In our last article, we reviewed Oracle’s 1Q 2017 financial results and checked in on our forecasts for Oracle’s valuation drivers since picking up coverage in 2013. This article digs into the company’s 2016 full year results – long story short is that it is not as bad as it looks – and explores some sources of uncertainty that have developed at the firm.

2016 Results

Oracle’s Investor Relations website has press releases and financial statements, so I won’t repeat what is already a part of the public record. In short, revenues fell by a few percent and profitability (as measured by earnings per share) also lagged.

Part of the reason for the weakness is that the firm has been converting clients from its On Premise software to Cloud software. An effect of this switch is that revenues are depressed and profit margins compressed, but we view this as a non-economic artifact of accounting convention (search our articles archive for “ratable” to find an explanation of why).

Another part of the reason is because a good bit of Oracle’s revenues are generated overseas, and thanks to a strengthening dollar, those revenues are translated over into the financial statements at a depressed rate. Again, we view this more as an accounting artifact, rather than a material economic weakness.

Because of these accounting issues and the business changes underlying them, it is hard to get an understanding of the health of the demand environment without doing a little digging. Our digging – the results of which are reviewed here – leads us to believe that the demand environment for the firm’s product offering remains strong.

Let’s dig into Oracle’s software business to test our contention.

Software Revenues

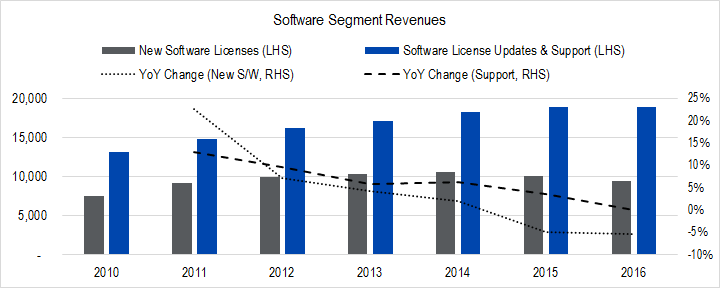

Oracle has historically reported its software-related revenues in two segments: New Software and Software Updates. Over the last few years, revenues in these segments have looked like this:

Figure 1. Source: Company Statements, IOI Analysis

The first thing to note is that Software Updates consistently generates more revenues than New Software, and this difference has been growing over time. We’ll see below that in terms of Oracle’s valuation, the Software Updates segment is much more important than New Software. The Software Updates segment’s revenues grew slightly last year despite the currency headwinds.

In the figure above, you can also see that the growth rate for New software has been negative for the past two fiscal years. This decline is one of the reasons the investment community seems to be worried about Oracle. In short, it is killing its old On Premise business and its Cloud business can’t make up the difference.

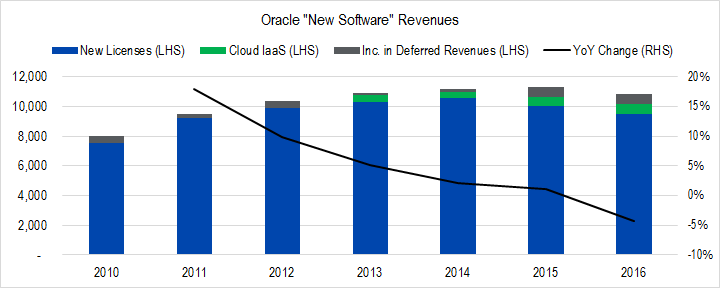

However, just looking at the numbers from these two segments does not give an investor the whole picture. First, Oracle started reporting some of its software sales in a new segment Infrastructure as a Service (IaaS), so to get an apples-to-apples comparison, this segment should be added in. Also, to correct for the accounting artifact mentioned above, one should also include the annual increase in deferred revenues (IOI members who would like an explanation of why this is so, please drop me a line!).

Correcting for these two issues, we get the following revenue chart for the “New Software” segment.

Figure 2. Source: Company Statements, IOI Analysis

The sharp fall-off in revenue growth for this adjusted revenue line is almost entirely due to foreign currency effects, which we believe to be immaterial to valuation (there is one instance where foreign currency effects can have a very severe valuation impact on a firm, but Oracle’s case is not an example).

In general, demand for Oracle’s Cloud offering appears to be exceedingly strong and the company has finally bought into the idea that it will become a Cloud software firm. Some observers criticize Oracle saying that it lags other Cloud providers too much. While Cloud revenues at Salesforce (CRM) or Amazon (AMZN) are indeed larger than Oracle’s, Oracle has advantages (client relationships, broad software offerings, highly-efficient hardware offerings) that still make it relevant and important in this field, in our opinion.

Software Profits

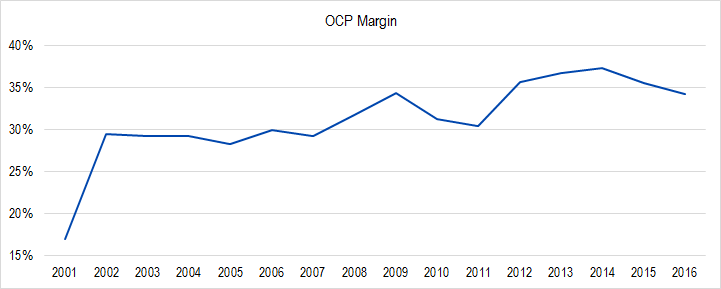

Due partly to the currency issues discussed above and to increased operational expenses related to the shift to the Cloud, profitability (as measured by IOI’s preferred metric, Owners’ Cash Profits) dipped several percentage points in 2016.

Figure 3. Source: Company Statements, IOI Analysis

We believe that profit margins will once again improve to the 37% level, but the present 34% level is equal to our worst-case scenario.

There is some mixed news here, but in general, it looks as though Oracle is concentrating on the correct strategic goal.

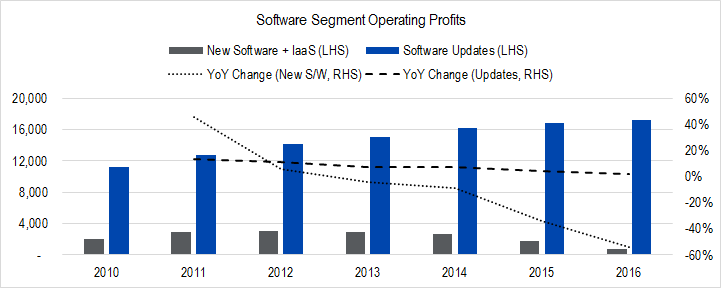

Figure 4. Source: Company Statements, IOI Analysis

In this diagram, we have added the new IaaS segment profits to the New Software segment profits to get a truer picture over time (note also that the numbers below are the operating profit figures provided by the company, not OCP).

The first obvious thing to notice about the figure above is how much more profit the Updates segment generates versus the “New Software” segment. In fact, 82% of Oracle’s operating profits in 2016 were generated by this Updates segment; this segment is, in a real sense, the heart of Oracle’s business. Updates’ profits grew several percentage points during the year on flat revenues; this observation leads us to believe that Oracle’s heart is very strong indeed.

The second obvious thing to note is the precipitous drop-off in New Software profits in 2015 and 2016. While not shown here, this is a function of the old New Software segment rather than the IaaS segment that we are lumping in. This means that in addition to currency effects and increased operational expenses, Oracle has likely been offering large discounts to entice clients to buy. There is some evidence of this discounting, especially as it relates to Oracle’s smaller rival Workday (WDAY), whose software competes with Oracle’s Taleo line.

In our view, this discounting, while “irrational” over the short-term, is in Oracle’s long-term best interest. It knows that if it can convince clients to buy Oracle software (whether On Premise or Cloud), Oracle has a good chance of keeping clients in the Software Update funnel, which is the true source of its profitability and value. Oracle spent more on research and development in 1Q 2017 than Workday generated in revenues over the past 12 months. As long as Oracle can keep improving its software faster than Workday or other smaller competitors, it has a good chance of dominating the space simply because of its scale.

While this Oracle’s 2016 results seem good to us, there are some new sources of uncertainty with regards to the company.

Near-Term Uncertainty

Oracle announced the acquisition of Cloud software provider NetSuite (N), a company partly owned by Oracle founder, Larry Ellison. The first bit of uncertainty relates to both revenue growth and investment spending due to this proposed transaction. The second largest holder of NetSuite shares after Ellison, T Rowe Price, has announced it would vote against the acquisition. If the acquisition is voted down, Oracle saves $9 billion and change, but loses out on a revenue boost of around $1 billion and the chance to fill out its Cloud software offering.

Another source of uncertainty is tied to capital expenditures related to Ellison’s recently announced plan to take on Amazon’s AWS service using a combination of Oracle’s high-performance servers and its IaaS offering. Oracle is talking about providing high-performance, low-cost server farms for large corporations to rent out. This plan necessitates that Oracle spend a good bit of money to build and equip these server farms. While it has plenty of money to do this, any cash spent to buy equipment is an investment and investments are risky. If Oracle’s investment does not pan out with faster profit growth in the future, Oracle’s value will fall.

The last bit of uncertainty relates to recent comments by Ellison that Oracle will be the first company to generate $10 billion in Cloud revenue. Larry seems like a pretty sharp guy, so I figure that he can do arithmetic about as well as I can. Considering that Salesforce already generates nearly $8 billion in Cloud revenues and Oracle only about $2, the arithmetic doesn’t work out unless: 1) Oracle’s server farm idea is instantaneously successful in stealing a large proportion of AWS revenues and then some, 2) Oracle acquires a company that has about $8 billion in Cloud revenue. Acquiring Salesforce would return order to the universe (in that Benioff, Salesforce’s founder and CEO, was Ellison’s protégé at Oracle before founding his own company), but it would also mean that something like $65 billion worth of Oracle’s profits (roughly equal to the last five years of Owners Cash Profits) would go out the door.

We will take these uncertainties into account when we publish our updated valuation of Oracle to IOI Members.