In the news this week is the continuing Machiavellian saga in Saudi Arabia. There’s been plenty of coverage of the goings on there…and it doesn’t bode well for stability in the middle east, particularly with the mess consuming Lebanon now. But that’s not our focus here. We look for news that’s important but maybe less covered…and not always on investing directly. The Harvard Business Review this week looks at whether leaders can be good at BOTH strategy and execution. Given our bipolar response to successful vs. struggling CEO’s (Bezos vs. Immelt this week), this is a helpful read for anyone with their ear to floor of business. John Authers at the FT wrote a note this week entitled “As Good As it Gets…” that looks at the risks and rewards in our financial markets. This is a balanced look that’s a must read. Finally, we look at two interesting pieces, one on the state of our relationship to the American Military and the effects of that on military operations. At the other end of the spectrum is an update on the progress of quantum computing and the effects that might have on our lives sooner rather than later.

Here is a curated list of important stories outside the main headlines that caught our attention this week.

How to Excel at both Strategy and Execution (12-minute read; Harvard Business Review). It is often said that one can be good at one of these two crucial elements of success, but not both. The article calls this “visionaries” vs. “operators”. Investors are often concerned about these traits as new managers are appointed to positions of power and influence in company’s we own. The authors here say this paradox can not only be broken in leaders but that “leaders like Howard Schultz don’t just have both the visionary and operator skills—they deeply value the connection between the two skill sets. In fact, they see them as inextricably linked, since a bold vision needs to include both a very ambitious destination and a well-conceived path for execution that will get you there. This is ever more important today, where differentiating your company is so difficult. Differentiation increasingly requires more innovative thinking, and the use of very specific areas of expertise…” The article goes on to point out HOW both these skills can be built and cultivated at the same time.

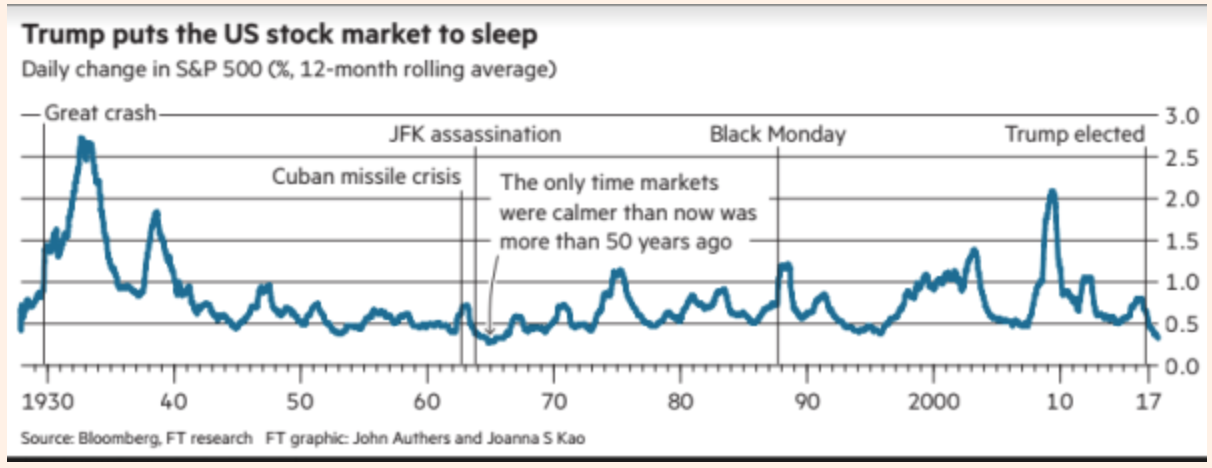

John Auther’s Note: As Good As It Gets (10-minute read; FT.com). Sometimes it pays to take a step back. John Authers at the Financial Times takes a look at the strengths and weaknesses of the financial markets with a long focus on valuations. Auther’s observes, “Can it possibly get any better than this? And if not, how much worse can it get and how quickly?” As he points out, these are fair questions to ask given the current market state. One has to go back to more than a year ago to witness even a 3% drop in market prices. I think it is safe to say that, probabilistically, returns look low from here. This is worth reading and thinking about.

The Tragedy of the American Military (30-minute read; theatlantic.com). This is a sobering look at how America sees its military organizations and the 1.4M Americans who serve in it. Interestingly, it was passed to me by a friend with military experience. There’s a clear eyed comparison to history as well. Bottom line, we have developed a pretty strange relationship between our citizenship and the military machine. The author starts by highlighting the misspent resources in the Military-Industrial ComplexThe piece both explains and warns against the growing divide between our citizens and our military. Higher than representative military representation in our governments impact how we see war in our list of options. Indeed former Chairman of the Joint Chiefs of Staff, Admiral Mike Mullen says, “It’s become much to easy to just go to war”. Gary Hart, former senator, was asked by President Obama’s administration to review military culture and operations and his commission’s recommendations are reviewed herein.

Race for Quantum Supremacy His Theoretical Quagmire (10-minute read. nature.com). We try each week to provide some news not directly related to investing. Here’s this week’s… Futurists have been talking about a concept called “singularity ” for some time. This is the hypothesis that the invention of artificial superintelligence will abruptly trigger runaway technological growth, resulting in unfathomable changes to human civilization. Another powerful concept is that of quantum supremacy in computing. This is the idea that computers that operate by quantum rules will be able to perform in ways beyond any classical computing solution. Turns out, quantum computing is making some real progress. Scientifically the challenge that has arisen is to prove that quantum is outperforming classical. How does one tell? Quantum computers can complete operations that a classical computer might not, but we cannot directly know if that is a computing failure or just lack of an algorithm to compute the work? This is a quick informative look into this important field.