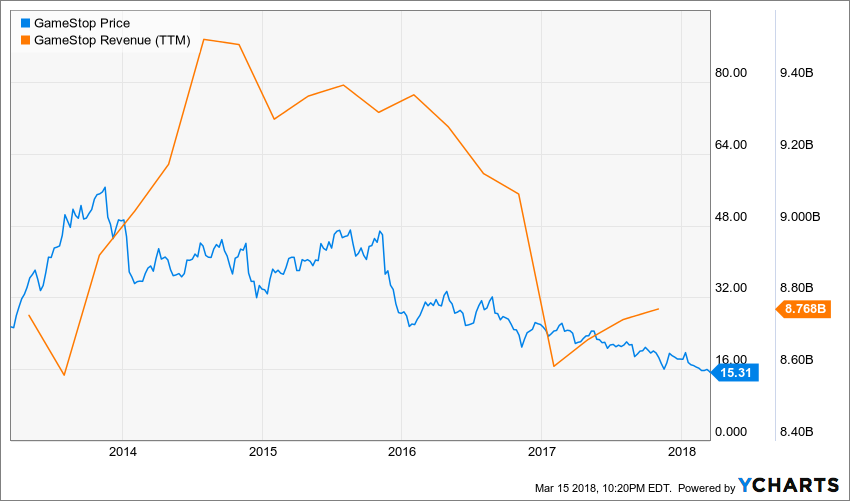

GameStop (GME) has been in the news of late for a variety of reasons. The Company has made a number of “low priced stocks” lists and “undervalued companies” lists. About this time last year (March 2017) a number of analysts had published “it can’t get any worse” reports. Well, the stock price had a $30 handle then. Today, that handle is $15.

GameStop is another victim of the “retailpocalypse”. The market sees the Company as a pure play video game, console and accessory distributor and, we surmise, believes they are about to be Amazoned. Here are just a few price ratios and market stats to get your value investor juices flowing:

P/E (TTM) = 4.53

P/S (TTM) = 0.18

P/B (TTM) = 0.67

% of share float sold short: 42%

You read that right. Forty two percent of available shares are sold short. Wows! That is some serious short interest. GameStop’s price and short float make the company appear priced as a questionable going concern – making this look more like a special situations analysis a la Joel Greenblatt (guess who owns some shares of GME?).

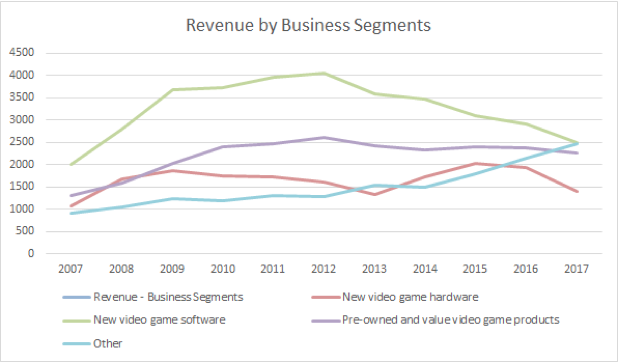

So, what’s happening here, really? Turns out that GME is working on a turn around and while it’s early days, it is progressing. Historically more than 75c of every dollar of revenue game from video games in some way. By 2021 GME expects video game contributions to be less than 50c per dollar of revenue. They have diversified away from gaming by leveraging their core competencies in small store real estate and site selection – buying Spring Mobile and Cricket Wireless stores (GME is ATT’s largest retailer partner) and expanding into Apple retailing with SimplyMac stores. In addition they have sought to monetize their current customer base by getting into collectibles and video game accessories with the addition of ThinkGeek in 2016. These businesses contributed 25c per dollar of revenue in 2017 and we expect they will contribute close to 30c in the FY ended 1/31/2018.

Source: Framework Investing

We are looking more carefully into the specifics of the business but, at our first pass this week, it does not look like GAME OVER for GME.

Loading...

Loading...

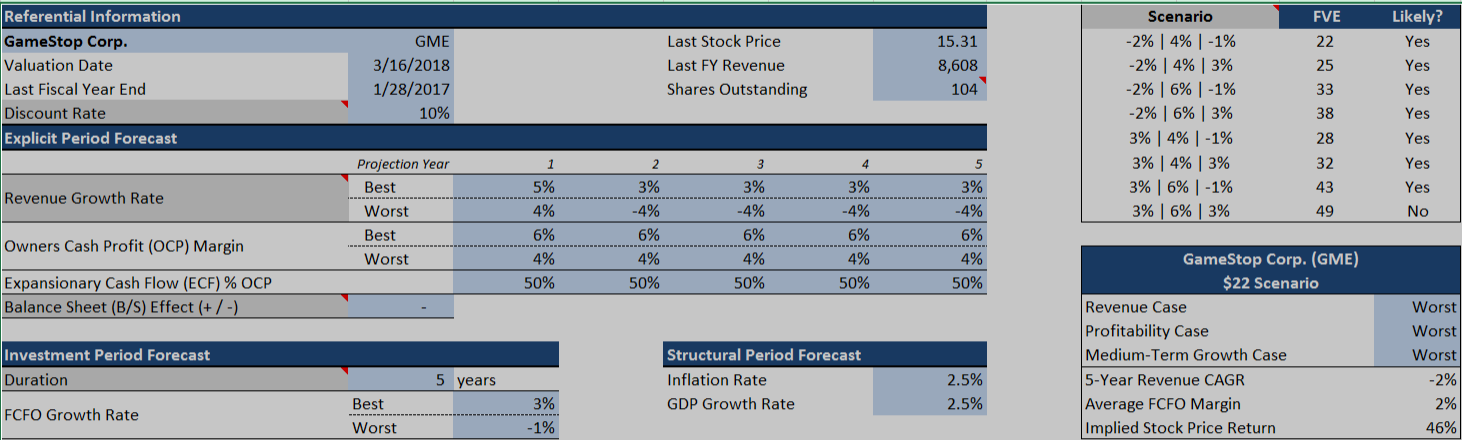

We did two models for GME, one where we attempted to kill the company (Death2gamestop) by effectively running the video game business into the ground while keeping growth in the non-video game businesses in the low single digits (typically they have been running over 14% annually on average). Only under those conditions were we able to generate values in the $11-$16 per share range.

The second, the GameHasNotStopped model is attached here ![]() and outlines our thinking and assumptions behind our valuation model in the waterfall above.

and outlines our thinking and assumptions behind our valuation model in the waterfall above.

There are certainly some risks in the GME business model going forward.

The company clearly knows the small, niche brick and mortar retail market well. It has been less savvy with its digital storefront but still maintains a competitive presence with the Amazons and Walmarts, Targets and BestBuys of the world. GameStop still occupies a soft spot in gamer hearts as a brand. The company has to keep growing outside of gaming and that will require investment. The company ran negative FCFO in 2017 due to acquiring over 400 ATT retail stores. They paid out over 70% of FCFO in 2016 to purchase ThinkGeek collectibles. We need to keep seeing progress on the revenue side and see what effects this new mix has on profitability. This has been a low OCP margin business from the beginning.

On balance, performance does not seem as bleak as the market is pricing. That said when things go bad they tend to do so slowly and then all of a sudden. That’s the risk here.

Be on the lookout for more investment analysis and a possible investment structure / FWI Tear Sheet coming soon.