In our recent Guided Tear Sheet web conference to discuss the valuation drivers of Gilead Sciences (GILD), an IOI Member asked a question about the Conviction Ratings that we publish on our IOI Tear Sheets. The question brought up the deeper topic of position sizing – a vitally important issue in investing which we discussed in our article last week In Investing, Siz(ing) Matters.

This article discusses the thinking behind IOI’s conviction ratings, gives several actual examples from IOI Tear Sheets, then suggests a framework for how an investor can successfully manage his or her portfolio by mixing single-stock investments of various convictions with low-cost index investments.

Conviction Ratings

IOI publishes only two Conviction Ratings – “High” or “Low” (more on the insanity of “Medium Conviction” and “Hold” below) and both of these levels relate directly to the relationship of price to value and indirectly to position sizing.

A high conviction investment is one where (in case of a bullish investment), our worst-case valuation scenario is at least equal to or higher than our Effective Buy Price on the security using the strategy detailed in the Tear Sheet. A good example was the Tear Sheet on Wal-Mart (WMT) that we published last October:

Loading...

Loading...

You can see that our worst-case valuation of $59 was just about where the stock was trading at the time and since this strategy involved receiving a cash inflow of $2.35 by promising to buy Wal-Mart at $60 / share, our Effective Buy Price worked out to be ($60 – $2.35 =) $57.65 / share.

In contrast, a low conviction investment is one where:

- The entire investment would be an “Immediate Realized Loss” (in the jargon introduced in The Framework Investing) because we are making an investment entirely in option time value, and / or

- At least one valuation scenario that we believe has a material chance of occurring would generate a realized capital loss if we took a position.

A good example of this is the Tear Sheet on National Oilwell Varco (NOV) that we published earlier this year.

Loading...

Loading...

You can see here that the “Speculative Strangle” strategy involves buying two Out-of-the-Money options (one call and one put). Any premium spent on an OTM option is entirely time value, so we consider it an Immediate Realized Loss. Any IRL is automatically a low conviction investment idea.

Managing Uncertainty

Buffett says his first rule of investing is “Don’t Lose Money.” A Low Conviction investment is one which we approach knowing that we certainly will (in the case of option time value) or might (in the case of a losing valuation scenario) lose money. Does this mean the investment should not be undertaken? Not necessarily.

Buffett’s mentor, Benjamin Graham – operating in a very different age and environment from his protege – invested in companies that he thought might not be successful. He invested in a relatively large number of companies and, through his use of “Margin of Safety” and valuation rules of thumb, assumed that over time, he would be right more often than he was wrong, so would end up ahead of the game.

Investing in Graham’s way is different from Buffett and Munger’s strategy (expressed by Andrew Carnegie in his quip “Put all your eggs in one basket, then watch that basket.“), but is no less valid. However, note that Graham tended to invest in more companies, so committed less capital to any one idea.

The Graham approach is essentially the strategy to which our Low Conviction rating would lend itself. Investing a little in a relatively large number of these investments and hoping that over time, you were right more often than you were wrong so that the wins from the “right” column more than offset the losses from the “wrong” column.

In contrast, Buffett’s style of concentration is obviously more suited to High Conviction investments. If you are pretty sure that you will at least not lose any money over the long run and think you also have a good chance of making a good amount of money, it makes sense to commit more capital to the investment.

Note, though, that when we talk about “High Conviction” investments, we are talking about worst-case valuations, and not saying anything about stock prices. As we discuss in our IOI 101 Course on Behavioral Biases and Structural Factors, there are a myriad of sensible and not-so-sensible factors that influence stock prices in the short term. Stock prices can and do move unpredictably in the short term. If you don’t have a good understanding of value and you react to an adverse price movement by selling an investment security, you’ve broken Buffett’s first law of investing by voluntarily realizing a loss.

The Insanity of “Hold”

The only other Conviction Rating IOI publishes is “Valuation Only.” We assign this rating when our valuation range of a stock overlaps so closely to its implied future price range that we find no opportunity to invest in the company in such a way as to tilt the balance of risk and reward in our favor. A good example of this is our recent Tear Sheet on Ford (F).

Loading...

Loading...

In Wall Street lingo, this Conviction Rating would work out to a “Hold” recommendation. But in my opinion, holding a fairly-valued investment like this is stupid, and an analyst recommendation that the security be held is ridiculous and unhelpful.

After all, the valuation range straddles the present price of the stock, meaning that you are as likely to suffer a permanent loss of capital by investing in this stock as you are to realize a gain. What’s the sense of that?!

Does this mean that one should only have a portfolio with three high-conviction investments in it? Probably not. Even highly-trained professional hedge fund managers who practice high concentration investing may not be successful over time.

If concentration isn’t the answer, what about holding a larger portfolio of low conviction investments? Well, you could, but you would then be running a hedge fund, and most individual investors and “Family Investment Officers” scarcely have the time to do that!

How then, can we invest intelligently and aim to beat the market?

Beating the Market

We think University of Chicago professor Richard Thaler hit the nail on the head when he characterized the Efficient Market Hypothesis – the academic theory related to market-beating – as being comprised of two separate contentions:

- The Price is Right

- No Free Lunch

“The Price is Right” means that the price of individual securities always reflect their “true” probabilistic value. This is clearly nonsense.

“No Free Lunch” means that it is very hard for an investor to pick a portfolio of stocks that consistently beats the market overall. This is clearly true.

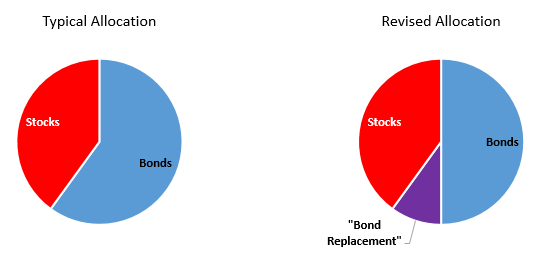

In our view, the best solution is to set aside one’s main allocation to invest not in a specific set of stocks, but in the broader market – using ETFs or the lowest cost mutual fund you can find. This strategy allows you to reap the benefit from the market’s “No Free Lunch” rule in a cost-efficient way.

Then, set aside the rest of the allocation to make stock-specific investments only when you find securities whose fair value ranges deviate from their present stock prices. This allows you to profit from the fact that the price is not always right! Using a sensible investing framework also allows you to be cost-efficient with these investments, since it implies that you are using a longer time horizon, so minimizing transaction costs.

The active portion of a portfolio may contain a few concentrated, high-conviction investments or relatively many diversified low-conviction ones, as your attention span, risk tolerance, and confidence dictates.

The active portion of a portfolio may contain both income and growth components, depending on your personal needs. Balancing these allocations is, in fact, one of the main topics of the IOI 103 Course on Exploiting the Option Market.

Source: IOI 103 presentation on Exploiting the Option Market