Brokers love their clients to sell covered calls, but it’s not always clear that covered calls are an appropriate strategy for clients. From the article I posted last week, it’s obvious that a lot of investors have the wrong idea about what this strategy can and cannot do.

Why do brokers love covered calls? First, because they get to earn some extra commissions and fees when the option trade is made, and the heart of a brokerage business is that of a toll taker.

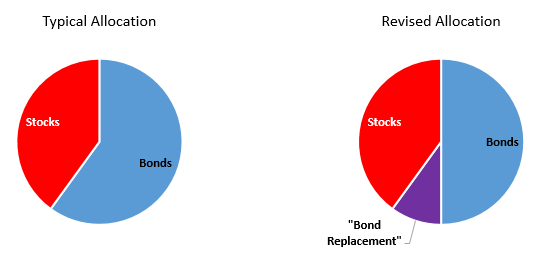

Figure 1. Source: IOI 101 presentation on Behavioral and Structural Factors

Also, because the transaction is fully collateralized by the client’s position in the underlying stock, the broker doesn’t have to worry about rapid stock price movements – known in the business as gamma risk – that could jeopardize the client’s (and in turn, the brokerage’s) liquidity if the client is unable to meet margin.

Last, a lot of people freak out a bit if their favorite stock on which they’ve sold a call starts to reach or exceed its strike price, so end up closing the position before expiration. A glance at figure 1 and recalling what business brokers are in will convince you that brokers would be happy for this as well!

So are covered calls simply a scam to generate steady and low-risk fees for brokers that create little actual benefit for brokers?

Executed poorly, they certainly can be, but with a little education, they can become an important portfolio allocation.

Assume for a moment that you are 65-years old and are paying attention to the rule of thumb that your portfolio’s allocation to bonds should be a percentage equal to your age. If you invest in a typical intermediate-term corporate bond fund, you’ll generate something like 3.6% yield per year right now. If you have a portfolio of $2 million, and invested 65% of it in that fund you’ll generate a skinny $46,800 worth of income this year. Hardly a great strategy for generating income.

However, if you set aside some portion of your bond allocation to invest in a rolling series of 3-month covered calls (or short puts) on undervalued companies, you might generate a “quasi-yield” of 4% per quarter – more than quadrupling the cash inflow possible with bonds alone. As I explain in the IOI 100-series class on options (IOI 103), the risk / return profile for a bondholder of a company is very similar to that of an investor writing a covered call on the company, which is why I use the term “Bond Replacement” in discussing these option strategies.

Figure 2. Source: IOI 103 presentation on Exploiting the Option Market

This realization is the impetus behind the Covered Call Corner research we published most recently last week.

One important thing to note is that I use the term “quasi-yield” because the cash inflow received from a covered call or short put on a particular company is different from the yield you might receive from a bond on the same company in several ways:

- The bond issuer is contractually obligated to pay you interest and principal. You, as a covered call writer are contractually obligated to hold a stock.

- A bond owner has no economic exposure to the company after the bond matures. You, as a covered call writer, may have long equity exposure after the option expires.

- Because you may end up holding the stock as a covered call writer, you may have to either realize a loss (if you sell the stock at expiration at lower than the Effective Buy Price – EBP), generate less yield (if you sell the stock at expiration between the EBP and the strike price), or realize a gain over a longer time period than you originally expected (if you hold the stock and it appreciates over time).

These are the sorts of issues participants learn to recognize and manage in IOI training courses. Mastering the process can make covered calls a much more effective and beneficial part of your portfolio strategy.

Contact Us to Learn More about IOI Training