Long-time Framework member, Wilson M., started a Framework Forum thread about Facebook that included his valuation estimate of $235 / share.

I updated a model for Facebook and wrote a post that I will publish on Forbes tomorrow. To be quite honest, I have no idea what Facebook is worth — I have only used Facebook once, when a friend passed away and I was trying to get in touch with our mutual friends — but it does seem to be worth more than it is trading for now.

The article looks at what valuation driver assumptions would have to be for the company to be trading at today’s market price of $164 / share.

Anyone who wants to tweak the model and derive a thoughtful valuation range gets a free month’s access to Framework! Download the model and take a look!

Framework Integrated Valuation Model for Facebook (FB) ![]() Here is the Forbes post. I’m supposed to post this to Forbes first… Shhhh…

Here is the Forbes post. I’m supposed to post this to Forbes first… Shhhh…

The other day on our Framework Forums, a member wondered if Facebook had fallen far enough to be an attractive investment. With Zuck in front of Congress today, I decided to look at what would have to happen to Facebook’s business to make it worth the $164 / share for which it is trading today.

There are only a few things that can change the value of a company:

- Revenue growth

- Profitability

- Investment level, and

- The medium-term cash flow growth the firm’s investments bring.

The Framework valuation model isolates each of those valuation drivers, so it is easy to back into the present stock price. Here is what we found:

Revenue growth would have to fall off a cliff.

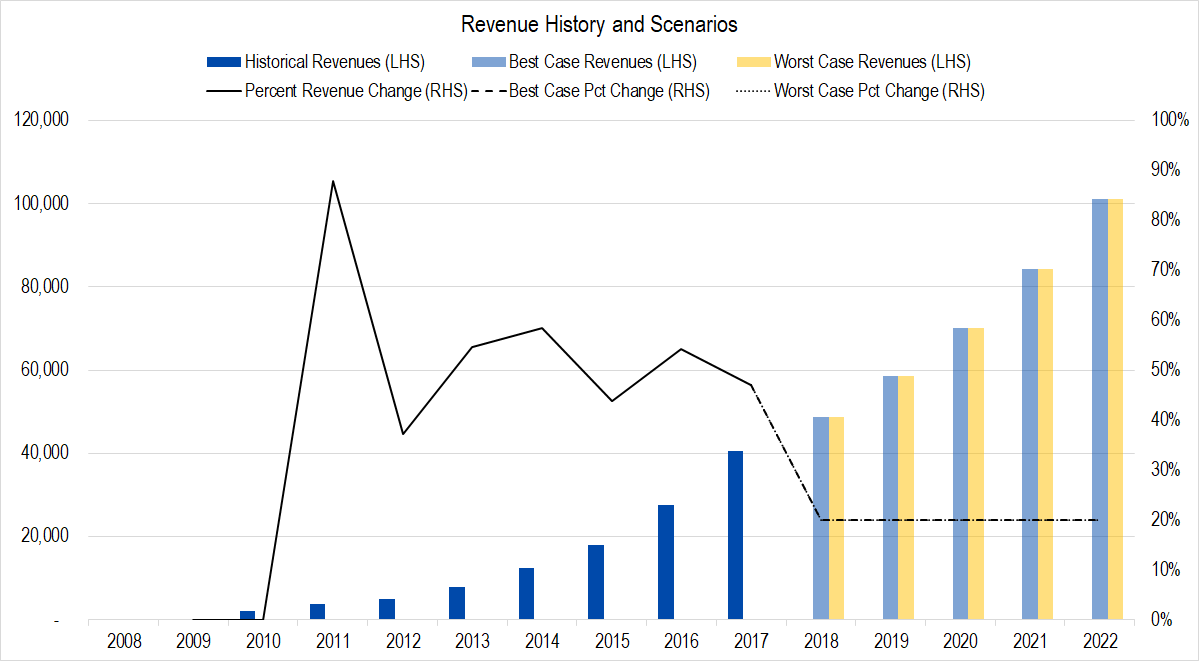

Figure 1. Source: Company Statements, Framework Investing Analysis

Since Facebook’s operational history began in 2010, the company’s revenues have grown at a compound annual growth rate (CAGR) of 54%. As you can see from the black line which represents year-over-year change, other than 2011 – when the firm was fresh out of the gates – and 2012 – when the firm was trying to get the kinks worked out of its mobile advertising platform – growth rates are pretty steady at around 50% per year.

Our “forecasts” drop the growth rate to 20% per year – a quick pace for a mature company, but much slower than recent history.

Profitability would have to take a massive hit.

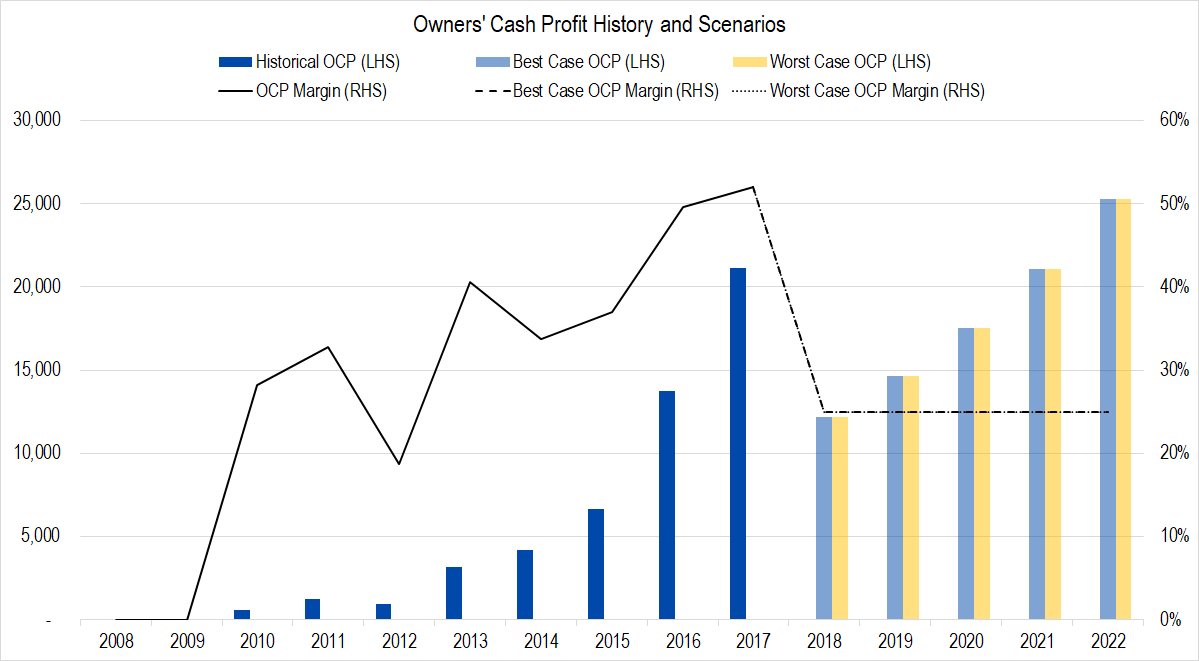

Figure 2. Source: Company Statements, Framework Investing Analysis

Note that we measure profit using a cash-based metric called Owners’ Cash Profits or OCP. On an OCP margin basis (shown by the black line), the lowest five-year average profitability for Facebook since its founding was 31%. We have to assume that the company will only be able to convert profits at half the rate that it has over the last two years – at a rate that is six percentage points lower than the prior low five-year average value.

The firm would have to spend over 60% of its profits on investments.

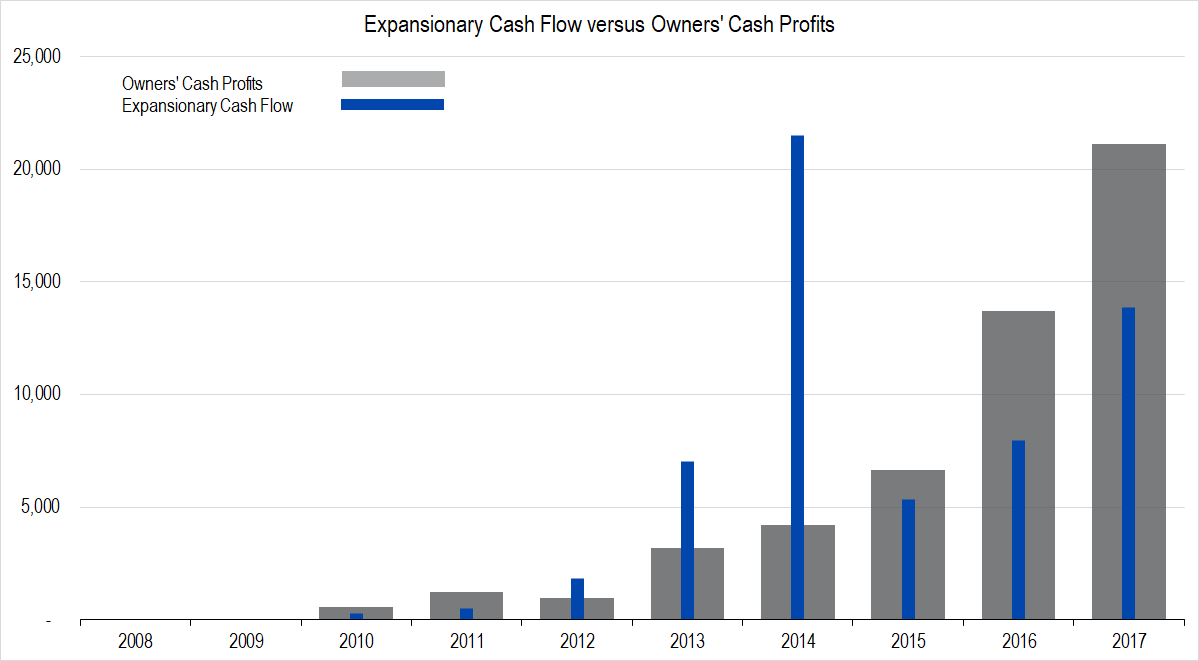

Figure 3. Source: Company Statements, Framework Investing Analysis

2014 was a year that saw Facebook acquire WhatsApp ($19 billion) and Oculus VR ($2 billion). 2012 was Facebook’s acquisition of Instagram ($1 billion), and 2013 saw a huge amount of dilutive stock issuance, which we count as a virtual investment expense.

Setting aside those three years, our projections for Free Cash Flow to Owners for the next five years (the difference between what the firm earns in profits and what it spends in investments), is about half of what it is has been historically in a normal year (less than $0.10 for every dollar of revenue versus around $0.20 for every revenue dollar).

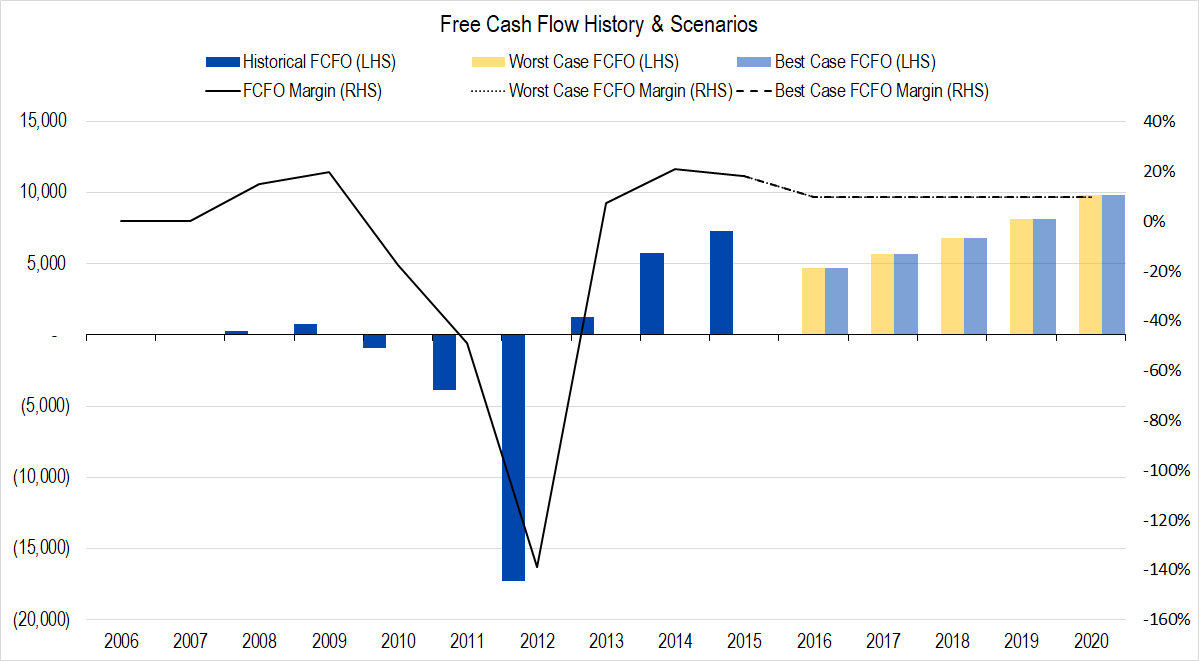

Figure 4. Source: Company Statements, Framework Investing Analysis

Growth of free cash flow in the medium-term would have to slow significantly.

Average annual profit growth over the last three overlapping five-year periods has been around 70%. We had to peg cash flow growth at 20% per year for a 10-year medium-term (2023-2033) growth period. 20% might seem high, but keep in mind that as the firm matures, it should need to spend less on investments and should become more profitable (recall that we assumed profitability over the next five years would drop precipitously), the net effect would be to increase the growth rate of cash flows, even if revenues were slowing.

Pulling all these assumptions together in our valuation model (which we have made available to Framework Members), we were able to peg the value to today’s market price of around $164 / share.

I’m not invested in Facebook, partly because I have no idea why anyone would voluntarily use it and partly because I’m too Contrarian in nature to ever do anything as trendy as buying a FAANG stock.

Looking at these valuation assumptions, however, I’m beginning to think a little money allocated to FB might not be entirely bad…