In my Twitter feed the other day, I saw a post from Josh Brown, the well-known investment personality and CEO of Barry Ritholtz Wealth Management.

The stock market has been weak in April, with the NASDAQ down eight days in a row. In a tweet, Josh said the explanation was straight-forward:

In Josh’s view, people need money to pay taxes in April – especially when the market was up over the previous year. They sell their stocks to pay their tax bill – plain and simple.

I thought that this explanation seemed plausible, and if the effect was real, it would clearly show up in the data. I decided to run a simple test to see if April tax selling was a measurable effect or merely another investing myth.

To do so, I went back and pulled daily returns for the S&P 500 since 1950, then tracked returns every year from the end of March until April 15. If people really were selling just before the tax bill was due, that effect should show up in the form of consistently negative returns over the first weeks of April.

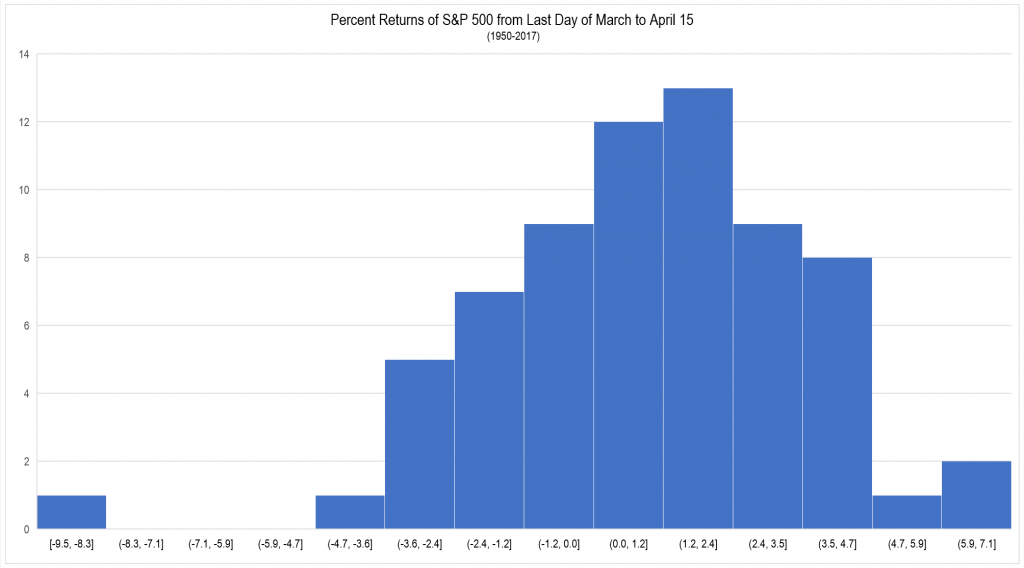

Here is the returns histogram that resulted from that study:

Figure 1. Percent returns of the S&P 500 Index from the last day of March through the 15th of April for all years from 1950-2017. Source: YCharts, Framework Investing analysis

You can see that there are five columns representing negative returns – the column labeled (-1.2, 0.0] and those to its left. The column labeled (0.0, 1.2] and the five columns to the right of it represent positive returns.

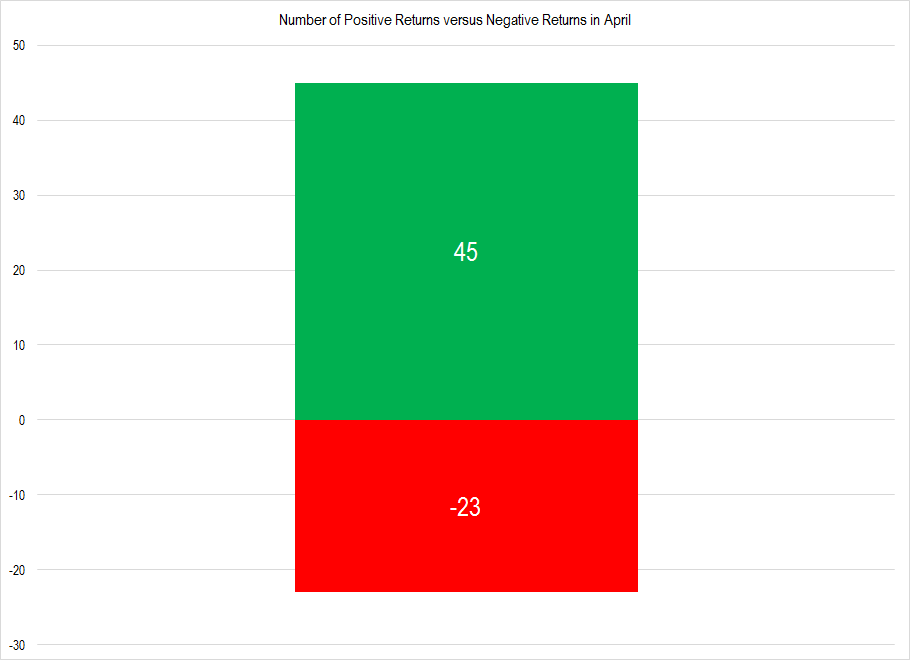

It’s clear from this histogram that the returns are mainly positive. Indeed, if we look at the number of positive returns versus negative ones, we find that in the first two weeks of April, positive returns are nearly twice as likely as negative ones.

Figure 2. Count of the years during which early April returns for the S&P 500 index were positive (Green) or negative (Red). Source: YCharts, Framework Investing analysis

This evidence in itself suggests that the idea that investors would sell stocks in April to pay for taxes is probably a myth, or at least that the effect is not large enough to have a systematic effect on returns.

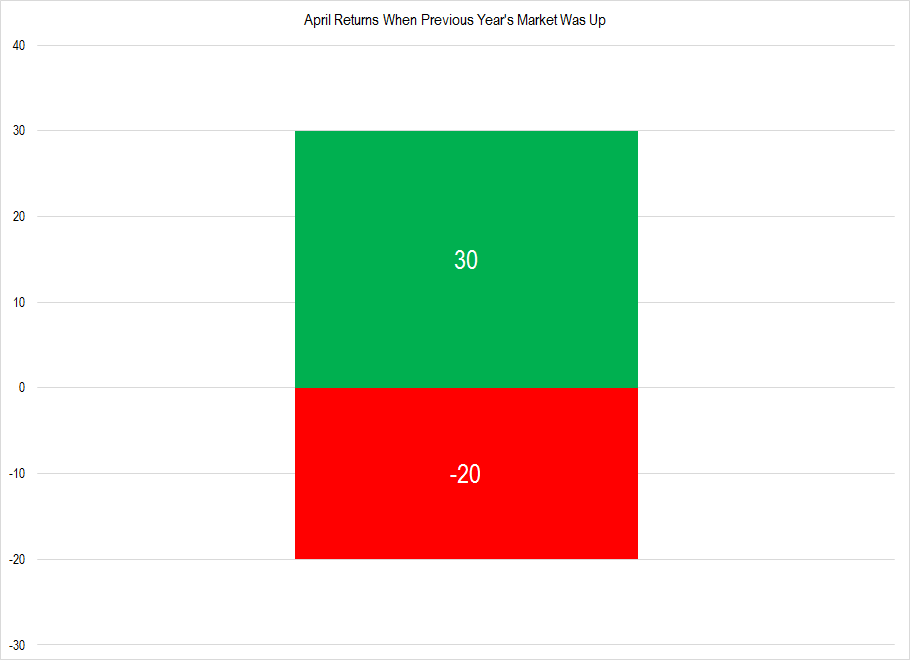

Still, I realized that I hadn’t completely disproved Josh’s theory. Perhaps there was a correlation between negative April returns and positive returns for the stock market in the previous year.

Presumably, investors would be more anxious to sell in April if they had healthy capital gains the previous year, so positive returns over the previous year might be more predictive of negative returns in the first weeks of April.

So, I compared positive and negative April returns for only the years that followed an up year for the market. Here is the resulting graph:

Figure 3. Count of the years during which early April returns for the S&P 500 index were positive (Green) or negative (Red) following a year during which returns were positive for the index. Source: YCharts, Framework Investing analysis

In fact, narrowing down the study to these conditions showed that positive returns had occurred with 50% more regularity than negative returns in the first two weeks of April.

After looking through these statistics, I feel confident in saying that the market being down over the last few weeks due to tax selling is a myth.

As an added bonus, in addition to busting this myth, I have a great hedge fund idea for an enterprising sociopath. Set up a fund, gather up investment dollars, lever up those dollars as much as you can, and place a long trade in S&P 500 futures at the close of the last trading day in March. Close your position at the market close on the last day before April 15 (inclusive), and, if historical returns are a guide, you will be able to retire to a life of leisure to the Turks and Caicos after having only worked two trading weeks. If you have bad luck and manage to hit a down year, just try the next year with some new investors! Truly a strategy worthy of Gordon Gekko!