General Electric, a firm about which we have written extensively and in which we are invested, announced its first quarter 2018 earnings before market open today. The shares are up modestly on a down day for the markets, suggesting that investors were pleasantly surprised by GE’s numbers.

Certainly, expectations for GE are phenomenally low, thanks to a dividend cut, an enormous charge related to its legacy long-term care insurance business, and a simultaneously historically weak market for power generation units and oil and gas products and services.

Because my mental model has been proven spectacularly incorrect over the last year, I am hesitant to opine on the earnings without a thorough review, but there are several items that particularly drew my attention:

The Good:

- An marked increase in aviation sales to and orders from military customers

- An improvement in cost control, leading to positive operating leverage

- A full-year EPS guidance which, compared against the market price of the stock, implies growth lower than that of the economy into perpetuity

The Bad:

- Enormous fall-off in the Power segment’s orders and sales

- Continued weakness in the “long-cycle” Oil & Gas business

The Mixed

- A huge growth in orders for onshore wind turbines

We walk through each item below.

Aviation Sales & Orders

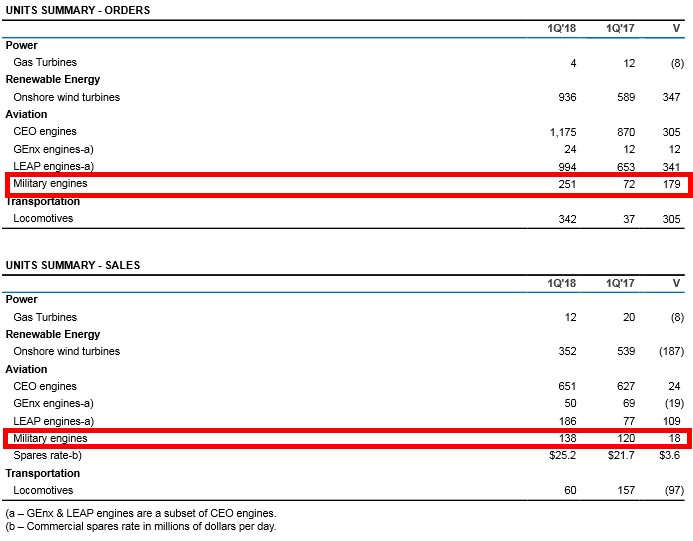

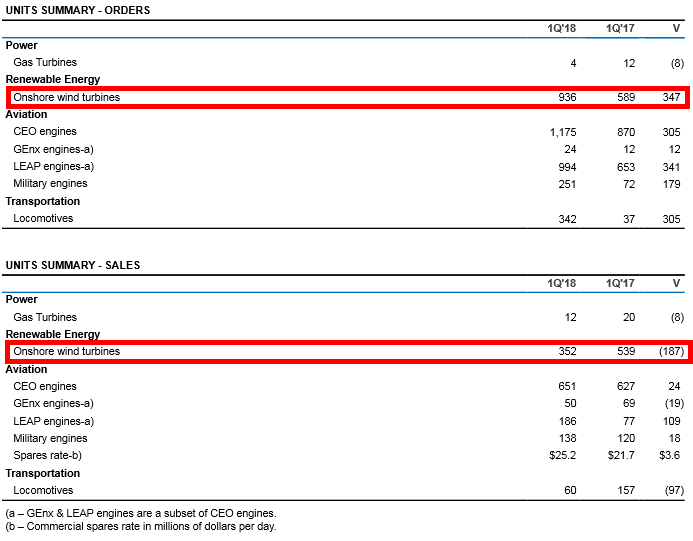

On page 3 of the Supplemental Information published by GE with its earnings announcement, we find the following table:

Figure 1. Source: Company Statements

We expected a sharp uptick in orders and sales of commercial engines (GEnx, LEAP) since the company is in the midst of a major product refresh for that division. However, the increase in military engine orders by more than three times (see top box in Figure 1) and the 15% increase in military engine sales was a pleasant surprise.

Granted, military engine represent only about fifth of the orders and sales of commercial engines, but the focus on military is a low-hanging fruit for GE’s Aviation segment and will provide some attractive marginal upside.

Cost Control

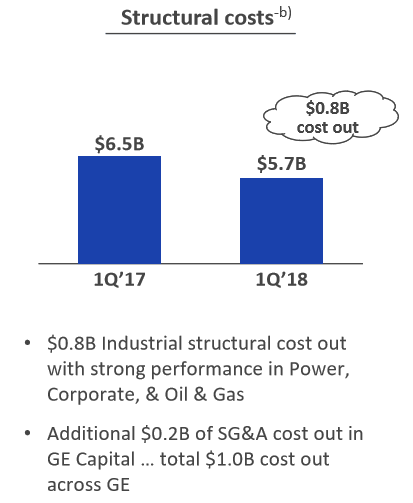

The company’s earnings presentation slides refer to $800 million in structural cost reductions.

Figure 2. Source: Company statements

These cost reductions — layoffs, shuttering of facilities, and general austerity — combined with strong Aviation orders drove an improvement of operating profitability in the Industrials business.

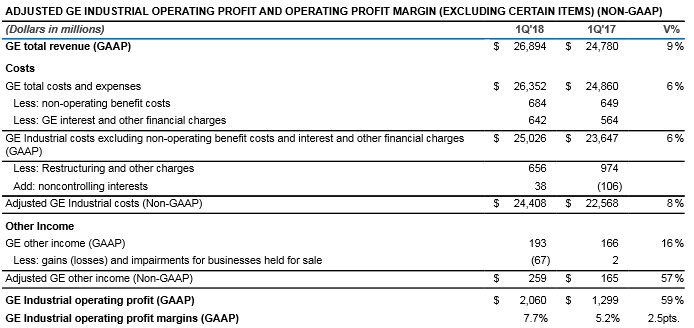

Figure 3. Source: Company Statements

Note that Industrial revenues increased by 9%, but that Industrial operating profits grew by 57%. GE’s new CEO, Flannery, is clearly focused on cost-cutting and “right-sizing”, which we applaud.

EPS Guidance

The company guided to $1.00 – $1.07 of earnings per share in fiscal year 2018.

Figure 4. Source: Company Statements

If we take the low end of that range and back out growth while using a discount rate assumption of 10%, we find that at the present share price of $14.53 / share, the market assumes GE will grow EPS at a rate of only 3.1% in perpetuity.

3.1% is close to the historical inflation rate, and barely more than recent history. In comparison, Framework models assume 5% growth in perpetuity, which is itself lower than the post-War average nominal growth rate of 6%.

Use this worksheet to see this calculation and input your own variables

If we assume GE will only grow its present earnings — which are very close to a trough, thanks to synchronized collapse of both the Power and Oil & Gas businesses — only at the same rate as the economy at large, the stock should be worth either $20 / share (5% growth rate) or $25 / share (6% growth rate).

This is a pretty dull analytical tool, but it is not a bad back-of-the-envelope approximation.

Power Segment

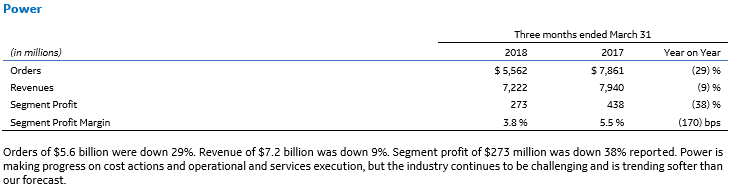

There is no adjective to use other than “horrible.”

Figure 5. Source: Company Statements

Orders for new equipment were down by 40% versus 1Q17 and down by 19% for services. Price competition is fierce, so margins are low — segment profit dropped by 38% year-over-year and margins are what one might expect from a well-run grocery store rather than a state-of-the-art engineered systems firm.

Guidance for this business until June or July of last year was rosy. The head of Power at that time was fired, but it is hard for me to believe that GE will not see law suits stemming from communications related to the Power business.

In our view, the future of the Power business is vitally important to the value of the firm. Renewable power sources are becoming more popular and widely used. Thus far, renewables have hurt the gas and steam turbine business only at the margins — renewables decrease overall use of turbine generators, meaning that maintenance work need not be performed as regularly.

The greatest valuation question facing us right now is the degree to which the present weakness in fossil fuel power generation is cyclical and how much is secular. If cyclical, this is a great time to buy GE; if secular, the 3% per year implied growth rate we calculated above may be appropriate.

GE is cutting costs in the Power business, and this will help a great deal if the business is in a cyclical trough. If the business is in secular decline, there is no point in making small cuts.

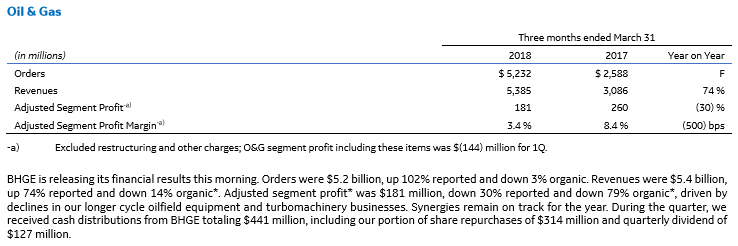

Oil & Gas

The long-cycle business — mainly related to offshore exploration and drilling — remains poor due to relatively depressed oil prices. The short-cycle business — mainly that acquired with the purchase of Baker Hughes — should be doing well, but we have not read through the Baker Hughes materials yet.

The numbers are bad, but recently rising oil prices make me less circumspect about this business. Apparently, it also makes GE executives less circumspect about the business, as CFO Jamie Miller recently commented that management sees a lot of upside in the business.

Figure 6. Source: Company Statements

GE is prevented from selling off its majority stake in Baker Hughes until 2019. If oil prices continue to rise (my conspiratorial side thinks that Saudi Arabia is engineering a rise in oil prices so that it can get top dollar for its Saudi Aramco IPO in 2019), GE may see the sword of leverage cut in its favor at last. Rising demand for on- and offshore oilfield services will go a long way to making this an attractive business.

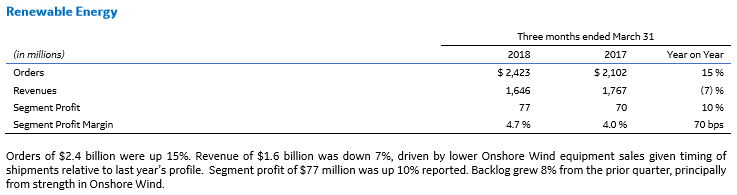

Wind Turbine Orders

GE was facing tough comparables regarding wind turbine sales, due to a large order in the first quarter of last year, but orders were strong.

Figure 7. Source: Company Statements

We classify this news under the “mixed blessings” category because while it is always better to have more orders than less, the rate at which wind turbine revenues are converted into profits is much lower than GE’s corporate profit margin overall.

Figure 8. Source: Company Statements

Even with a burst of demand, profit margins are in the 5% range, not dissimilar from the profitability of Power and Oil & Gas, which are both at multi-year low levels.

GE must have exposure to this business to be a part of the coming century of power production, but the profits it generates from it are very low due to intense competition. In addition, GE does not have much exposure to offshore wind turbines, which may eventually become more important than onshore turbines due to the consistency of the speed and direction of offshore winds.