Since posting our May Covered Call Corner spreadsheet last week, I have been busy making transactions.

With the transaction on Berkshire Hathaway yesterday, I have made a total of seven bond replacement investments — all taking the form of covered calls.

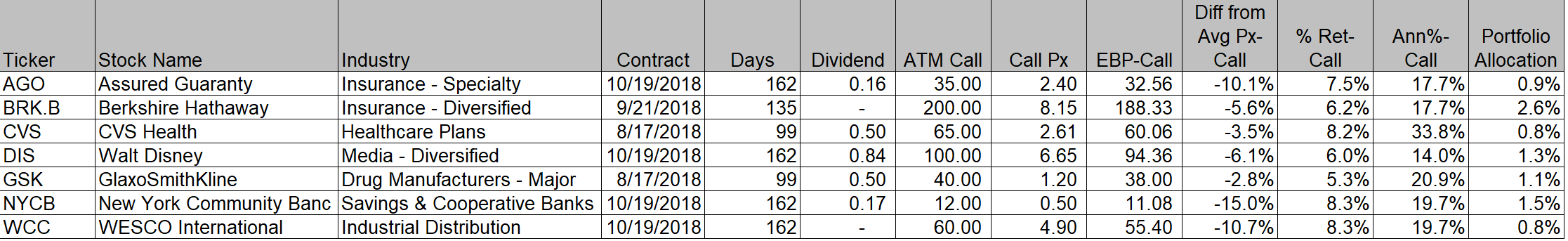

The details for each of the transactions are shown in the figure below.

Figure 1.

As you can see, I allocated a modest amount to each investment, ranging from between 0.8% to 2.6% for Berkshire. The average allocation not including Berkshire was 1.1% of the portfolio. In all, 9.1% of the portfolio is allocated to bond replacement investments from the May 2018 Covered Call Corner screen. The portfolio also has a 4.1% position in the IBM investment recommended in our last Tear Sheet, which I consider to be a hybrid between a concentrated investment and a bond replacement one.

Due to price changes and the progression of time, annualized yields if all the shares are called away increased somewhat. The allocation-weighted average annualized yield is 19.5%.

We think that period returns are a better way of thinking about potential yields. If all our stocks are called away from us, the allocation-weighted averaged period yield will be 6.9% over an average tenor of 141 days — just over four and a half months.

The list looks well-diversified and were all stocks to be delivered away, we will boost our portfolio’s yield by a non-trivial 1.8%. Of course, there is always some slippage, so actual numbers will likely end up lower.

A single contract of Amazon would give us too large of an allocation to the name, so we will not execute that transaction. The market closed before we were able to transact in Brookfield Asset Management (BAM) and the very high yields on MBIA make us want to take a closer look at that name before committing capital.