Having previously worked together on an investment based on the possible merger of Bayer and Monsanto, Framework Investing and The Brier Fund began a new experiment in mid-August with an eye to making an directional investment in MSCI South Korea Index Fund (EWY).

The Brier Fund saw an opportunity to compare its forecast to the market’s probabilities of this fund’s performance with a particular focus on the market expected probability of increased ETF volatility. As you are aware, there has been an increasing level of “saber rattling” taking place between the Trump administration and North Korea. After sending Erik our initial forecast, he determined that gaps existed between what the market was predicting about the future price of EWY and how the Superforecasters at the Brier Fund saw those price outcomes.

The challenge here is to use Framework 103’s principles on investment structuring to take advantage of the differences in the predicted outcomes. How might we do that here?

Laying Out Structuring Options (no pun intended…well, maybe)

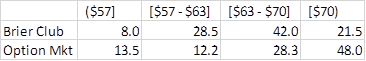

In the table below are the approximate option probabilities compared to Brier Club forecasts (FWI has pulled the data for $57 and below from the put side and the rest from the call side – the numbers add up to around 102%…)

The biggest difference is that the option market sees a roughly 50-50 chance of the security being priced over $70 whereas the Brier Club sees only around a one-in-five chance of that outcome. In addition, the range from $57-$70 is deemed much more likely by the Brier Club than by the market (70% chance vs 40% chance).

This outlook suggests bearish investment strategies, and I think this could be implemented two different ways using options.

- “Short Call Spread”

- “Long Put Option”

For a short call spread, what you would be doing is selling a call struck at $70 / share. At the time of writing, this would have generated a restricted cash inflow of $2.44 when I pulled the prices (restricted because you would have to wait for option expiration to realize the premium inflow). Most brokerages will not allow you to sell a “naked call” option, so you would need to cover that risk by buying a call option at some strike above that. If you bought the call option struck at $80, you would have $10 / share ($1,000 per contract) of capital at risk and would pay probably something around $0.30 for that contract. This implies a net cash inflow of ($2.44 – $0.30 =) $2.14 per share ($214 per contract) and a period return if the entire premium is realized of 21.4%. This is a moderately-levered investment with a limited profit potential.

A variation of this might be to use some of the proceeds to offset the cost of buying a speculative Out-of-the-Money put option. $63 seems to be an important level, so if you bought the $63-strike put option, you would pay $1.98 or so. With this structure, in the way we think about option premia, you will have realized an immediate loss of ($1.98 + $0.30=) $1.28 per share, have a potential cash inflow of $2.44 per share plus a potential capital gain on the long put position (if the ETF fell to that level immediately, you would probably be able to realize at least $2 of profit on the contract per share 100% return; this return is path dependent, and if the security fell to $63 only at option expiration, you would not have any capital gains to offset the realized loss of the option premium); also you would be placing $10 at risk in total, ($2.44 – $1.28=) $1.16 of that is offset by the received premium for a total of $8.84 of original capital at risk. This is a highly-levered investment with the potential for a very high profit (not unlimited, but if a highly negative event drives down the price of EWY before your options expire, you’ll make ~$63 on your original put option investment plus will realize all your premium from the call spread).

For a long put option, you could structure this in various ways. I’d be tempted to structure it as a “synthetic short” structure – buying an ITM put option, let’s say struck at $80 / share. This would have cost somewhere around $12.50 (contract not traded, bid-ask spread wide) and would have risked about $11 of capital (assuming a stock price of around $69 / share) and an immediate realized loss of around $1.50 (from paying money for the time value on the option). If the stock fell to $63 by expiration, you would make $6 / share less the $1.50 paid in premium for a period return of roughly ($4.50 / $11 =) 41%. This is a low-leverage investment with the potential for a very high profit.

Buying an OTM put option is also a possibility, but again the outcome of this investment is path dependent and the premium outlay should be considered an immediate realized loss. You would have to buy the $60-strike option to reduce your immediate realized loss to below the level of the $80-strike’s $1.50. This is a highly-levered investment with the potential for a very high profit.

Again, options offer investors…options… There are various permutations of these strategies that all have their own strengths and weaknesses. The structures shown here are the basic ideas that the Brier team should probably start from in thinking about investment structure design.

Now, as so often happens with best laid plans, life got in the way. Before Brier Fund’s Partners had a chance to discuss the different investment strategies, North Korea fired off a number of missiles, including one that flew over sovereign Japanese territory, Trump threatened to end Kim’s regime with “fire and fury”, Kim threatened to bomb the US airbase on Guam and conducted two nuclear bomb tests, one of them allegedly a hydrogen bomb. If that wasn’t enough, Trump also suggested that the US might withdraw from their trade agreement with South Korea.

All of this necessitated that Brier Fund’s forecast be updated based those events, and interestingly, also by the fact of how resilient EWY’s price had been. A new forecast was sent over to Framework on Sept. 4th and the Brier Fund team will now review its potential structuring strategies.

We will keep you posted on our progress here!