Over the past year and a half, I have been publishing research on U.S. rail giant Union Pacific (UNP) related to my bearish position in the company. With the recent upswing in the company’s stock price, I have taken a close look at the company’s valuation drivers in a series of posts that covers everything from revenues to profits to investment spending. This re-analysis has been a useful exercise which has turned up an interesting and potentially meaningful difference between Union Pacific and its only true rival — Burlington Northern Santa Fe — the railroad owned by Warren Buffett’s Berkshire Hathaway.

The difference involves the amount of capital each railway is spending on maintaining and improving its respective rail network. While this is a topic not often discussed in the financial media, the amount of money a company is spending on its business is vitally important to its future as a firm — especially in industries that are capital intensive.

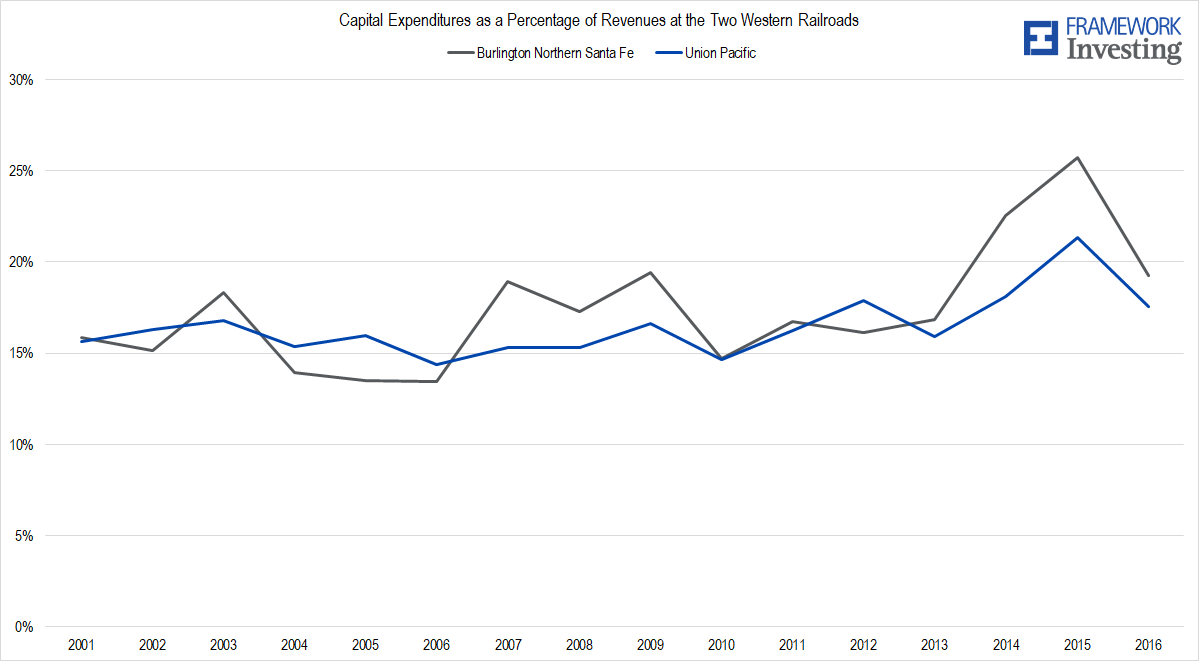

Comparing Union Pacific’s capital expenditures (capex) to that of BNSF’s, I found that, while both companies had significantly boosted investment spending during the past decade, BNSF has spent a proportionally larger slice of its revenues than Union Pacific.

Figure 1. Source: Company Statements, Framework Investing Analysis

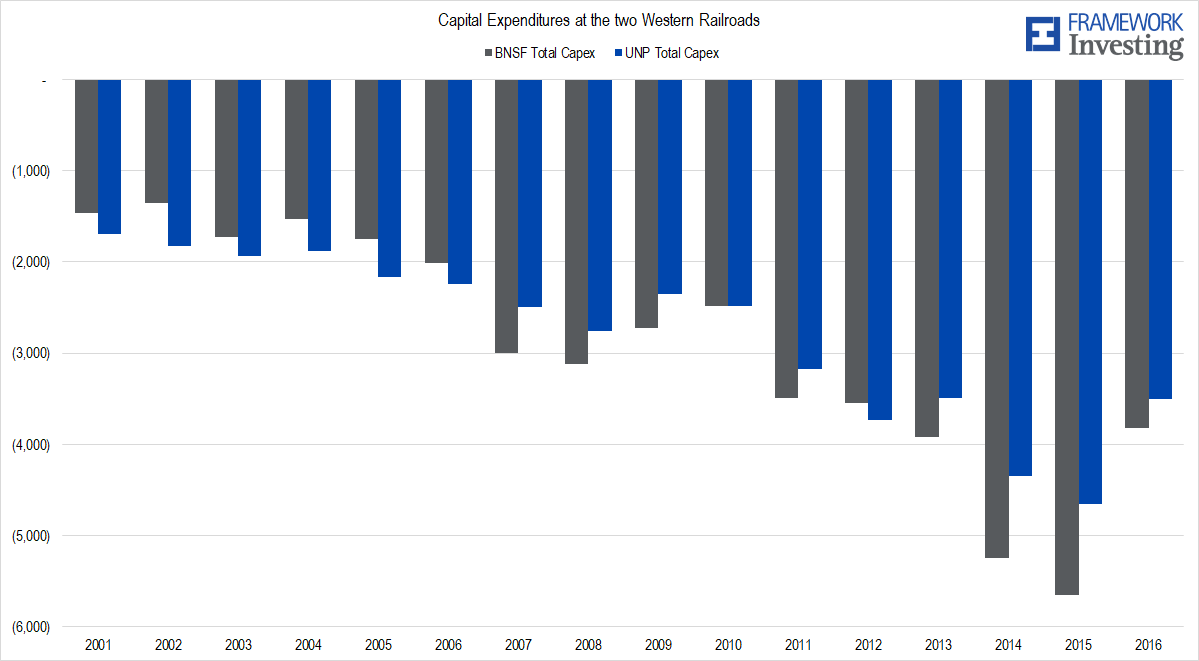

From 2001-2009, both firms spent an average of 16% of revenues on capital projects. In late 2009, Buffett announced he would buy the three-fourths of BNSF that he did not already own and the transaction closed in early 2010. Since that time through the close of the last fiscal year, BNSF outspent Union Pacific on capital improvement projects every year but two. BNSF’s capex as a percentage of revenues jumped to 19% and Union Pacific’s inched up slightly to 17%. In real dollar terms, BNSF has spent $2.8 billion more than its rival during the 2010-2016 period, outspending Union Pacific four out of six years.

Figure 2. Source: Company Statements, Framework Investing Analysis

Considering the similarities between the two companies, we think there are three possible reasons for the spending discrepancy:

1. Burlington Northern, free from public market discipline, is spending too much on its capital projects.

2. Union Pacific, under pressure from shareholders to maximize short-term results, is spending too little on its capital projects.

3. There is some intrinsic reason why Burlington Northern should, over time, spend more on capital improvements than Union Pacific.

The third option is a possibility. While the two railroads’ route maps are similar, BNSF’s network has more northerly routes compared to Union Pacific, whose exposure is more southerly. It might be that BNSF’s northerly routes require greater expenditures to maintain them in top working condition. However, if this were true, capital spending as a percentage of revenues from 2001-2009 should show BNSF consistently outspending Union Pacific. There is a small difference of 0.4%, but this difference is not statistically significant.

The first option — that BNSF is spending like a drunken sailor now that its management is no longer subject to quarterly earnings conference calls — also seems doubtful. There were some well-publicized problems with BNSF in 2014 related to the railroad not having sufficient capacity to meet customer demand, especially demand for transport of oil out of the tight oil fields in North Dakota. This suggests that the capital spending the company was doing between 2010 and 2014 was perhaps even overly conservative.

If we reject the first and the third options, that leaves us with only one — that Union Pacific is underspending to boost short-term results. We think this is most likely, considering we found that the company has been issuing debt to buy back shares especially over the last few years.

Underspending on capital projects can have effects in both the short- and medium-terms. Short-term effects are related to skimping on spending to maintain the business as a going concern (maintenance capex); medium-term effects are related to underspending on “growth capex.”

When a company underspends on maintenance capex, it runs the risk of more industrial accidents and lowered efficiency. Indeed, in July of last year, Oregon Public Broadcasting reported that Union Pacific had more accidents than BNSF despite traveling fewer miles and carrying less tonnage. In December, OPB reported that the Federal Railroad Administration required Union Pacific to increase the frequency of its inspections and the quality of its track maintenance program. As a counterpoint, the company reports that the number of accidents has been decreasing even as average train speeds have been increasing, but we believe this improvement is more a function of the low freight volume environment than improved track conditions.

When a company underspends on growth capex, it runs the risk of being left behind during industry upturns. Revenue and profitability growth will be constrained and client satisfaction will be lower (this is what happened to BNSF in 2014). Right now, other than Union Pacific’s southern region — where demand for railcars full of frac sand is booming — generally lower freight volumes are creating slack in the company’s network. When volumes increase, if the company is not spending enough on capital improvements, it may not have the capacity to meet demand. This would limit medium-term growth and push down the value of the firm on a cash flow basis.

We have not completed our revaluation of Union Pacific yet, but we think the last two weeks’ leg up in the stock price has a great deal to do with optimism regarding the GOP tax reform package. We will publish our updated valuation and investment strategy to our Framework members soon.

This article originally appeared on Forbes.com