Since Donald Trump began his harangue on retail revolutionary, Amazon (AMZN), I have been watching the stock price drop, wondering what it was worth.

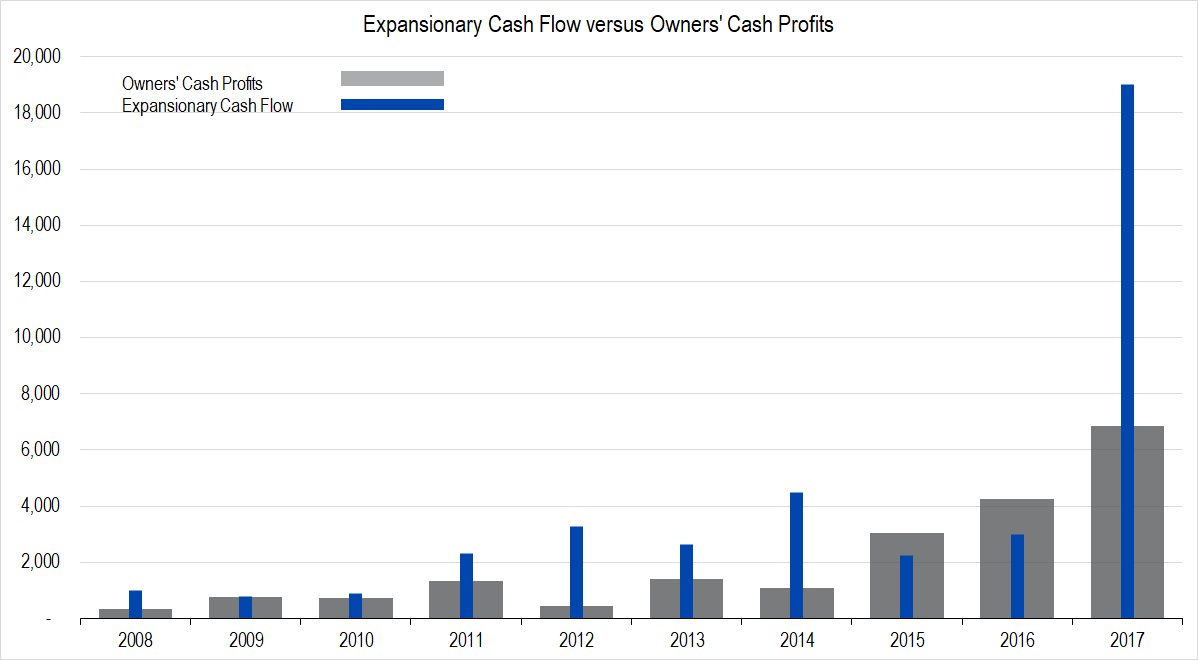

Figure 1.

Long story short, Amazon is a difficult firm to value, and even after looking at the numbers and letting them roll around in my brain for awhile, I still do not have confidence in this valuation.

Here is the model for those who want to cogitate over it with me.

Framework Valuation Model for Amazon (AMZN) ![]()

Revenues

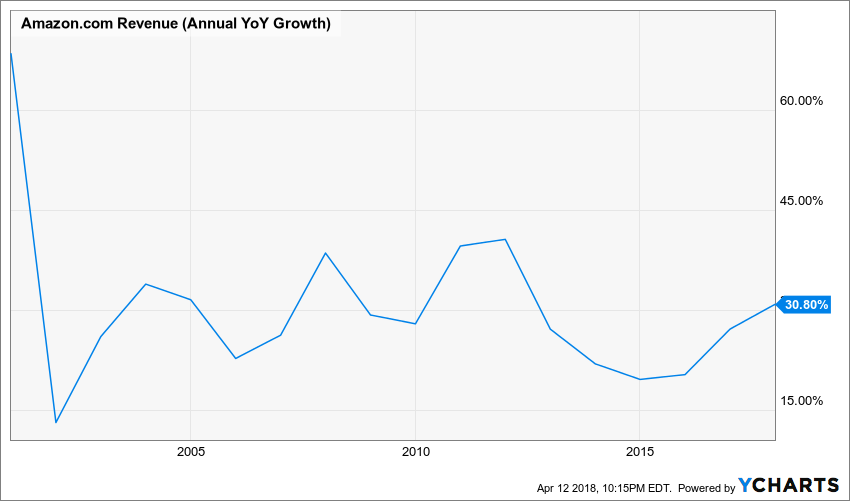

One area in which Amazon has continually amazed me is just how long it can grow so fast.

This is the rate at which Amazon has grown during the 21st century. Phenomenal.

Figure 2.

This is an amazingly long, amazingly rapid growth and the growth doesn’t seem to be trailing off.

Amazon Web Service (AWS) is a new business and it is growing at an average rate of 54% over the last four years. It probably still has a ways to go.

Bezos is playing a few steps ahead in the game of retail chess, and that business is still growing consistently in the 20%-30% range.

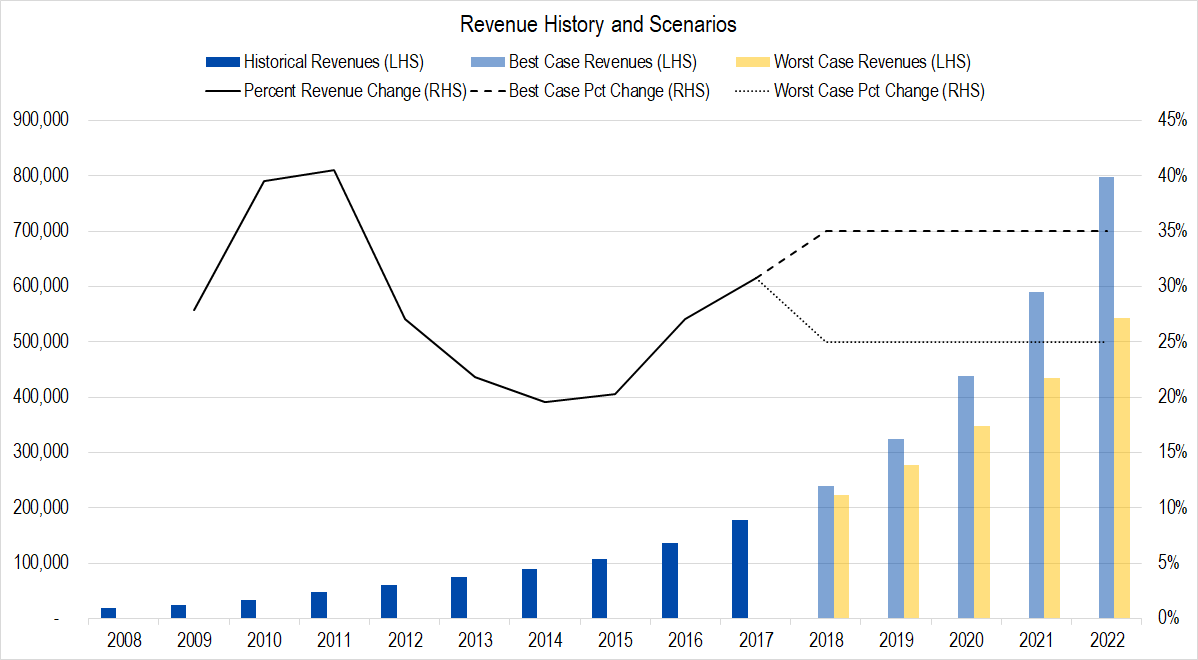

My projections for annual growth — 35% in the best case and 25% in the worst — straddle Amazon’s historical average revenue growth of 30% per year since 2001.

Figure 3. Source: Company Statements, Framework Investing Analysis

Profits

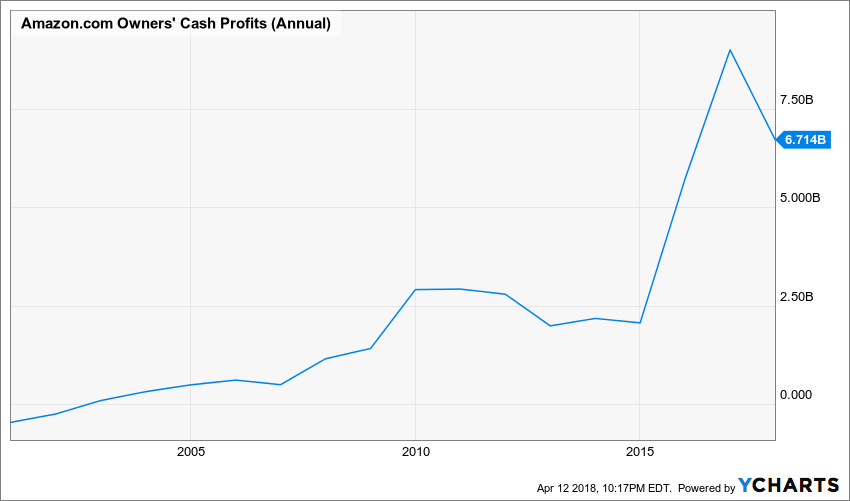

Amazon is an amalgam of several retail businesses (expanding its breadth quarterly) and one high-tech one. AWS is the market leader in the provision of enterprise Cloud servers — Infrastructure-as-a-Service (IaaS).

In contrast to retail’s single-digit profit margins, AWS generates profit margins in the mid-20% range. As mentioned above, AWS’s revenues are growing in the 50% per year range — about twice as fast as the retail business is growing.

As time passes, simple arithmetic says that the profitability of the firm will increase as the high-profit revenue stream becomes a larger percentage of total revenues.

Figure 4.

However, the AWS business is changing the nature of Amazon as a whole. One of the things I was most surprised about looking at Amazon’s numbers this year was that Amazon was no longer running net negative working capital overall (in other words, it was using cash to build inventory, pay accounts receivable, and the like rather than generating it as it has in the past).

This is a big change for Amazon, which had financed its operations for years by paying suppliers more slowly than it received customer payments.

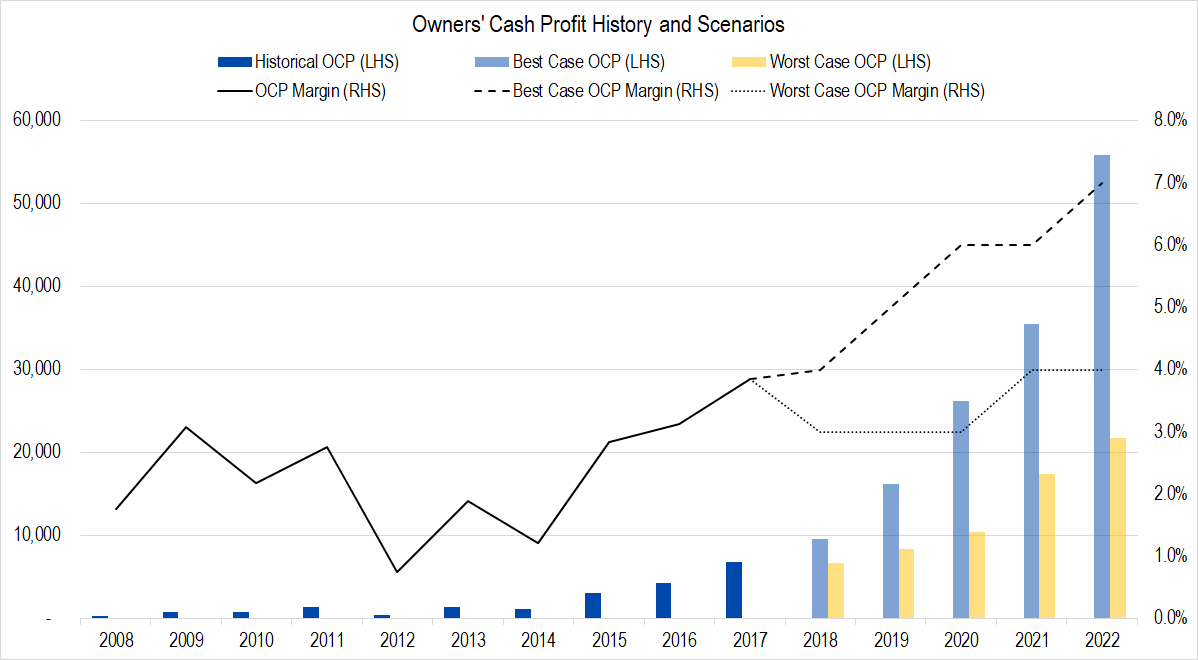

I would like to be able to split out AWS from the retail operations to understand and model both businesses from a cash flow perspective, but Amazon does not provide these details and I have not taken the time to try to estimate them. Instead, I eyeballed about how much it seemed like profitability could increase on an overall basis given the quickly-growing AWS. Here are my projections:

Figure 5. Source: Company Statements, Framework Investing Analysis

The best-case looks too good to me, but the worst-case also looks too low. I think the firm’s profitability in five years will be in the mid-single digit percentage range.

Investments

Amazon is still acquiring and spending heavily to build both its retail business and its IaaS business. I have eyeballed a rate of investment spending as a percentage of profits at 95%, but have no basis to think I am right about this.

Figure 6. Source: Company Statements, Framework Investing Analysis

Medium-Term Growth

Amazon’s revenue growth may be brisk for another 10 years. But even as revenue growth slows, profitability can still increase as the company develops scale efficiencies. In addition, it is unlikely that investments will be as large a proportion of profits as the firm matures.

My estimates for Amazon’s medium-term growth (which I have set to 10, rather than the usual five years) are 45% and 30% in the best- and worst-case, respectively. Over the past few years, profits have grown at closer to 70%. I have zero confidence that I or anyone else can make more than a guess at that growth rate.

Valuation

Pulling all this together into a valuation gives a phenomenally wide range.

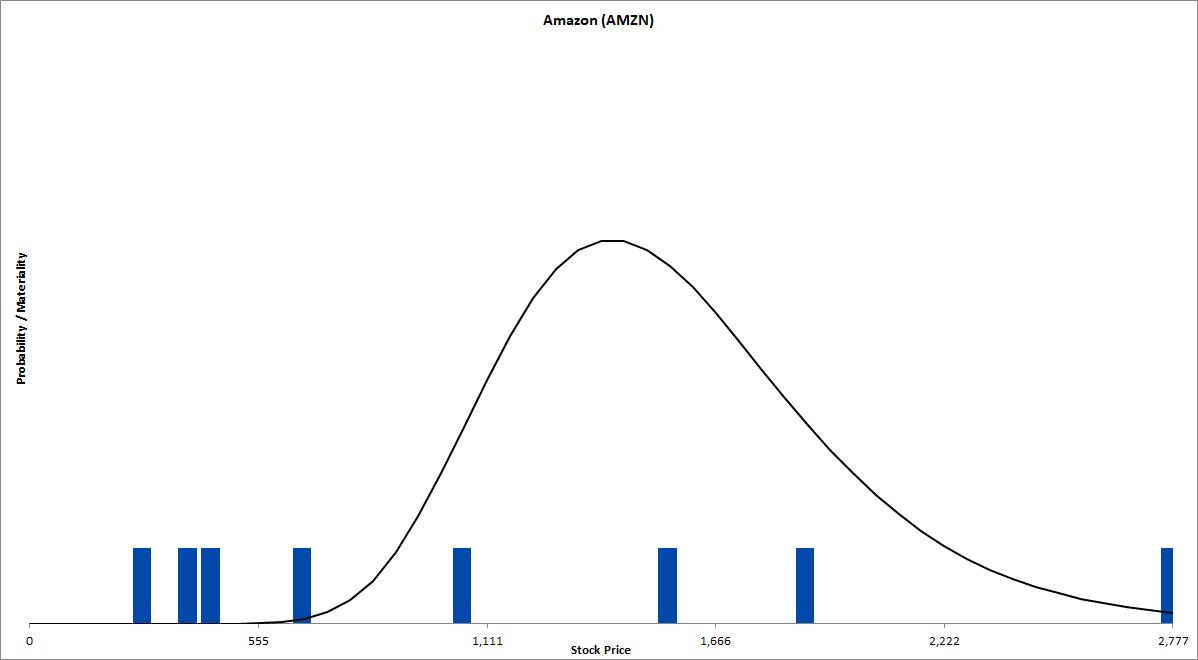

Figure 7. Source: CBOE, Framework Investing Analysis

Amazon is worth from $300 – $3,000.

It is true that most of the valuation scenarios lie below today’s price, but given the uncertainties surrounding the inputs, it is hard to say whether this datapoint hold much meaning.

In my opinion, investing in Amazon turns out to be a bet on how far you think Jeff Bezos’s brilliance can take the company. And it has been hard to bet against Bezos in the past…