One of our clients asked me about a stock her client owns – Globus Medical GMED. The end client holds a sizable position in the name thanks to a prior business transaction, so we are taking a quick look at Globus’s value drivers to help our client assess some of the main issues about which her client should be aware.

Our valuation framework focuses in on a handful of fundamental drivers, of which there are only three main ones in the short-term and one related one in the medium-term. We’ll work through each one-by-one.

Revenues

Globus Medical is a small fish swimming with names like Zimmer, Stryker, and Johnson & Johnson – it specializes in orthopedic devices for spinal problems.

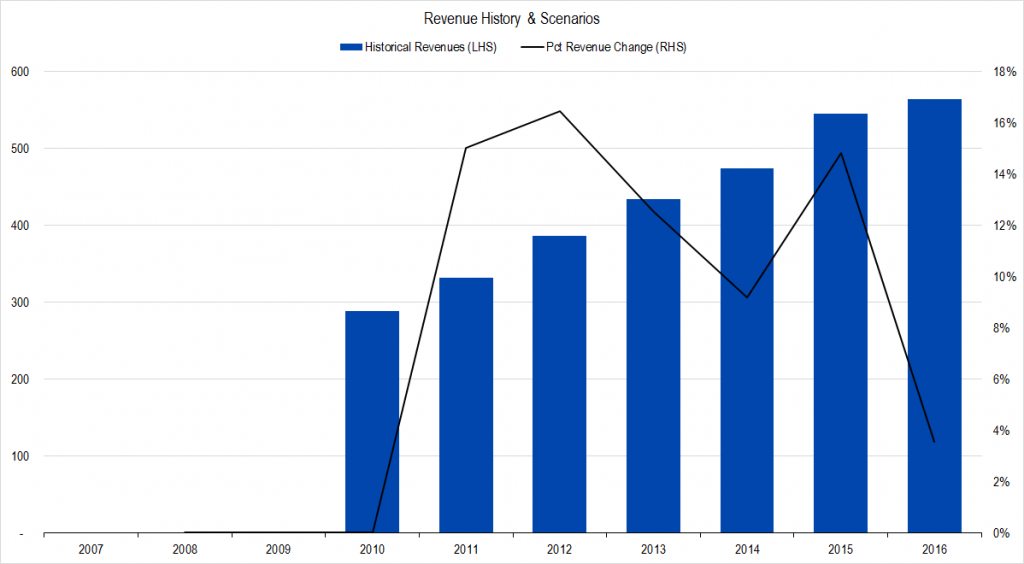

In this graph, we can see from the black line showing revenue growth rate that Globus has gained share in the slow-moving orthopedic products area since it went public in 2012. Recently growth has slowed and Wall Street analysts expect 2017 growth to come in around 11%.

Figure 1. Source: Company Statements, Framework Investing Analysis

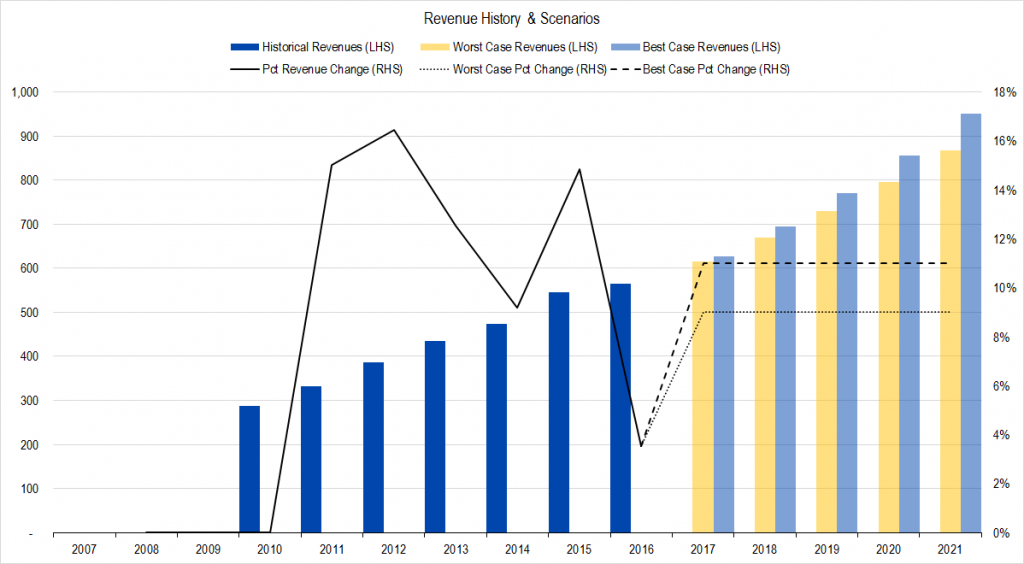

To get a quick idea of value, let’s say that best-case, the company grows at an average annual rate of about 11% per year – it’s five-year rolling growth rate ending in 2016. Worst-case, it grows at 9% per year its three-year rolling growth rate ending in 2016.

This is what our graph looks like now – light blue columns being best-case, yellow columns being worst.

Figure 2. Source: Company Statements, Framework Investing Analysis

Profits

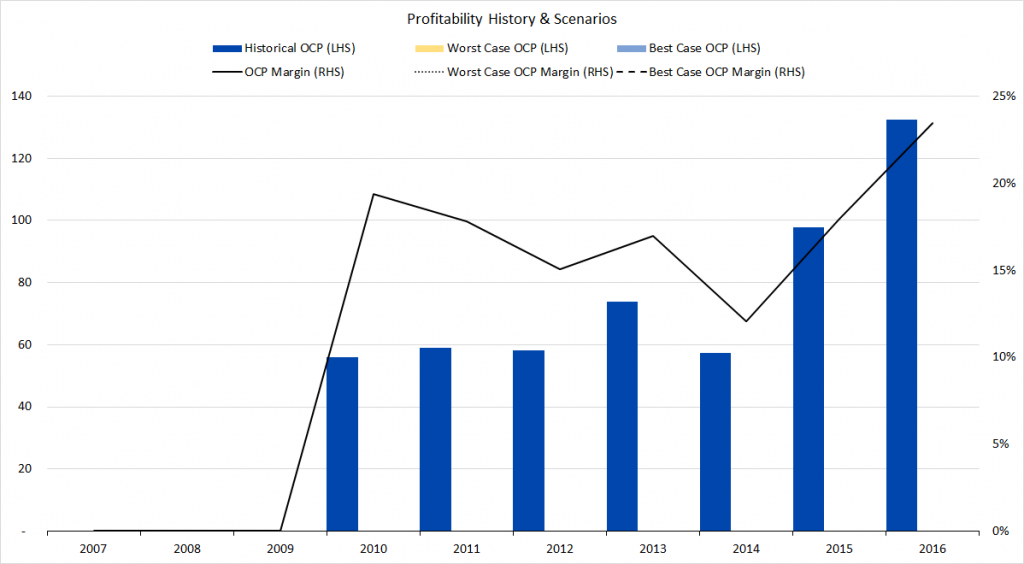

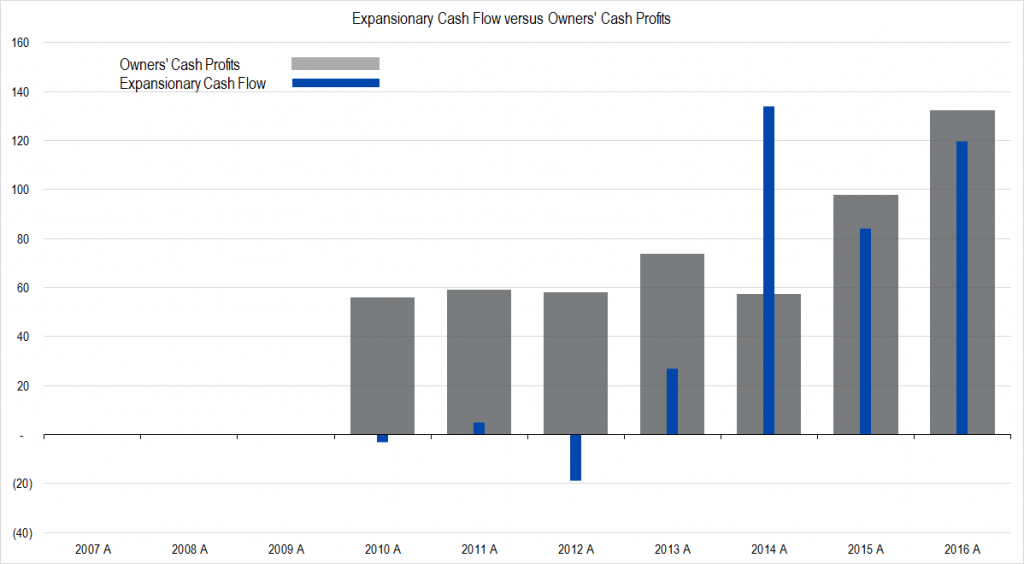

Our preferred metric is called Owners’ Cash Profits – OCP. In the years 2010-2015, average OCP margin was 17%. 2014 was a negative outlier at 12%, but all the other years were between 15%-19%.

Figure 3. Source: Company Statements, Framework Investing Analysis

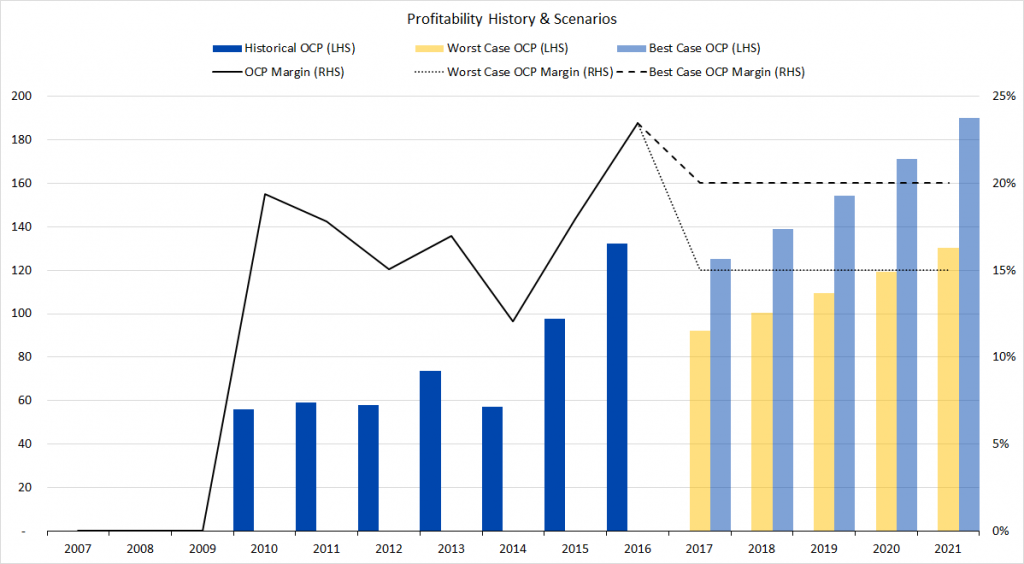

I’d like to know more about the big profitability bump in 2016, especially because we know that is a year in which revenues grew tepidly. For the time being, I’m going to just plug in the profitability range we used when we analyzed its larger competitor, Zimmer: between 15% and 20%. Making the change in our model creates a graph like this.

Figure 4. Source: Company Statements, Framework Investing Analysis

Investment Spending

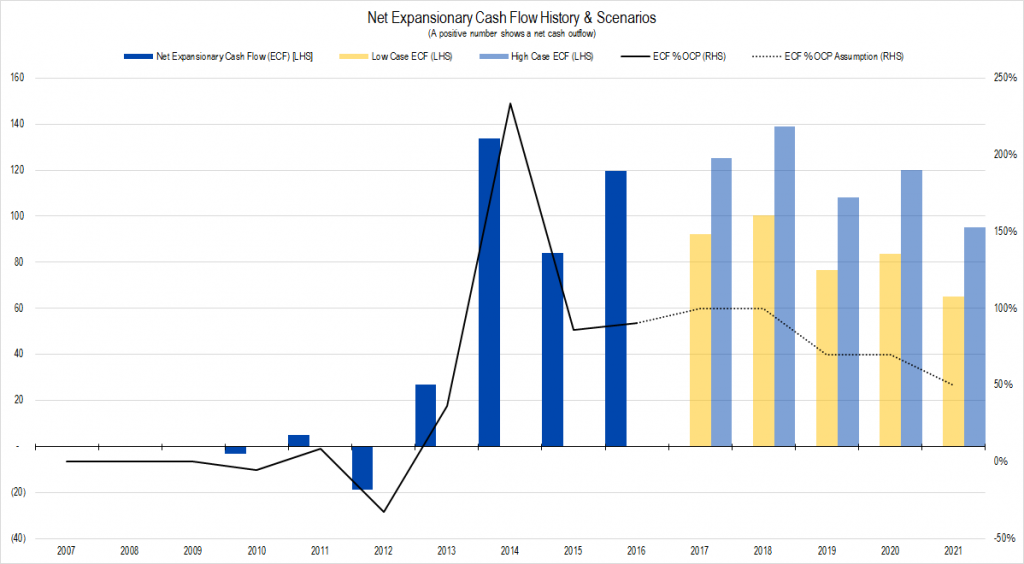

Bigger companies in this industry spend only a very modest proportions of profits on investments – these investments are mainly focused on acquiring other companies. Globus, as a small company, spends a much larger proportion of profits on investments – around 100%.

Figure 5. Source: Company Statements, Framework Investing Analysis

Even if we assume that the company reduces investment spending from 100% of profits to 50% of profits five years from now, this is still much higher than a mature firm.

Figure 6. Source: Company Statements, Framework Investing Analysis

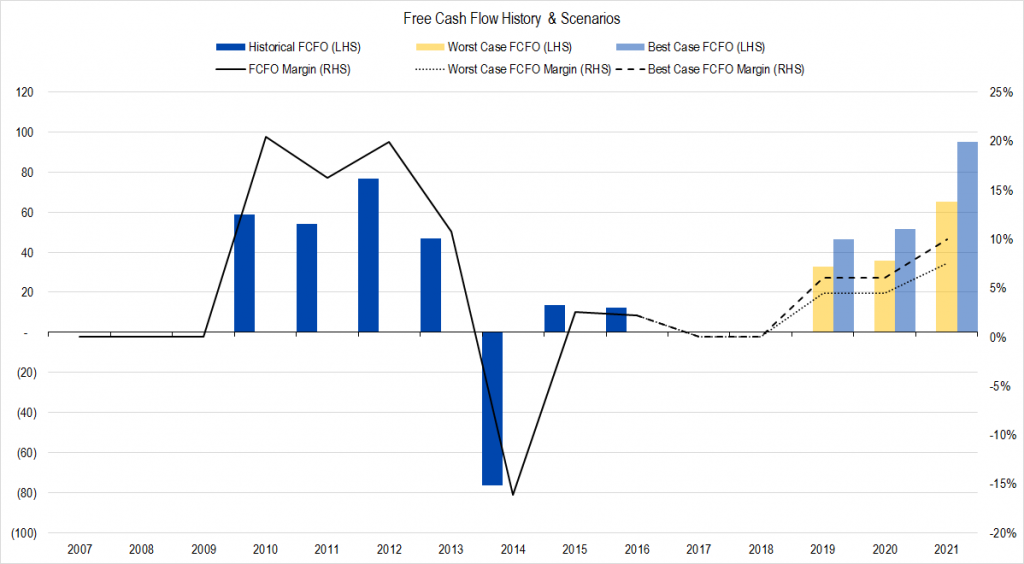

This assumption implies a Free Cash Flow to Owners (FCFO) of $0.075 to $0.10 for every dollar of revenues in the fifth year of our forecast.

Figure 7. Source: Company Statements, Framework Investing Analysis

Medium-Term Growth

This is a small company with a new, innovative product. Companies like this often have very long periods of abnormally high growth as they increase profitability and spend proportionally less of these profits on investments. For Globus, we’re using 10 years as an assumption for how long this company will be able to keep up better-than-market growth. How fast can it grow? This is kind of a crap shoot with a company so young, but we’ll plug in values of 25% per year and 10% per year for best- and worst-case growth assumptions.

Valuation

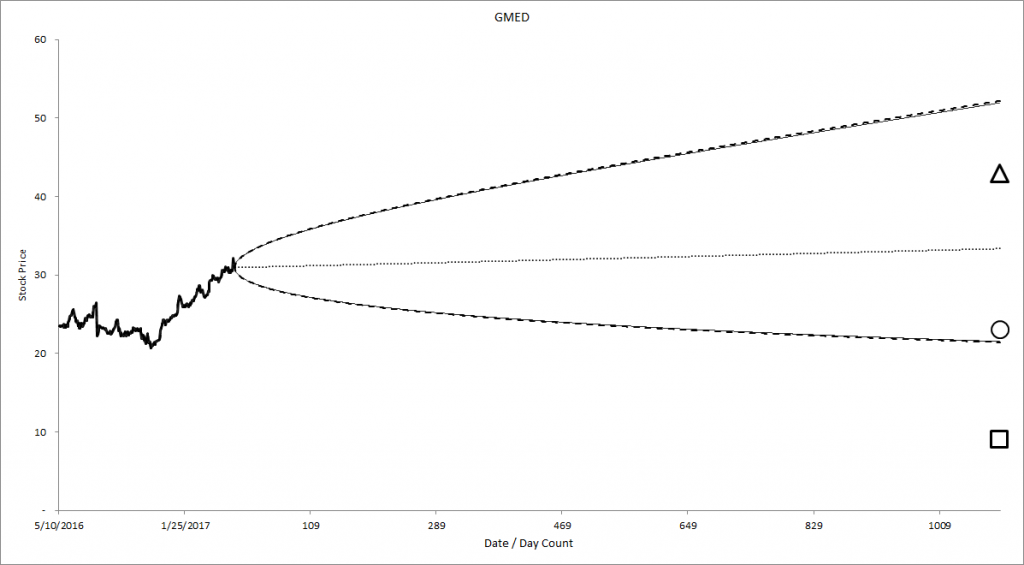

Pulling this all together gives us a best-case valuation of $43 and a worst-case valuation of $9 per share with an equal weighting of all our eight valuation scenarios at $23 per share.

Figure 8. Source: Company Statements, Framework Investing Analysis

Comparing this to what the option market is forecasting, we see that our downside valuation scenario and our weighted valuation scenario is much lower than what the option market is forecasting. While this is only a cursory analysis, I’d be worried if I were the person who owns a big stake in this company.

To make a firmer valuation I would want to understand three things:

- What is driving the demand for Globus’s spinal orthopedic products?

- What is the company investing so much of its profits in and how long will this large of an investment be necessary?

- Is the goal of Globus management to create an attractive acquisition target for Zimmer or Stryker or another big fish, and if so, what is the likely timing and reasonable multiple-based price range?

Valuing young companies is difficult because of all the uncertainties, but by using a sound framework, you can at least highlight the areas in which to pay particular attention.

Additional Resources

- Framework Investing Integrated Model for Globus Medical

- Guided Tear Sheet on Zimmer Biomet: A larger competitor to Globus