Last month Framework initiated a discussion on investing in a fully valued market prompted by a question from one of our members, Carey C. In our summary of that conversation, we promised a watchlist from Framework member and professional portfolio manager, Sheila Chesney. But, before we get to that, some background is needed.

As experienced investors, you realize that a watchlist is first and foremost a reflection of the portfolio design rules that the manager has outlined ahead of time. As with many things in life, it’s the design work or preparation that provides the greatest value. It’s also the part that most of us want to avoid. But developing skill in investing demands following a decision process. The thing is that is doesn’t have to be complicated. It just has to be defined and repeated and in the continual repeating you learn.

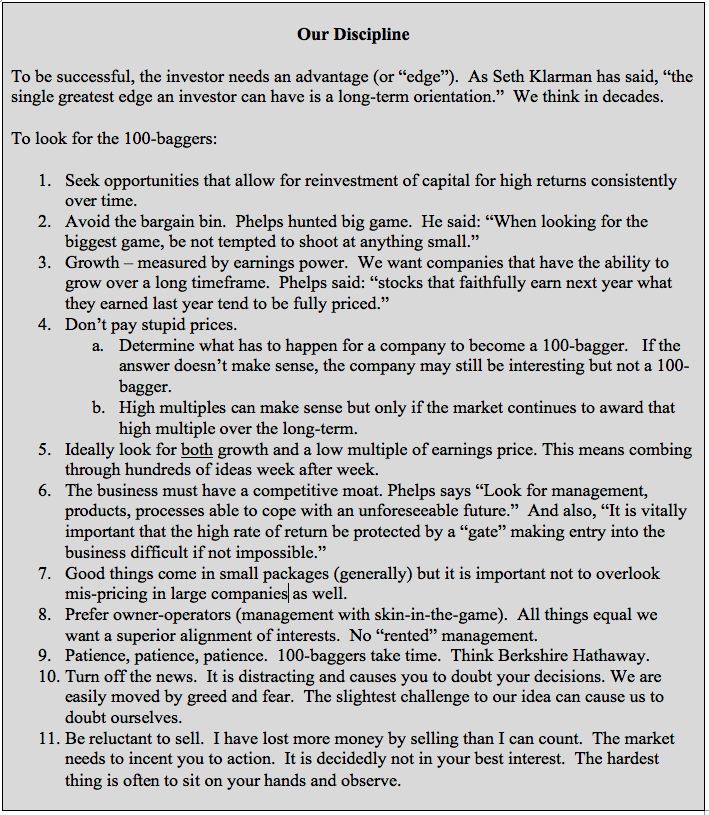

In my case, we have come to establish a set of rules for our equity portfolio. Our fundamental premise is that we want to find opportunities that will significantly enhance our wealth over time and we have studied the ideas of people who aspire to that same objective. As they say there is nothing new under the sun and so we give credit to those smart people who taught us along the way. Warren Buffett and Charlie Munger, certainly, but two people who specifically focused on the search for the 100-bagger: Thomas Phelps who authored 100 to 1 in the Stock Marketand Chris Mayer who updated Phelps’ work in a book entitled 100 Baggers. Both books are treasures.

So, we owe the fact that we have a process to lots of smart people. It is important not to get discouraged about developing the process because it turned out to be a very satisfying, self-feeding mechanism in that the more you work it the better it starts to hang together and the better it hangs together the stricter you become in your thinking. Our fundamental elements tend to keep us on a path. Here is how we look at the world.

This is all well and good. Generally, this list elicits head nodding from all who read it. But what does it really mean? How do I make this PRACTICAL for myself? That gets into the Portfolio’s DESIGN. The hardest thing is deciding how to put ideas into a funnel and then decide if they are worth pursuing.

We decided that a good starting point was to come up with buckets that made some logical sense to us. There is simply a limit in time. Your design can be your design. Fundamentally we are looking for long-term investments in companies that will compound wealth. This is our core strategy. We call it the “coffee can” – for companies that we want to own for a very long time. Our secondary bucket has three portfolios (one for real estate investments for our clients who do not wish to participate in direct real estate investments). You will see a common theme running through the ideas that flow back to our fundamentals.

Portfolio Models

- Primary:

- Strategic (long-term) Portfolio (CORE)

- Secondary

- Thrift Conversions

- Special Situations

- Real Estate (for clients who do not participate in direct investments)

Strategic Portfolio (“Coffee Can”)

- Long-term compounders

- Can be concentrated (we do not believe in naïve diversification)

- Generally limited to 20 positions

- Minimum position size is 2% – if we can’t justify at least that, it is not the right holding

Thrift Conversions

- Newly-minted IPO thrifts

- Relatively low-risk positions with historically attractive returns (Seth Klarman idea)

- Buy at around BV

- Hold for the minimum 3 years

Special Situations

- Opportunistic portfolio; can be event-driven

- Can include options (currently TARP warrants)

- Can include convertibles, preferreds

- Often manager-driven rather than valuation-driven (Senvest, Fairfax, etc.)

Real Estate

- Very limited positions researched

- Generally long-term oriented

- Short list of positions followed

- Kennedy Wilson

- Howard Hughes

- Equity Commonwealth

- Tanger Outlets

You have probably noticed that I do not set hard weightings for each of these buckets. We are eclectic. In general, our strategic portfolio will dominate and that is where we look to hold our growth ideas. The secondary portfolios are satellite holdings.

The Watchlist

Here is our current watchlist. Full disclosure, we own many of these ideas (some for a number of years). Our watchlist can change regularly as new ideas come on and just as quickly drop off.

Loading...

Loading...

As I said, these are positions we own in some cases or are just interested in. You are welcome to ask questions about any of them.

This is Step 1 for my firm in looking at investments. We’ve been doing this successfully for over 25 years, and this step has remained consistent. The process that guides our arrival at this list is frankly, more important than the list itself. The names change. The process does not.

Joe and I will come back to you in the next piece to talk about Step 2 and how I implement the Framework I’ve learned here to solidify my actual investment decisions.