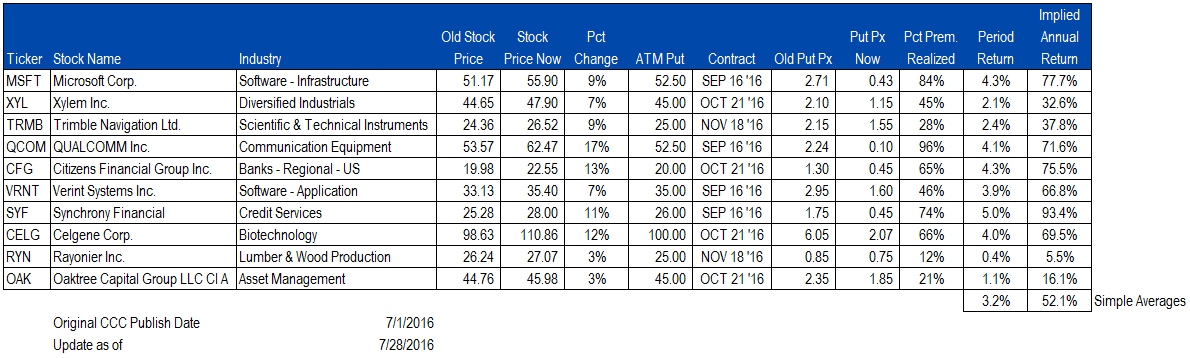

Each month, we publish a list of “bond replacement” candidates to our subscribers. July was a terrific month for our bond replacement picks – covered calls / cash-secured short puts on companies that influential value-oriented fund managers are buying – generating a monthly return of 3.2% on average (52.1% annualized).

A summary of our suggestions is shown below in figure 1. Note that we are only showing the cash-secured put transactions because they are identical from a risk / return to covered call transactions. Also keep in mind that even though these strategies use options, all of them are structured to be zero-leverage investments, so the returns mentioned above are not boosted through leverage. IOI Subscribers are welcome to download this record-keeping spreadsheet from our Research section posting ![]() .

.

Figure 1. Source: CBOE (pricing), IOI Analysis

For many of the suggestions, the time value of the option contract has already dropped by a substantial amount (e.g., 84% for MSFT or 96% for QCOM in the “Pct. Prem. Realized” column). Realizing profit on these transactions and reusing that capital for another investment is a sound strategy when so much of the value of a sold contract has already wasted away. We will be publishing another Covered Call Corner screen tomorrow with new investment candidates.

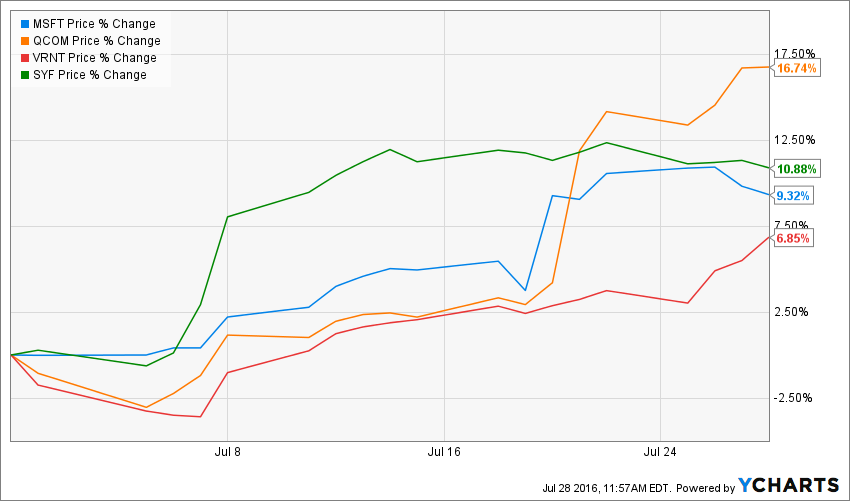

Stock Price Charts for Options Expiring in September

MSFT, QCOM, VRNT, SYF

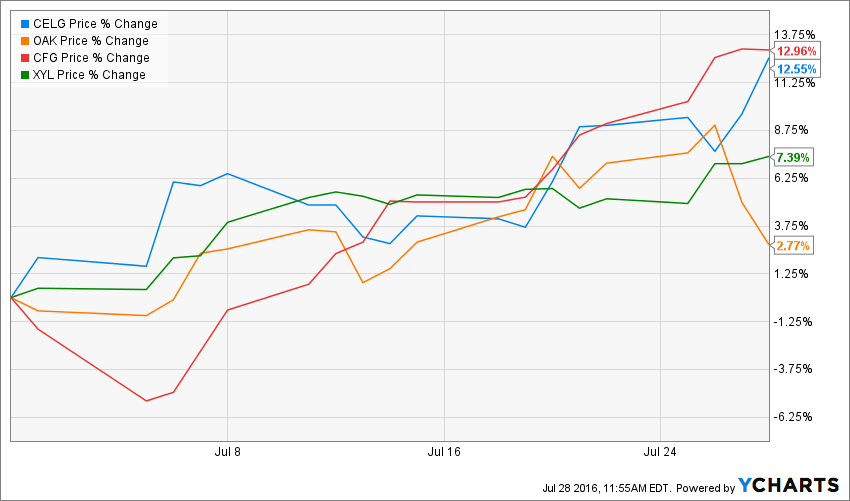

Stock Price Charts for Options Expiring in October

CELG, OAK, CFG, XYL

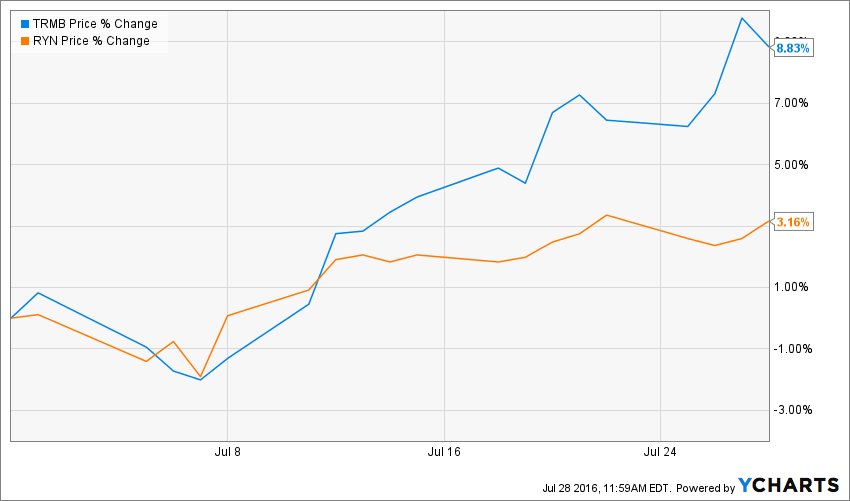

Stock Price Charts for Options Expiring in November

TRMB, RYN