Those who have followed my research for a while, know that I am usually dismissive about macroeconomic and political events (for evidence, see my Forbes articles Surviving and Thriving When Markets Drop, Don’t Sweat the Fed, and Five Steps to Reducing Market Risk).

But sometimes, an event occurs which shifts the rules of the game. We believe that the Trump presidency has the potential to be a game changer.

In an extensive report published to our members, we take a clear-eyed look at the factors that brought about the electoral shift toward American populism, discuss likely winners and losers from Trump’s policy proposals, and assess the potential for market shocks. This article summarizes our findings.

Economic Factors Driving Populism

Political elites on both side of the aisle have been hand-wringing about the undercurrent of populism – expressed by Sanders on the left and Trump on the right – that has threatened to overturn their respective apple carts.

But the working- and middle-classes have reason to feel dissatisfied.

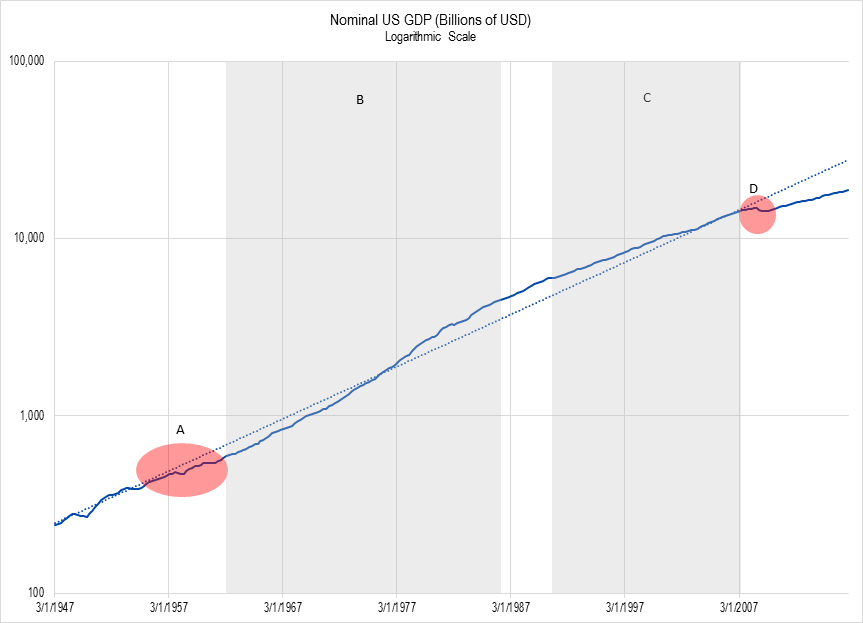

Post-Crisis economic growth has not only been tepid, it has failed to bounce back to the post-War trend and pulls further away from trend every passing quarter.

Figure 1. Source: Bureau of Economic Analysis, IOI Analysis

The discrepancy between actual economic growth (the solid line) and trend growth (the dotted line) since the red-shaded period labeled “D” is the prime factor that makes many people think the Great Recession never ended. Most of President-elect Trump’s proposals – discussed below – aim at pushing the blue GDP line back toward the dashed line.

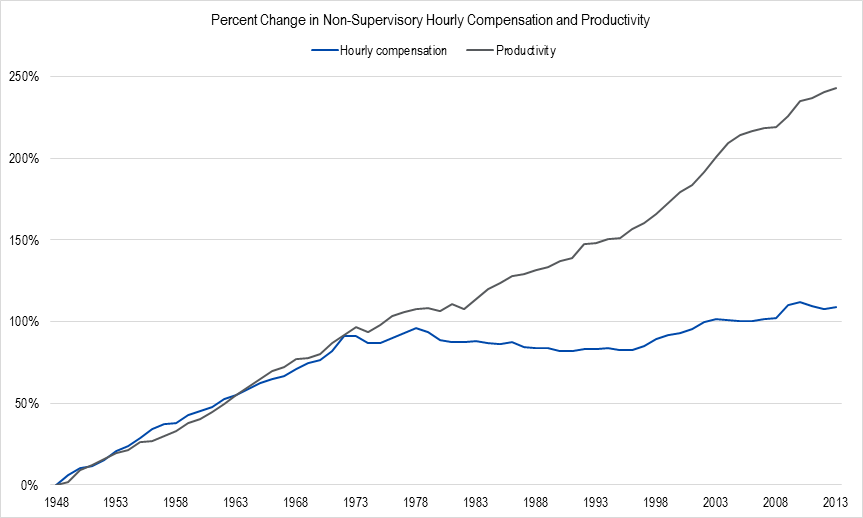

The other reason for popular dissatisfaction is that wages for many workers has failed to keep pace with the growth in national wealth since the mid-1970s.

Figure 2. Source: BEA, BLS data via the Economic Policy Institute

This flattening out of wage growth meant that a generation or more of Americans have had to borrow to maintain their standard of living. The real reason why the GDP line in Figure 1 refuses to move back to trend rates after the Financial Crisis is not mainly due to policy issues, but because households, faced with high debt and low wages, are “de-levering” – choosing to save money rather than spend it (become a member to see the full IOI report for details).

President-elect Trump has implied that solving the GDP growth problem shown in Figure 1 would solve the wage growth problem shown in Figure 2.

Now that we have a handle on the problems, let’s see how President-elect Trump’s policies are designed to solve them.

Trump’s Policy Proposals

Our report analyzes the likely short- and long-term economic and investing impacts of five of President-elect Trump’s main policy areas:

- Infrastructure Spending

- International Trade

- Taxes

- Energy

- Defense

The following, in a nutshell, are the likely effects for big three policy areas (see the full report for all the details).

Infrastructure Spending. The market loves the idea of infrastructure spending, but issues with timing, political opposition, and program structuring may cause problems. Keynesian stimulus would push up the GDP (Trump’s first goal) if these issues can be overcome, but the most likely beneficiaries will not be manufacturers but big banks, which are already doing better due to increased inflation expectations.

If this spending is structured mainly as tax breaks to investors in the infrastructure projects (an idea that has been floated by the man reported to be our next Secretary of Commerce), there is a distinct possibility that the policy will actually benefit the rich more than the working class. If inflation heats up, wage earners stand to be doubly hurt because their pay will not stretch as far.

International Trade. Here, Trump’s plan is to reduce the number of imports and shift production to the US – both of which would provide a big boost to GDP.

That said, globalization is a genie that can’t easily be stuffed back into the bottle. Labor is a global commodity, so imposing controls on goods to boost domestic wage rates will simply force firms to find a more efficient way to manufacture products.

That self-service checkout line in the grocery store, the call center powered by Artificial Intelligence, and the robots that weld the frames of automobiles are just the beginning. If import tariffs or domestic production regulations are implemented, you will eventually see domestic labor costs drop to the global average. Either we import cheap goods (something that helps consumers) or we indirectly import low wages by spurring the adoption of automation – the end result is the same.

Taxes. A drop in taxes would feel great to consumers – just like a one-time pay raise – and would add value to companies, but its effects on GDP is harder to assess.

We worry that the Trump proposal is basically a reheated version of Reagan-era supply side economics, which has been shown to have either a neutral or negative effect on GDP growth long-term and has the potential to lower national savings rates (which is also damaging). We also note that Reagan’s tax policies did correspond with a sudden rise in the proportion of income taken in by the wealthiest strata of society – suggesting that Trump’s tax proposals might exacerbate popular discontent.

In short, we don’t think that President-elect Trump’s policies will do what they are designed to do in terms of boosting the economy, and may actually make things worse for many who voted for him.

Potential for Market Shocks

Our full report covers our reasoning in detail, but in short, we suspect that President-elect Trump’s administration might bring the one thing that markets hate most – uncertainty.

One of Trump’s most attractive qualities as a candidate was his status as a brash outsider. But once in office, the outsider must function within the political structure to implement his policies. Many insiders, some of whom are inside the administration itself, have vested interests against or fundamental philosophical opposition to some of President-elect Trump’s policies.

If Trump’s policies are implemented piecemeal, it is likely that the bits implemented will be those that help workers the least. This is likely to cause political unrest among his base that may well exacerbate issues of social divisiveness that the election brought to the fore.

An additional wildcard is that of international relations. Conflicts in Europe and the Middle East, the threat of domestic terrorism, and an increasing shift toward nationalism world-wide have the potential to increase pressure on an administration that seems susceptible to stress.

All things considered, we have suggested that our clients not get carried away with the Trump Rally, but approach the equity markets with caution.

This article originally appeared on Forbes