We reviewed database and application software giant, Oracle’s ORCL, third quarter earnings announcement in a note published on March 21, and posted an updated model and Valuation Waterfall a week later, after we had had time to analyze the data.

We found some encouraging hints within the earnings release and are hoping that Mr. Market will give us a lower price for Oracle so we can increase the size of our investment position in the company. We are keeping an eye on an Effective Buy Price of $40 / share, as that, we think, is a reasonable worst-case valuation.

Market reaction to the earnings announcement was negative. Oracle lost around 10% of its value on the trading day after it issued its earnings announcement and is now down around $9 from its all-time closing high of just shy of $53 / share.

Figure 1.

We believe the negative reaction was mainly due to investor worries regarding slowing Cloud sales growth. This article looks at trends in both the Cloud and On-Premise* businesses, and describes why we believe investor worries regarding Oracle’s Cloud business are overblown.

Oracle’s Cloud Business

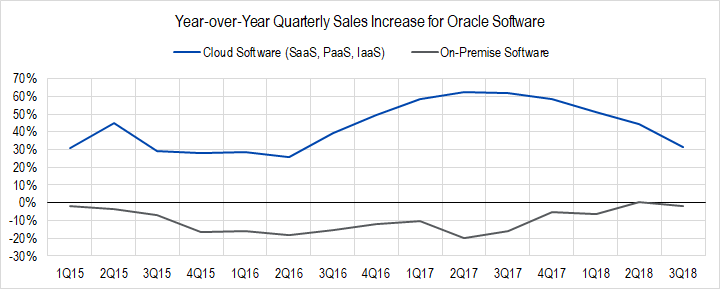

Indeed, the graph of year-over-year (YoY) growth of Oracle’s Cloud business revenues presents a striking picture.

Figure 2. Source: Company Statements, Framework Investing Analysis

The blue line above represents the YoY change in Cloud sales each quarter, and the downward slope of this line has encouraged investors to believe that Oracle’s Cloud business might be losing ground to Cloud competitors.

In my mind, that interpretation misses two important features about this graph. First, year-over-year revenues are still growing at a 30%, which is hardly shabby. Second, shrinking of On-Premise software revenues is finally modest enough not to cause much of a headwind to revenues. Compare the recent flatness of the gray curve to its depth during the 2015 – 2017 period, and you’ll appreciate the improvement.

The extraordinary growth Oracle’s Cloud business displayed over the last few quarters probably had several causes. Oracle made several acquisitions (MICROS in 2015 and NetSuite in 2017), and some of the year-over-year (YoY) rise is likely due to the integration of those companies and the cross-selling of Oracle products to its customers.

In addition, Oracle was making a strategic push into the Cloud during this timeframe and switching On-Premise clients to the Cloud. This effect is shown in both the depth of the gray line and the height of the blue one.

Last, due to revenue recognition rules for Cloud subscriptions, there is a lag between when deals are signed and revenue is recognized. Especially at the start of a rapid rise in Cloud bookings in place of On-Premise sales (which are recognized immediately), there will be some lag in revenues that eventually evens out as the Cloud business matures.

The On-Premise Business

As noted above, the On-Premise business has at least been holding its own for a few quarters. There are likely two reasons for this:

- An new version of Oracle’s database software was released and this is creating a temporary surge in demand.

- Oracle has begun a “Bring Your Own License” (BYOL) model that allows license holders to install licensed software on Cloud servers (Amazon, Google, Microsoft, and Oracle’s).

The database upgrade cycle is not as interesting to me as the potential for a Cloud / On-Premise hybrid revenue model that would play to Oracle’s traditional strengths.

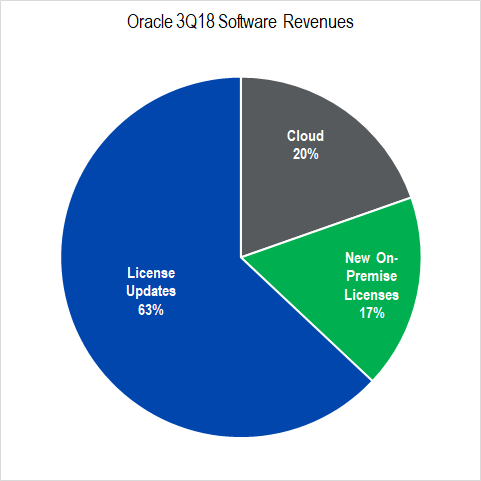

When people talk about Oracle’s software business, they tend to focus on the balance between Cloud software and new On-Premise license sales. However, the biggest part of Oracle’s software revenues is from its “License Updates and Product Supports” segment.

Figure 4. Source: Company Statements, Framework Investing Analysis

Updates represent the heart of Oracle’s software business. The profitability of this segment is phenomenal, so Oracle salespeople have always been willing to offer discounts to license purchasers to make a sale just to get more clients into the Upgrade funnel.

Even though there has been a gradual switch from On-Premise software to Cloud, some clients will never move certain software packages to the Cloud, and for that software, they need to continue to purchase updates and support.

With the BYOL model, a client owns the software, even if it is installed on a Cloud server, so needs to buy an update and service contract for it. Clients like the model as it saves on operational costs compared to a straight Cloud model and saves on capital costs compared to a straight On-Premise model. Oracle likes the model because it allows them to continue feeding its cash cow.

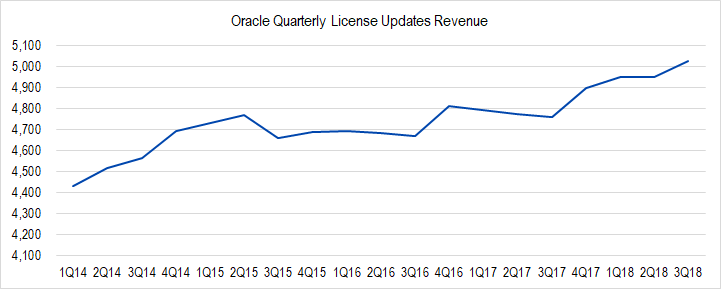

A look at Oracle’s Update segment revenues shows us that they have been turning up over the past few quarters after having been stagnant for several years.

Figure 5. Source: Company Statements, Framework Investing Analysis

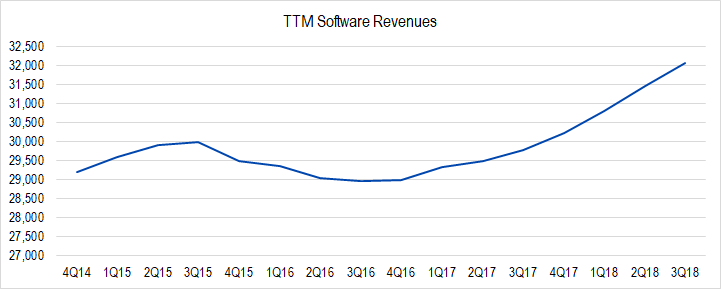

The Software Business

Most investors are so focused on the dynamics of Cloud revenues vis-à-vis competitors that they have failed to notice that Oracle’s software business overall – Cloud, On-Premise, and Updates – is growing again. In fact, Trailing Twelve-Month Revenues are at an historical high and the trajectory looks good.

Figure 6. Source: Company Statements, Framework Investing Analysis

3Q18 software revenues are 11% higher than those recorded in the recent nadir (3Q16).

The Business Overall

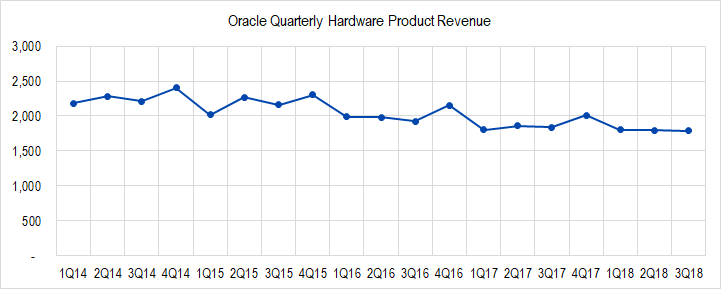

Another bright spot in the 3Q18 earnings was that Hardware revenues, like On-Premise Software revenues, look to be holding their own and are on track to end roughly flat with the prior year.

Figure 7. Source: Company Statements, Framework Investing Analysis

In my mind, the purchase of Sun Microsystem’s hardware business in 2010 has probably already generated a fairly good return for Oracle through sales of bundled engineered systems, whose software ended up funneling into the wildly profitable Updates segment (CTO Ellison claimed this to be true a few years ago, and made a good case for it). In addition, if Oracle does win its suit against Alphabet related to Java patent infringement, it stands to receive damages greater than the amount it paid to acquire Java’s rights in the first place.

In addition, having an integrated hardware / software offering does allow Oracle to tune its databases and applications to operate much more efficiently. Oracle claims that the efficiency gains are so great that end-user costs actually go down compared to buying cheap but inefficient x86 servers. This efficiency gain may serve to boost Oracle’s Infrastructure-as-a-Service and Platform-as-a-Service offerings (equivalent to Amazon’s AWS or Microsoft’s Azure) as well.

All things considered, I thought Oracle’s 3Q18 to contain more positive information than negative.

While 2018 revenues will likely be around my worst-case estimate from two years back, at the current revenue trajectory – mid single-digit growth for the next five years – the company will generate revenues more similar to my present best-case assumptions. Also, as discussed in our note on Oracle’s earnings, profitability has started to head up, suggesting that our worst-case valuation scenario is too pessimistic. As shown in our recent Valuation Waterfall diagram, our best-case valuation range puts Oracle’s intrinsic value in the mid-$50 range, growing at 10% per year.

If Oracle does a better job of controlling what we have long characterized as egregious stock compensation for executives, and the effects of its Cloud and Hardware investments generate better growth and profitability than I have projected, our estimate for Oracle’s intrinsic value starts to edge up to nearly $60 per share, growing at 10% per year.

Notes

* The traditional model for software sales is termed On-Premise. A client bought a license to a software product, installed it on their own servers, and paid extra to be able to receive software updates and upgrades. The Cloud software model is a subscription-based one. The software is not installed on servers owned by the client, but instead, the client purchases access to the software installed on a third-party’s servers.

Cloud is now the most popular choice for new software purchasers because the client need not spend capital resources to buy servers. That said, many businesses continue to run On-Premise software, especially for critical or sensitive information.