On Monday, I noticed that Union Pacific’s UNP stock price had hit $110 per share. Ah, great time to sell the bearish call spread I had featured in an earlier FWI Tear Sheet. I opened my brokerage application checked prices and entered my order. The message I received was: “This order will be placed on July 5th when the market reopens.”

Aaargh. I had gotten tied up with something and hadn’t noticed the time. I guess I’ll just keep being patient.

This incident was a microcosm of my week. On Wednesday, I thought it was Monday and I’ve continued to be confused ever since. It’s nice to have holidays, but the holiday-shortened trading weeks really throw me for a loop!

Here is a curated list of important stories outside the main headlines that caught our attention this week.

Jim Chanos: U.S. Economy is Worse Than You Think (Institute for New Economic Thinking). Famed short-seller, Jim Chanos, thinks there are a lot of meh aspects to the economy that, taken together, are probably a warning sign. He is negative the idea of the public-private partnerships to boost infrastructure investment (as we are – see our news summary from mid June, and members should read through our report on Trump-era investing, available in the Dashboard) and points to the discrepancies between hard and soft data that we mention in our next story. He also has some interesting comments on some of the Tech 2.0 firms. Chanos is a short-seller so gathers more funds for his firm if people generally believe they have a need for bearish market exposure. As such, any negative comments Chanos have for the US economy boost his bottom line. Make sure to remember that when you read this article!

Why Americans Feel So Good About a Mediocre Economy (Bloomberg). This article, written by an economist popular in the financial Twitterverse named Noah Smith, ponders why recent sentiment surveys seem to be positive, but that harder indicators (e.g., M&A and stock buyback activity) have been weak. He believes that the difference can be explained by partisan leanings – the proportion of the populace that voted Trump into office hoping that he would unleash a wave of economic growth from reducing regulations and lowering taxes continue to cling to that initial hope in the face of contrary evidence. While this argument makes sense to me and I am inclined to nod my head in agreement, that may simply be because I am a vociferous opponent to President Trump’s off the cuff approach to the most weighty job in the world. No matter what we take in as information, we should be careful to remember that objective truth gets filtered through the faulty walnuts sitting on top of our spinal columns.

Russia-born dealmaker linked to Trump assists laundering probe (Financial Times). This week, it was announced that a Russian-born financier named Felix Sater had agreed to work with lawyers investigating shady real estate dealings related to our current President and a deposed Kazakh leader’s family. While there is a huge amount of hogwash floating around the media world related to what connections President Trump may or may not have with Russia, the most plausible, in my opinion, relate to the President’s need for funding. After failing at several heavily leveraged businesses, US banks – which had been The Donald’s source of funding – cut Trump off, deciding that projects he managed were not worthy of their credit. Real estate transactions and casino activity are, I understand, the easiest ways to launder large amounts, and since 1) real estate and casinos represent Trump’s main business interests 2) there were a lot of Russian oligarchs that needed to get a lot of dirty oil money out of Russia in the 90s and early aughts, and 3) Trump needed money in the 90s and early aughts, it’s not hard to make the case that there are some skeleton’s in President Trump’s closet. The Financial Times is a sober, respectable news source, and I’ve found its coverage of this issue to be particularly helpful. By the way, this guy Sater seems like a real winner. Working as an stockbroker in the 90s, he was convicted of attacking a fellow stockbroker with a broken margarita glass – charming fellow.

Searing Heat Is Hurting Texas Wind Power (Bloomberg). Who woulda thunk it?! You know those hot summer days when there’s not a hint of a breeze? Well, that’s caused by a meteorological phenomena – high pressure ridges – and when this phenomena occurs, it’s rather hard to turn wind turbines. I was surprised to learn that 20% of Texas power generation is from wind and that the persistence of a high pressure ridge over Texas would make a measurable difference to the amount of power wind farms would be able to generate. Solar arrays would be doing fine in these conditions – high pressure ridges are associated with sunny days as well as no breeze – but this article mentions the slack being taken up by natural gas and coal-fired plants. I guess solar is not as popular of an energy generation alternative in my home state of Tejas.

Fed ready to begin unwinding stimulus ‘within months’ (Financial Times). One of the big themes at the Grant’s Conference I attended in March was the idea that the process of reversing the Quantitative Easing policies begun during the Financial Crisis was going to be a more challenging and complex process than the Federal Reserve or markets were ready for. A more disturbing possibility raised was that because of Fed Chairman Bernanke’s actions to stabilize financial markets during the crisis, the precedent was set for the Fed to take “equity market stability” as one of its implicit policy imperatives. The Fed’s task is hard enough – maintaining maximum employment, stable prices, and moderate long-term interest rates. If, in the back of the governors’ minds, they also have a goal of “maintaining low equity market volatility and rising index prices,” the job will be made much harder.

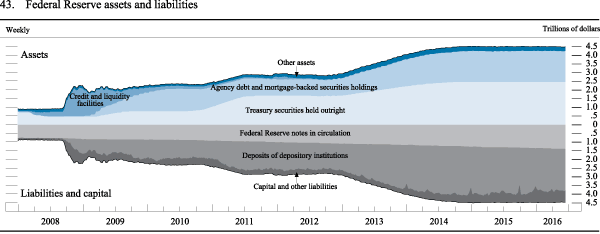

The stimulus policies that might start to being unwound is the holding of financial assets on the books of the Federal Reserve. The Fed reports semi-annually on its balance sheet, and the two largest areas of increase since the post-Financial Crisis stabilization are US Treasuries and “Agency debt and MBS.” For the Fed to reverse the stimulus, it would have to start selling these securities to US commercial banks (the Fed’s assets are balanced by deposits from regulated banking entities). The knock-on effect of this might be reduced lending to corporate borrowers by the banks and / or sharply higher lending rates. While this would help the retirees that have been “repressed” (using Reinhart and Rogoff’s verbiage) for so long, it would likely hurt current earners.

U.S. Hiring Accelerates While Wage Growth Stays Flat (Bloomberg). If it’s the first Friday of the Month, it must be Payroll Stats Day! The headline information is that payrolls rose by 222,000 (better than the estimated 178k), and that April-May revisions showed an additional 47,000 jobs having been created. While this news is positive, there are some continuing mysteries. The biggest one is that the employment market seems tight, but average hourly wages still seem to be growing rather tepidly. The year-over-year increase in wages was 2.5%, which doesn’t seem that bad to me, but it was under economists’ expectations for 2.6% growth, and there is some commentary in the article to the effect that the weakness may be due to the retirement of ageing, highly paid Baby Boomers.