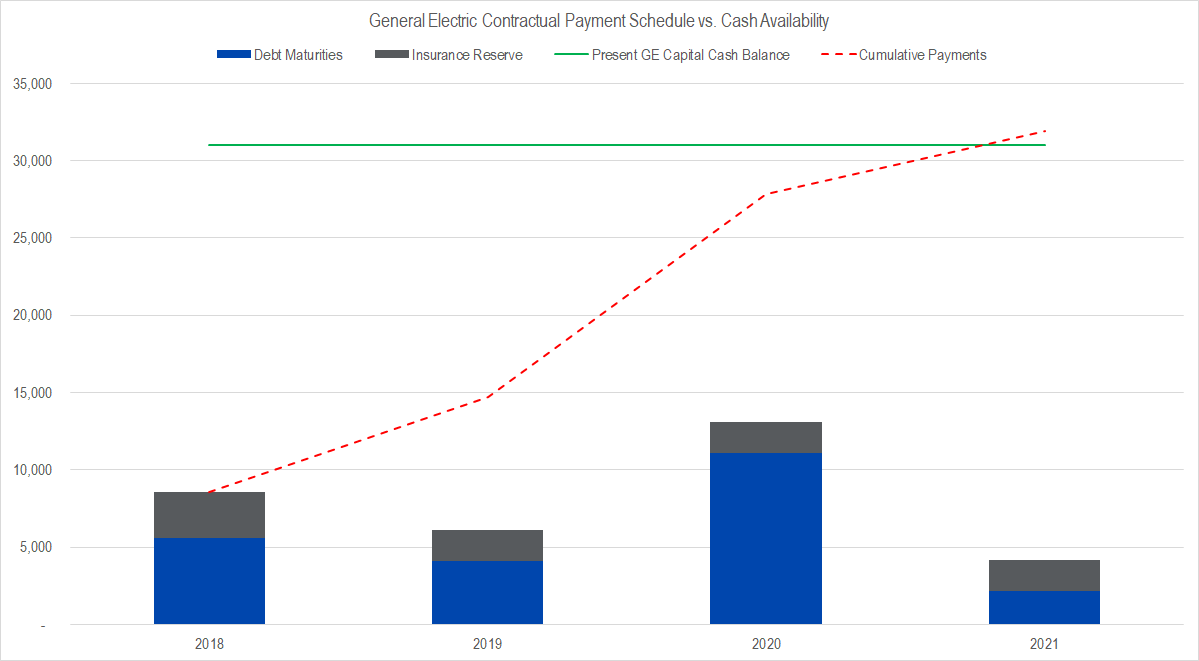

The other important issue is the question of cash sufficiency for future bond repayment. If we assume a $3 billion cash payment to reserves this year and a $2 billion cash payment in subsequent years, and add those payments to scheduled bond repayments (as taken from the 2016 annual statement), we find the following.

Figure 1. Source: Company Statements, Framework Analysis

The green line shows the amount that management reports Capital has in cash. The reported cash balance at the end of September 2017 was $27 billion, so GE Capital has generated around $4 billion in cash during the intervening period. The red line shows the cumulative amount of cash spent for repayment and reserve over the next four years. At the end of the period, the cumulative line extends above the green one, but as long as the company is generating cash flows (and its aircraft leasing business, GECAS, appears to be a strong cash generator), cash should be sufficient. We will dig into these assumptions with management as we’re working through our full valuation review.

Other Topics

The company made several other announcements during the presentation regarding the insurance business. The most notable are bulleted below, along with our brief commentary.

- Reduction in size of the GE Capital / Financing business. The company is planning to keep the jewel of the Financing business – GECAS – at about the same size, but will shrink the size of Energy Financial Services by more than half and Industrial Financing by around 40%. GECAS looks to be a great business for multiple reasons, so we’re happy that will be left intact. We have always perceived the EFS business to be higher risk and some of the Industrial financing also seems better off gone, so we think this is a sensible move as well. Presumably, the company will sell some of those financial assets to banks, which will also generate some cash to pay for the increased reserves.

- Non-cash charge will be taken related to tax reform passage. The value of GE’s deferred tax assets will be lower because of the lower statutory rate. When an asset’s value is judged to be lower, a non-cash charge is made that deducts from accounting earnings. The company guided the amount of this charge to be in the $3.4 billion range, but noted that cash effects from the change in statutory rates would be limited. This is pretty much of a non-event as far as we can tell.

- The company has guided to EPS at the lower end of the previously-guided range and CFOA at the higher end. This is unsurprising considering the insurance announcement – the Financing business will be less profitable. As for GE’s CFOA, I — like many analysts and owners — stopped paying any attention to that metric last year. We eagerly await GE’s fourth quarter announcement and will dig into our revaluation of the company at that time.