Executive Overview

The President-elect’s trade strategy, focused on bringing back manufacturing jobs to the US is, we believe, a reflection of our “instant gratification” culture. Some workers may receive a boost in the short-term, but the long-term effects of Trump’s policy proposals are likely to be negative for workers and for the economy overall. As is true for companies, whose medium- and long-term growth rates are determined by the investments they make in the present, the future economic health of a country depends on how the country is allocating resources today. We believe President-elect Trump’s plan is an investment strategy that will put the country in a weaker position long-term. This article represents a summary of arguments we made in a detailed report published to our members.

Investment Efficacy

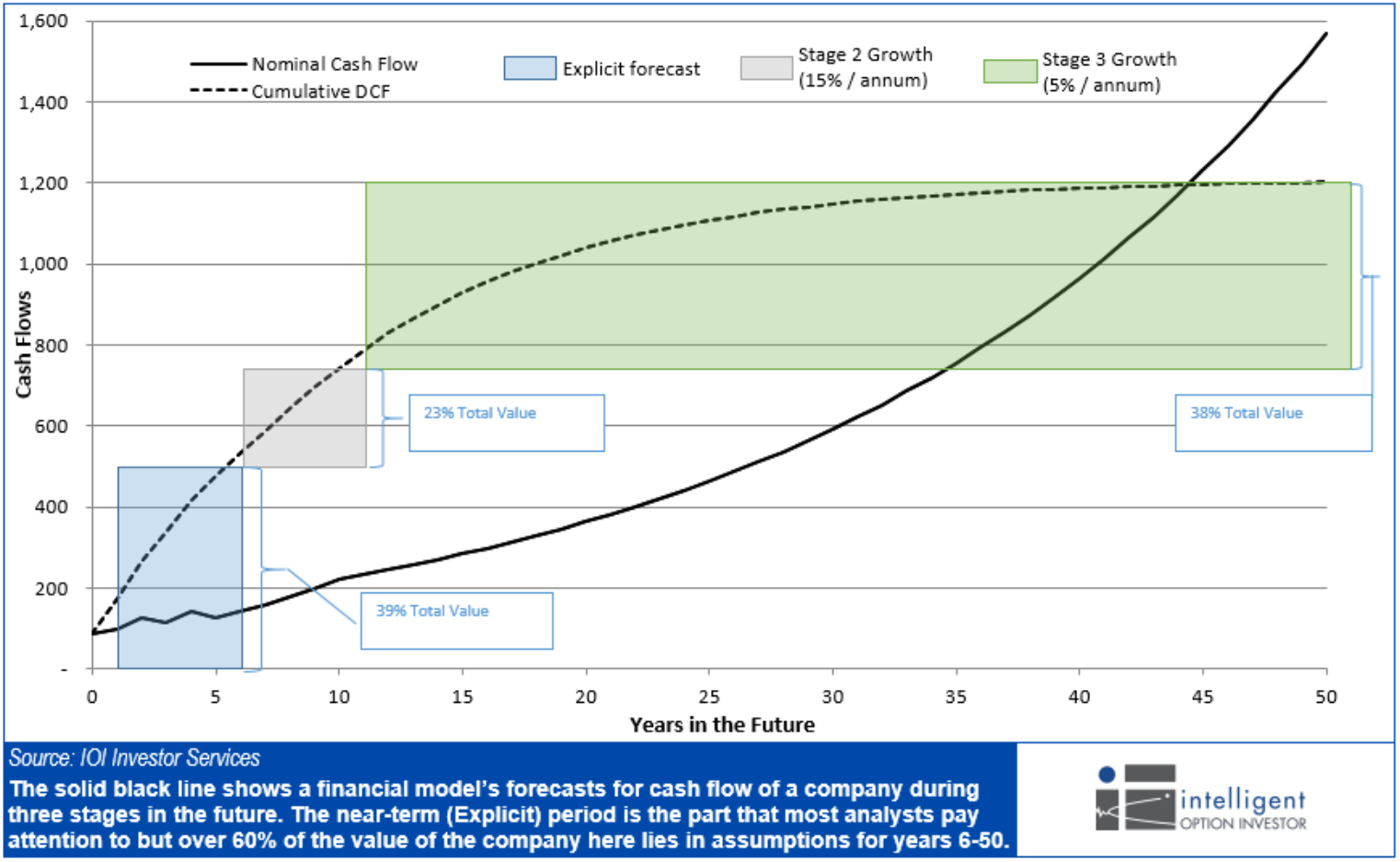

While investment analysts concentrate almost solely on the near-term operating environment, most of the value of a firm is generated by the assumption that the company will continuing to generate rising cash flows in perpetuity. The figure below shows the relative split between the value of near-term (years 1-5), medium-term (years 6-10), and long-term (years 11+) cash flows.

Figure 1. Dashed line represents the Discounted Cash Flows of this hypothetical firm. The range at which the DCF levels off represents the “intrinsic value” of the firm.

In our course on company valuation, we talk about the importance of a firm’s present investment programs on the future growth rate of the firm. If a firm’s present investments (acquisitions, new factories, etc.) are good ones, profits will grow relatively quickly in the future. If the investment plan is flawed, however, future profits are likely to grow relatively slowly.

While researching a report we recently released to our members regarding the investing implications of the Trump presidency (here is the summary on Forbes), we were struck by the parallels between investment-led growth for a company and investment-led growth for a country, and decided to assess President-elect Trump’s plans through the lens of what we call “investment efficacy.”

Manufacturing in the US

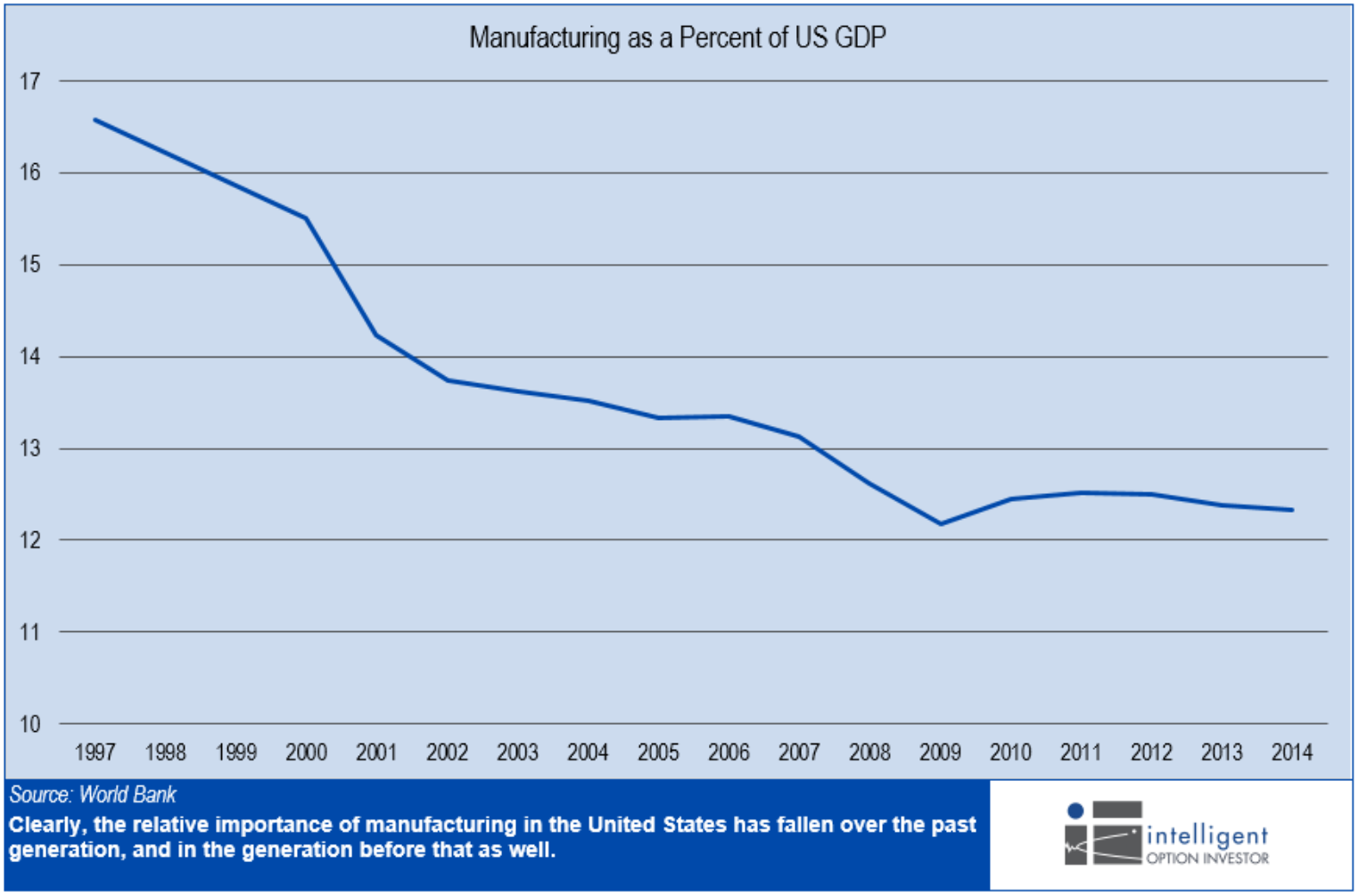

In this article, we want to focus in on the President-elect’s plan to create incentives to return manufacturing jobs to the US. The following graph is often used to show the “hollowing out” of US manufacturing.

Figure 2.

We can clearly see that the value of manufacturing as a percentage of GDP has decreased notably over this period. President-elect Trump’s plan of a Manufacturing Renaissance is designed to pull the line on that graph back up to the high-teens percentage range (or higher) again.

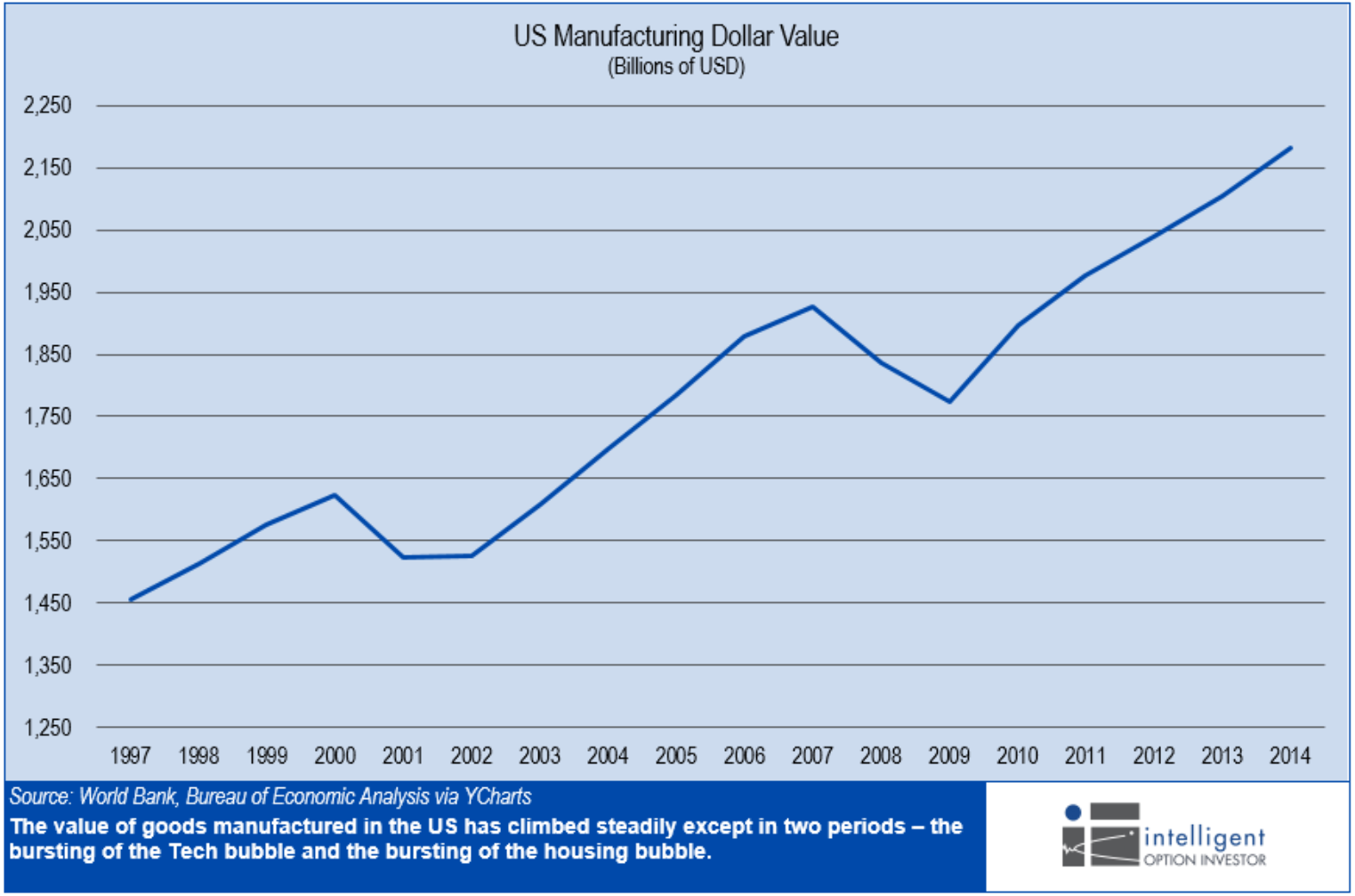

However, looking at manufacturing as a percentage of GDP only gives a partial picture. GDP grew robustly in the US over this period, so looking at the value of manufactured goods produced domestically shows a very different picture.

Figure 3.

The value of manufactured goods increased steadily during this period, meaning that the value of each good produced rose sharply. In fact, based on these data, the value of the goods manufactured in 2014 (the last year for which World Bank data are available) was 75% higher than those produced in 1997.

This happened because in 2014, US manufacturers were producing less low-value items such as televisions and HVAC units and more high-value items such as semiconductor chips, medical equipment, and airliners.

President-elect Trump’s “investment plan” for the US is to provide incentives (tax breaks and other perks for US manufacturers, tariffs and punitive actions for foreign ones) to move low-value manufacturing – like the production of HVAC equipment in the recently publicized deal with Indiana’s Carrier – back to the US.

If President-elect Trump pushes this policy through Congress, the line in Figure 2 might head back up, all things held equal.

Unfortunately, not all things are held equal. Foreign countries, whose own exports are priced out of the US market through tariffs, might return the favor and slap a tariff on high-value items exported from the US. A trade war would likely severely impact advanced manufacturing in the US since the value of advanced industry exports is in the $1 trillion per year range.

Even if we can avoid a trade war, the average value of manufactured goods that the US produces will necessarily go down because more low-valued items would be produced. In company terms, the “mix” of products would be getting worse.

The other reason that forced repatriation of manufacturing facilities will likely not help US workers long-term is that we believe it is likely to speed the push toward automation.

The Automation Revolution

As much as it may upset people to realize, the market for low value-added production labor is a global one and the going rate is far below that which will support a US worker. To remain competitive with products from other regions, US companies forced to produce locally are likely to attempt to drop their labor costs by replacing human workers with robotic ones.

This switch has already happened for higher value-added industries. According to a report by an Oxford professor quoted in this Bloomberg story, output per worker is higher in the US than any other major manufacturing country, and labor costs per unit of output in the US is among the lowest (surprisingly, it is just slightly greater than labor costs per unit of output in China). We believe this is largely due to increases in automation and to the shift toward producing higher value-added goods.

The only reason that low value-added assembly has been off-shored is that the capital investment required to invest in robots to do this work was cost prohibitive compared to shipping the work to China. Tariffs and punitive actions taken against offshoring companies will likely shift that cost-benefit equation in favor of automation.

Trump’s Investment Strategy and Our Alternatives

Let’s take a step back and assess Trump’s proposed plan for a US Manufacturing Renaissance:

- The plan would reverse a 20-year trend of US firms increasing the value of the goods they produce – creating a less valuable “mix” of manufactured goods in the medium-term.

- The plan would likely result in trade frictions, if not a trade war, and may hurt exports of the US’s most valuable manufactured goods in the near- and medium-term. Longer term, foreign competition might be able to gain a foothold in the manufacture of advanced industrial products, and this would severely affect the competitiveness of US firms (think Hwawei versus Cisco).

- The plan would likely speed the use of automated assembly for lower value-added goods, creating greater structural labor issues for the US in the medium- and long-term.

In short, if the US were a company rather than a country and we were assessing the likely investing efficacy of President-elect Trump’s strategy, we would say that it is poor, and would predict that future profit (i.e., GDP) growth is likely to be low.

What would be a better investment strategy? We think that the following proposals would offer a better chance of success:

- Investing more in vocational training and higher education that focused on training the workers of 2025 rather than trying to set the economic clock back to 1975.

- Providing tax and investment incentives to parts suppliers and other members of the manufacturing ecosystem (there is evidence that one of the reasons companies continue to offshore is that the ecosystem necessary for a robust manufacturing sector has withered in the US and is better developed in the new global manufacturing hubs).

The factors that led to the offshoring boom are complex and the policy response to attempt to remedy the issue will require time and careful planning. President-elect Trump’s proposals are, in our opinion, the equivalent of using a sledgehammer to open a jar with a stubborn lid. Certainly, the sledgehammer will cause something to happen, but it likely won’t be the outcome you desire.

This is one reason why we have advised our clients not to get caught up in the Trump Rally. The opportunity to buy stocks at lower prices is definitely a real one.

This article originally appeared on Forbes