We have been working with one of our hedge fund clients to apply the IOI model to the valuation of Real Estate Investment Trusts (REITs), and as part of this process, I have been thinking a good deal about the effect of dividends.

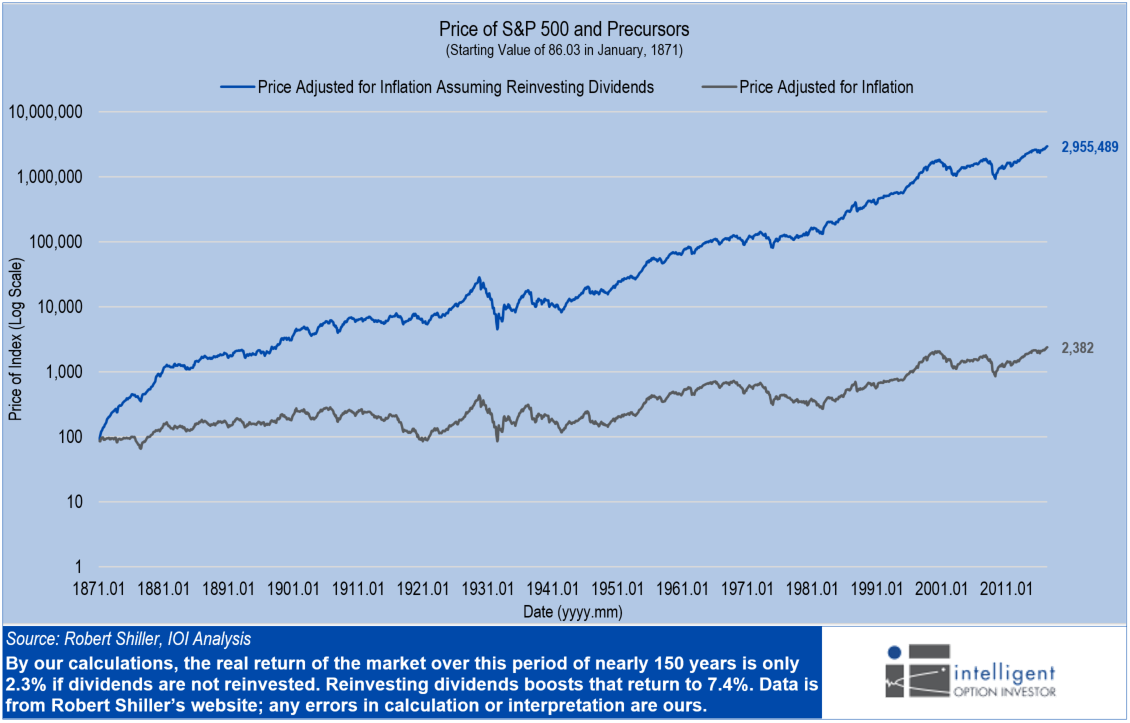

Yale professor Robert Shiller’s website has data from his book Irrational Exuberance that records the nominal and real price of the S&P 500 Index and its precursors from 1871 through the present. These data also include dividend payments, so I decided to pull together some graphs to see the effects of dividends and dividend reinvestment on an investor in relation to the REIT project.

The results were startling, as you can see from the image below.

Eat your vegetables and reinvest your dividends, kids!