Yes, yes, we know that all you brilliant Framework members have newsfeeds, but we like to think we bring you some things you might not otherwise read and maybe spark some different ways of thinking about your investments. Friday marked a material escalation in the Catalan crisis in Spain with the separatist region’s declaration of independence and Madrid’s response to take full control. Three months ago, no one in Europe saw this coming and Spain’s GDP and stock market have taken a hit, but maybe it’s all sound and fury? David Einhorn’s letter to his shareholders has so much good investing sense in it that it’s hard to know where to begin. Then there’s a wonderful piece on how digital and social media are having a positive impact on professional learning among surgeons – who, collectively, are among the hardest professionals to teach. You can learn online (as you all know)! Finally, Goldman predicts demand from ETF’s for equity assets will reach a record again next year after passing $300Bn in 2017. That’s bad news for price discovery.

Here is a curated list of important stories outside the main headlines that caught our attention this week.

Surgeons are Using Social Media to Share and Learn New Skills (HBR.com) – You can learn something important and impactful online and Twitter may yet find a way to monetize its platform. Surgeons, traditionally among the hardest professionals to “teach” once they are in practice, are independently sharing and learning operating skills using digital and social media. It turns out that even highly independent, entrenched people can be swayed by the anonymity of the internet and social media, at least initially. Once the barriers are down, communities of practice begin to form, just like we are trying to create here among our investor members!

Greenlight Funds Q32017 Letter to Shareholders – Bubble Baskets (David Einhorn via ValueWalk.com) – Things that make you go, hmmmmmm. Here’s my favorite quote from the letter, “Given the performance of certain stocks, we wonder if the market has adopted an alternative paradigm for calculating equity value. What if equity value has nothing to do with current or future profits and instead is derived from a company’s ability to be disruptive, to provide social change, or to advance new beneficial technologies, even when doing so results in current and future economic loss? It’s clear that a number of companies provide products and services to customers that come with a subsidy from equity holders.” We’re the equity holders here and Greenlight’s favorite bubble shorts are a regular Halloween house of horrors if you’ve actually been short these names; AMZN (horrors!), TSLA (aaaarrrrrgggghhhh!) and NFLX (oh, oh, go on without me…). Einhorn believes the market will turn, he just doesn’t know when.

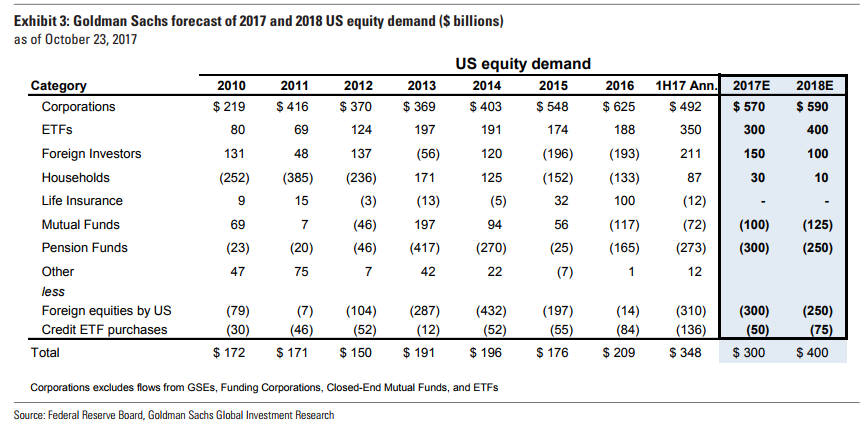

Goldman: ETF Demand Will Hit $400Bn in 2018 (Goldman Sachs: Flow of Funds: Outlook for US equity demand in 2018 via ValueWalk.com) – The rush to passive marches on. In this weeks Signal we’ve reprinted our note on The Trouble With Passive Investing. Goldman’s projections for next year show growth in the ETF space isn’t slowing down one bit – up 33% YOY. ETF assets under management (AUM), including index objective funds, is equal to 14% of S&P 500 market cap and 9% of the overall US public equity market! Goldman believes increasing ETF demand will further increase the active to passive rotation we have witnessed in the last 5 years. If you read the piece we wrote on the passive investing space, you’ll see why fewer active managers isn’t so good for passive investors.

Catalonia Isn’t Ready For This Fight: (Leonid Bershidsky – Bloomberg View). Catalonia has declared independence from Spain and the government in Madrid has responded by seizing control of the separatist region. We have yet to see where the Catalan police and security forces allegiances lie. This short “opinion” piece gives a very interesting take on what’s happening in the news flow by looking at some of the cultural elements at play in the Catalan “nation”. While the markets in Spain and Europe might be nervous, this piece believes it’s theatre.