The dog days of summer are upon us. But, that hasn’t stopped the markets from making all time highs driven by the likes of AAPL, FB and others. Earnings season is in full swing and the results have been widely viewed as “stupendous” (hat tip, Mr. President). All this in the midst of more Washington disarray (thank you for that lovely, candid phone call, Mr. Scaramucci) and continued geopolitical instability with another DRPK missile launch and new sanctions upsetting the love-fest with Moscow. Dog days indeed. Ah, the challenges put to we value investors in these times…

Here is a curated list of important stories outside the main headlines that caught our attention this week.

Emerging Value and Margin of Superiority and Why Are Stock Market Prices So High? (GMO Quarterly Letter). Sometimes seasoned, disciplined investors just make sense. And so it is this quarter in the letter from Jeremy Grantham’s management team. They introduce the idea of “margin of superiority” – the amount by which your best idea is superior to the next best investment idea in your portfolio. This concept is particularly important when valuations are high and the corresponding future returns are forecast to be low. That is indeed right where we are. In “normal” times, the benefits of diversification across ideas tend to dominate. Said differently, the cost of moving from your best idea to your second best idea is low. But in times where valuations become extended, the benefits of diversification can fall (you’re buying market risk and the market’s valuation is extended). In that case you might find the cost of moving to your second best idea from your best idea to be quite high. This is an important portfolio management concept and why, if you’re looking at our own portfolios, we tend toward single names we understand vs. overweighting index investments at times like these.

As if that wasn’t enough, the deeply experienced Mr. Grantham takes a hard look at the behavioral drivers of P/E ratios. This is a superb reminder that investors can be irrational, herding animals when someone starts to feel like they are the only one missing out on getting rich.

A Dim Outlook for Trumponomics (Project Syndicate – Nouriel Roubini). You must know by now that we love the stuff that doesn’t make the headlines. Roubini, widely known as Dr. Doom these days, takes you through a quick, thoughtful and insightful summary of where are and his view of the “disconnect between the performance of the financial markets and the real” market – the underlying economy. Roubini pays attention to macro things in a way that we here do not and he’s been right more than wrong during his years of doing this. It is most helpful to see the connections he makes between disparate parts of the capital markets and the economy that can often appear unrelated to one another. In the end, financial market asset values are growing well beyond the pace of the economy that is supporting them. That creates conditions that are ripe for a correction – either the economy catches up (a scenario Roubini deems unlikely) or the markets “catch down”.

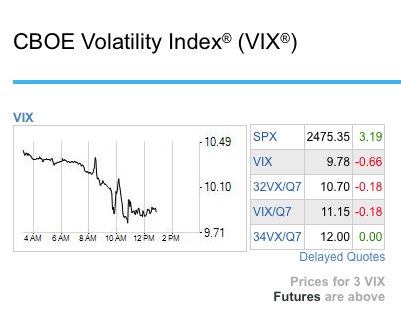

Please Stop Talking About the VIX So Much (AQR Cliff’s Perspective). The VIX index has been plumbing its historical lows now for the better part of the summer. It’s currently trading around 9.7 today. Applied Quantitative Research’s (better known as AQR) CEO, Cliff Asness has written a short post about what this number really means. This is a quick read and is focused on debumking how the VIX index is talked about on “bubblevision” vs. what it’s limited perspective actually tells us about the markets. This is important for two reasons – first the VIX does tell us, as investors, something important about market internals in a backward looking, moment to moment sort of way, and second, it reminds us that we must carefully question the conclusions people draw from numbers and ask, “is that really what that number tells me?”.

Shakeup at SEC Could Make it Easier to Get That ETF Approved (Bloomberg). Passive investing has been all the rage for the last few years and this has been widely supported by the growth of the “robe-advisor” service space. An investor can use ETF’s to gain exposure to anything from equity sectors to public debts to commodities. We have written some in the past about the watch outs for ETF and Index investors – particularly in that you must read the prospectus carefully so that you KNOW WHAT YOU OWN. Physical replication of indices vs. synthetic is the issue here. There are also price discovery concerns with assets that are in high demand through ETF’s and Indices. This is the challenge for consumers and regulators. To this point, the SEC has gone cautiously about its approval process for new ETF’s. That said, well over 125 ETFs/ETNs have already been launched with their approval in the first half of the year (source: ETF.com). A renewed focus on “investor choice” could see the number of these “non-vanilla” basket creation strategies come back on the table. While that is good for choice, we’re not sure it’s good for investing. Keep your eyes open and read the fine print.