“The secret of making money is to avoid risks; you have to take risks when you spend it.”

– Warren Buffett.

Buffett’s quote says it all. Investment portfolios that make money avoid risks. We are going to look at two portfolio types today: The “Salad Bar” Portfolio vs. A Portfolio that Works With the Market.

Assembling a portfolio of investments can be a fun, almost exciting thing to do. There are so many choices to be made…different sectors, market capitalizations, industries and business models. Like building a new home and outfitting that home, there are endless ways one could spend money. And, also like building a home, everyone has an opinion on how you should do it!

As we explained in our article on Portfolio Design vs. the Efficient Market Hypothesis, the equity market works off of two core principles.

Rule 1: The price is always right. This is provably untrue for individual securities at least and certainly for the market as whole. Otherwise bubbles and crashes would not exist.

Rule 2: There is no free lunch. Translation, it’s bloody difficult to beat the market over a reasonable time horizon. This is provably true. Witness the rush to passive strategies over the last 5 years.

Another way of saying this is that the markets reward knowledge and punish speculation over the long run. If you understand a company, sector, industry or business model very well, then you stand a better than average chance of being able to monetize that knowledge by taking advantage of Rule 1’s shortcomings. You might build your portfolio by taking positions in those things you know well. If you don’t understand anything about an investment opportunity any better than the average bear, then you stand the best chance of making money by hibernating and taking advantage of Rule 2. So you might begin your portfolio by investing simply in broad indices.

Many investors realize that knowledge is important to investing and so they consume information from all corners of the earth. However, knowledge is not information and much of what passes as investment research or insight these days is just information packaged nicely. What happens to these investors is that they invest like going to the salad bar. They know a little bit about everything on the bar and some of it “looks good”, but lingering in the back of their minds is the realization that what they KNOW isn’t much and so they better not go overboard. The result is a portfolio design that looks like this.

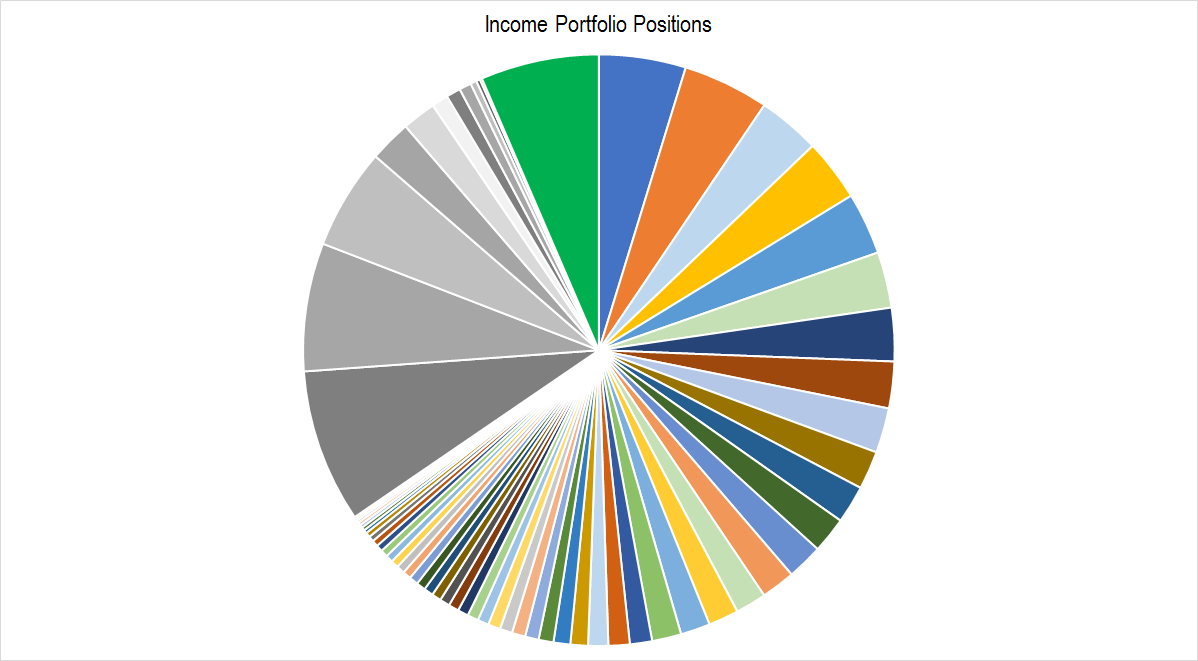

Figure 1.

There are many small positions. There are some funds. There are some “flyer investments” from a golf buddy. Managing a portfolio with so many positions will consume some transaction cost that acts as a drag on returns from the start.

Investment Result: This portfolio design has almost no chance of beating the market because it effectively IS the market with a transaction cost drag added to it.

Risk Result: This portfolio takes on market type risk thanks to it’s wide diversification, but it has little idiosyncratic risk for the same reasons. There is not any place designed into the portfolio with enough size to generate any real return above the market (or “alpha”).

This portfolio design is effectively fighting with the dynamic principles that govern our equity markets. A salad bar approach cannot work, and in situations where the salad bar drifts into companies who’s financial performance is risky, the portfolios are likely to underperform even more because the manager does not have the knowledge base to assess the risk those positions pose to his capital.

Building portfolios that work with the market is not hard, but it does require a less active (no transaction cost drag), more knowledge driven approach. First, there must be some passive or quasi passive element to this type of portfolio. We start with Rule 2 and say, ok, we are just getting going here and we know that there is a benefit to diversification. So we buy an index or some sort of “smart” index as our step 1. This might be a sizeable percentage of a starting out portfolio. Cash, particularly today, acts as a drag, so one might use cost averaging to build this position over some relatively short time period. And from that, we get the market return. Good start!

Now, how do we add alpha? We give ourselves the best chance to “beat the market” when we find opportunities that the market has gotten wrong. The more knowledge we are able to build about those opportunities, the higher the chance that we have uncovered something of value that the market missed. When we understand the key drivers behind how a company makes money and gets it back to shareholders, we give ourselves a better than average chance at accurately forecasting a range of values for that company. Valuation is a subject unto itself and you can find more information on those drivers, the value of valuation ranges and investment structuring in our 100 Series coursework.

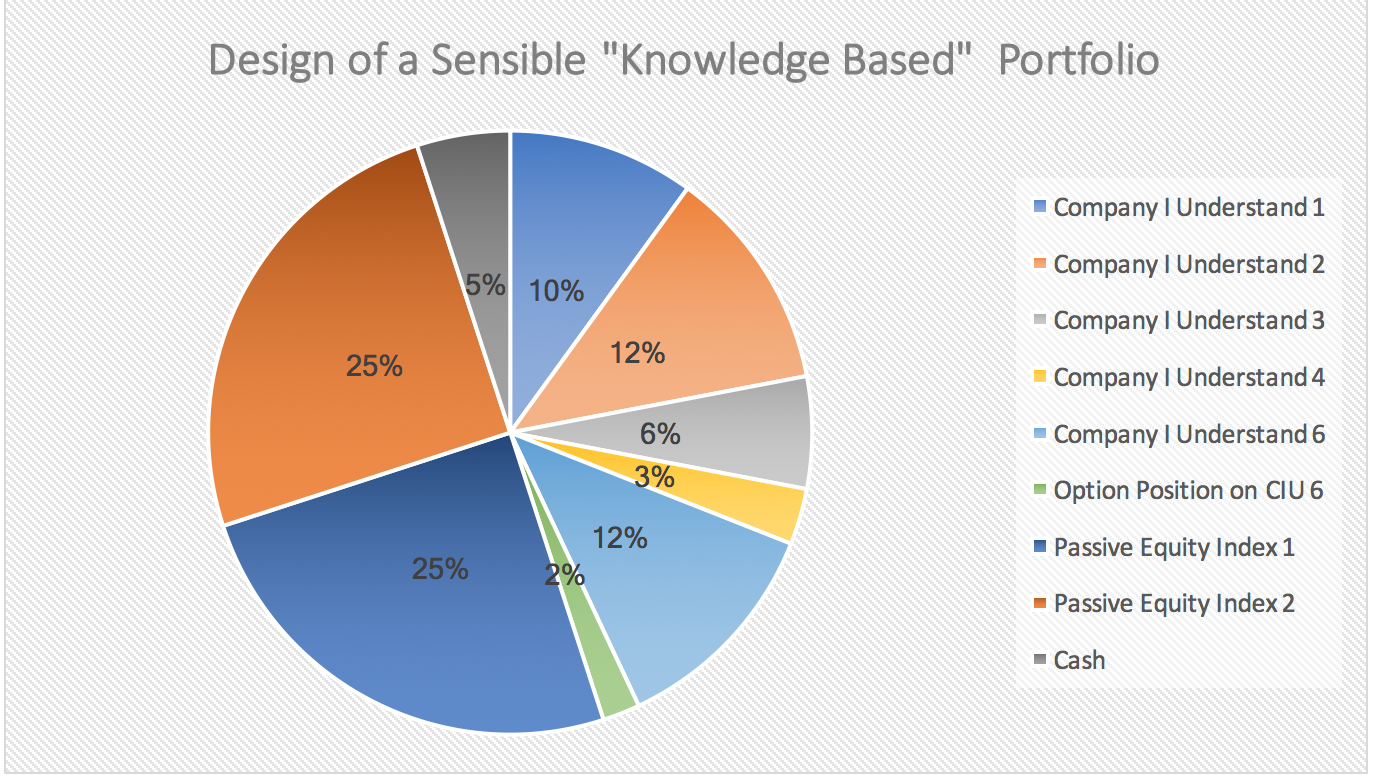

A portfolio that is constructed in this way might look like this:

Figure 2.

Investment Result: This portfolio starts with the market return. Your knowledge about Companies I Understand 1 through 6 gives you a better than average chance of delivering returns in excess of the market on top – particularly if you are able to use sensible amounts of leverage to strengthen those returns (see FWI 103).

Risk Result: Here we build a foundation of market risk and then add idiosyncratic risk through individual postitions that we have understood well. Because these companies have been put through a sound valuation framework and we understand something about their possible RANGES of values, we effectively mitigate the riskiness of the investment. This allows us larger position sizes and the opportunity to employ option leverage to take full advantage of market mispricing.

The power of investing frameworks is that they allow us to build this kind of monetizable knowledge about an investment opportunity. By taking the waterfall of information out there and using a framework to determine what’s actually important, we can begin to turn it into knowledge that we feel confident using.

The portfolio above takes some rather “large” positions in a few single name stocks. But, because you’ve spent time putting those companies through a sound framework, you feel confident that you understand where their value is relative to the current market price.

The rest of the portfolio – well, you’ll get what the broad market gives you and, over time, that’s turned out to be a fine starting point (see Rule 2 above).

The goal is to limit risk and risk is mitigated by real understanding. Risky investments often don’t look risky at all to someone who’s taken the time to understand them. Having a sound framework gives you a head start at being able to develop this kind of portfolio and get control of your investments.