We at Framework would like to take a moment to offer our condolences to families of those killed this week in Las Vegas and to offer our best wishes to those recovering from their injuries. Like many of you, we have read of and been moved by the heroic actions of many at the concert – actions to provide comfort and aid to others during and immediately after the shooting.

In this week’s stories, we have linked one good PBS Frontline report about the power of the NRA in US politics as well as highlighting The Financial Times best reporting on Catalonia. The other stories are a hodge-podge, one story about a hedge fund manager’s take on the relative valuation of the market using Buffett’s preferred measure, to an expose on “smart beta” and an interesting article related to Gilead’s hepatitis-C franchise.

Here is a curated list of important stories outside the main headlines that caught our attention this week.

The Catalonia Question (Financial Times). Here in the US, we investors are usually insulated from cares about far-away places. However, the present political strife in Spain’s Catalonia’s region is worth keeping on our radar, as the repercussions of the how Spain sorts out the Catalonia independence movement may end up reverberating through global bond markets; markets which already seem to be on edge. The Financial Times collected several excellent commentary and analysis articles into this special section on the big international news this week.

Gunned Down: The Power of the NRA (PBS Frontline). It’s not hard to imagine why foreigners are flummoxed by the topic of gun ownership in the US, since many US citizens are also flummoxed by it. This documentary is a dated one, but in light of the Las Vegas mass shooting, we thought we would highlight it in this week’s list simply because of its high quality and the light it sheds on the present political situation in the US.

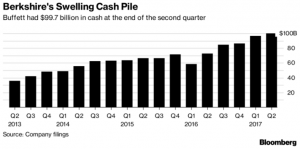

According To Warren Buffett’s Own Methods Stocks Are Not At All ‘Fairly-Priced Relative To Interest Rates’ (Jesse Felder, the Felder Report). There are financial pundits who have been saying that equities are headed for a huge fall since the second half of 2009. I’ve mainly ignored these pundits as the more one digs into their arguments and methodologies, everything looks “spuriouser and spuriouser” to borrow from Lewis Carrol. In the Framework 101 Course, I even talk about the logical fallacies that are often used to make broad pronouncements about market overvaluation. However, Jesse Felder, a hedge fund manager whose analyses I generally find insightful and valid, posted this article looking at actual statistics that Buffett has says he values and finds the market overvalued. I too have become more cautious regarding stock valuations; partly because a lot of companies I am researching now tend to be overvalued and partly because of my concern that a return to nationalistic trade policies will cut real growth. We pay more attention to people and views that agree with our own, so I am trying not to put too much emphasis on analyses like Felder’s, but still, I think his point is well-taken. Surely, some of you also saw that Berkshire Hathaway is holding a record amount of cash these days as well.

What the Hell Does ‘Smart Beta’ Mean? (Mauldin Economics). One of my least favorite phrases in the investing world is ‘smart beta.’ Hearing it just makes my skin crawl. Maybe my dislike is based on the appropriation of a mathematical term for a marketing slogan, or maybe it’s because I have seen just how ridiculous the work backing up a lot of these strategies are. This article, from Mauldin, explains the problems with smart beta well.

The Hepatitis Drug Market Is Worse Than Wall Street Realizes (Bloomberg Gadfly). We did a lot of work on biotech firm and undisputed king of the hepatitis-C market, Gilead Sciences (GILD) some time ago. While a lot of value types were talking about Gilead being a great value, I was less impressed, and think that the firm’s valuation risk is extreme. While I am not following Gilead closely any longer, I was surprised by the drop-off in Gilead’s hepatitis-C franchise when it reported earnings a few quarters ago. In my original model, I had created a worst-case scenario for that business’s revenue growth that I thought was pretty drastic; when the firm reported, actual sales were much worse than even that worst-case scenario. This Bloomberg article has some good graphs and information about Gilead’s main competitors and, reading it, I can’t help but think that, not only will Gilead have to deal with an environment of shrinking demand, but that they will increasingly face competition for the demand that is there from AbbVie’s new treatment, Mavyret. Those of you interested in Gilead should take a look!