Question: How does a company lose half its market value…quickly?

Answer: It takes one and a half years of owners’ cash profits and invests them in an acquisition, then writes off 75% of that investment’s value in less than a year.

As investors, we often overlook how effectively a company invests its profits over time. There are a number of reasons this happens, but the easiest explanation of our willingness to overlook this is that evaluating a company’s investment skill is hard and time consuming.

In the IOI framework, there are three very important reasons why we should carefully consider investment efficacy.

- The majority of any company’s value is made up of the cash flow created in the years beyond the explicit projection period (typically 5 to 7 years). The cash flows in these years are most directly affected by the investments a company makes.

- Companies that repeatably develop strong investment opportunities have the best capacity to earn outsized returns due to the effects of simple compounding.

- Companies that have an historical track record of their investments underperforming GDP growth tend to have stock prices that also underperform.

The corporate battlefield is littered with examples of investments that have destroyed great swaths of shareholder value. We could start with Cisco’s acquisition of Polycom – their lead investment in the company’s strategic pivot away from reliance on network plumbing. Then there is the merger of AOL and Time Warner at the top of the Tech Bubble. A final example is basically anything HP did from 2005 to 2011 culminating in the horrendous acquisition of Autonomy (from which the Q&A example at the beginning of this piece is taken).

Companies of all sizes from your local framing store to the largest multinationals are faced with “investment decisions”. Investments are actions a company can take to put profits to work beyond simply doing what they are doing now (maintaining a going concern through accounting expenses). As individuals we make investment decisions all the time to gain “growth potential”:

- We might purchase real estate to rent or sell.

- We might buy a computer or handheld device to improve our productivity.

- We might purchase an education from a university to gain a valued set of skills.

Importantly, and we cannot stress this enough, these things are done with an eye on some return target – or at least they should be if indeed we are making an investment vs. a lifestyle choice (where we don’t care about measuring the return). Interestingly, given the examples above, corporations also make lifestyle choices – except they do it with someone else’s money – the owners. That’s us.

Our goal in this article is to show how important a company’s investment skill actually is to its long run growth and intrinsic value. So, let’s return to the three IOI reasons that investment is so important for any company.

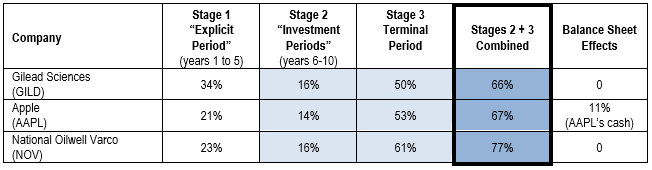

1. The value of a firm resides mostly in the years beyond our explicit forecast period and those are primarily affected by investment. In our analysis framework the explicit period, the next 5 years after the most recent set of actual financial results, forms the foundation of our company’s value. But it is the years past that where a company’s real value rests – because there is more time out there and because there is some growth typically assumed for the company. The table below shows how each period contributes to each company’s intrinsic value. Note: I assumed the worst performance case for each of these companies.

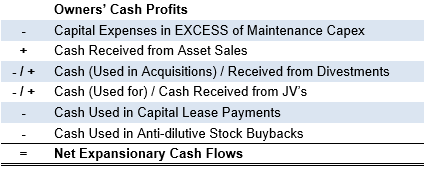

2. Net Expansionary Cash Flows (ECF) that lead to Owners Cash Profits (OCP) growth rates in excess of GDP must benefit owners directly. Net Expansionary Cash Flows are an IOI calculation of “cash used for investments in future growth” and include the following accounting elements:

One of the great advantages of using a cash-based measure of profit like OCP is that we can clearly see how much of a company’s profits the management is spending on investment projects.

Now that we know how much the company is spending on investments, we can compare the growth of OCP to that of nominal GDP to see if the investment program actually helped the business grow and if so, at what rate. If the profit growth rate is both positive and ahead of GDP growth, the amount of cash that the business throws off will grow through compounding as it is reinvested though the Medium Term growth phase of our valuation model.

Example: Oracle (ORCL) has grown OCP at over 11% over the last 10 years, well ahead of the historical GDP average of 6% and far ahead of the average GDP growth for the same period (~3%) and the value of the firm has responded accordingly moving from an initial valuation of roughly $30 to just over $40/share. The price of ORCL’s stock moved from the mid teens to over $40/share.

3. Companies whose Net Expansionary Cash Flows generate low or negative Owners Cash Profits growth rates must erode shareholder value. Here a company is committing hara-kiri with its profits by essentially investing them in projects that grow beneath the rate of GDP. Said differently, if the company had taken the same dollars and simply invested them into the US economy, it’s owners would have been better off.

Example: Thanks to the fall in oil prices, National Oilwell Varco’s (NOV) net expansionary cash flows have generated negative OCP growth rates over the last 5 years vs. the 6% GDP historical average, materially eroding firm the firm’s intrinsic value from ~$50/share to potentially below $20/share.

The difference in investment efficacy for any one firm can been seen in the differences between a company’s best and worst case IOI valuation scenarios. Our analysis of Gilead resulted in Medium Term growth rates that were above GDP in the best case and below GDP in the worst case. Assuming we leave all other projection values the same, the difference in medium-term growth led to a difference in firm value/share of from $30 to $50 per share!

The real beauty of these three points is that they focus on the VALUE of the firm because they directly impact the CASH a company generates. Performance on these metrics MUST either benefit or harm owners even in the absence of a direct, concurrent share PRICE response.

What companies do with their profits matters and it matters a lot because the growth rates in OCP that these investments generate materially impact the value of the firm.

Said differently, understanding and analyzing a company’s growth investments can provide meaningful insight on the Price to Value relationship that can then be thoughtfully exploited through proper structuring and position sizing.

In the meantime, Invest Intelligently.

– Joe Miramonti