One of the best things about working on Framework Investing is the people I meet. A few years ago, when I conducted my first Option Investing “Boot Camp”, one of the attendees was an analyst at a prestigious Midwestern hedge fund, who struck me (and everyone else attending the seminar) as a smart guy and a savvy investor.

The analyst – Tod Schneider, CFA, CPA – has carved out a specialty in investing in retail – on both the “long” and the “short” sides (i.e., bullish trades as well as bearish) and knows the space very well.

Recently, Schneider has renewed his interest in in L Brands (LB), the parent company of Victoria’s Secret, Bath & Body Works, and Pink, among others.

Victoria’s Secret sells underwear…

L Brands has been suffering lately – Victoria’s Secret’s same-store sales growth flipped from being consistently positive to being consistently negative over the last eight quarters, and L Brands’ stock has taken a hit.

Figure 1.

According to Schneider, Victoria’s Secret’s previous CEO worked hard to cut costs and maximize profits from its line of frilly unmentionables. While boosting profits may sound good, the tastes of the market have shifted, and Victoria’s Secret focus on squeezing profits from its existing lines meant that it failed to respond to consumer demand pivoting to athleisuire wear and bralettes.

Victoria’s Secret is now under the direction of L Brands’ billionaire Chairman and CEO, Les Wexner, a retailing legend who made his fortune by developing some of the strongest names in retail over the last generation – The Limited, Abercrombie & Fitch, and Victoria’s Secret. While these chains may seem more commonplace now, when Wexner was building them, the trend in retail was firmly in favor of multi-line department stores, so his focus on specialty lines and limiting the number products offered was deeply contrarian.

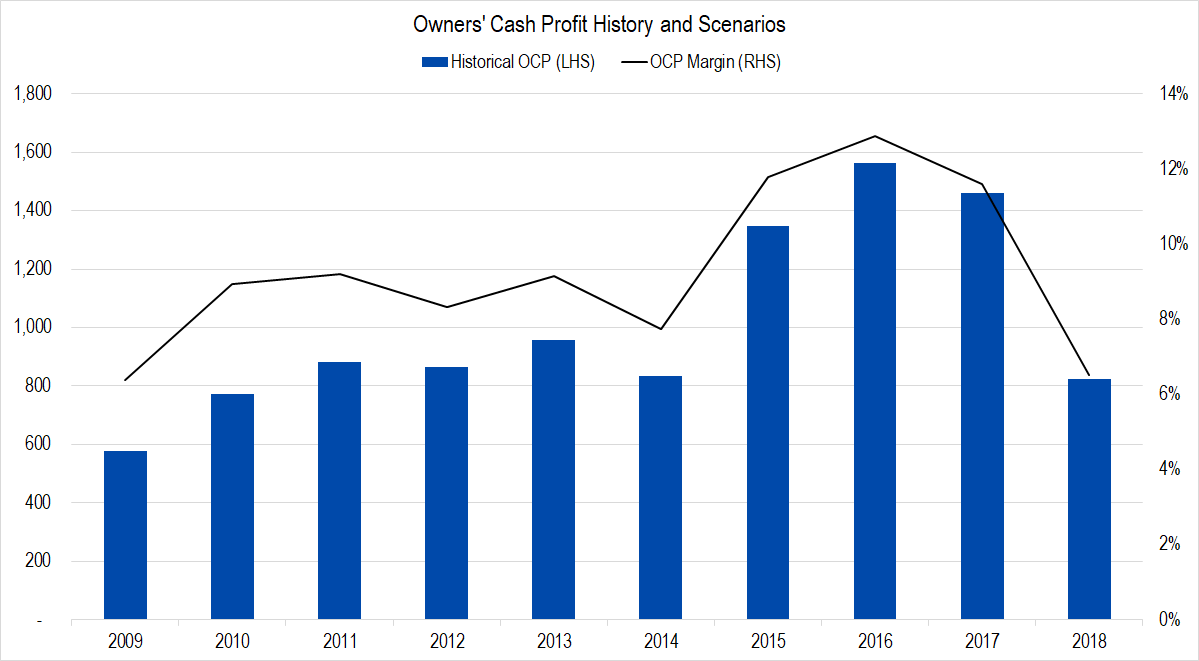

Wexner’s plan for Victoria’s Secret involves focusing on bralettes and athleisure, and on discounting products to increase store traffic. The discounts have notably lowered profit margins, as seen in this chart of L Brands’ historical Owners’ Cash Profits (OCP).

Figure 2. Source: Company Statements, Framework Investing Analysis

While many retailers are being hurt by online competitors – the Amazon Effect – Wexner likes his brick and mortar stores and operates over 3,000 of them under all of his brands.

Some retail analysts are critical of the number of L Brands stores, but Schneider points out that 99% of the locations are cash flow positive, suggesting the physical locations are holding their own against online competitors. While he acknowledges that the company will be forced to shutter some locations, he makes a good argument that taking L Brands’ store count out of context and saying that it is “overstored” is misleading.

It’s worth noting that L Brands also recently announced that it was closing its loss-making Henri Bendel stores in early 2019. Closing these stores and focusing on driving traffic at the firm’s larger brands makes good business sense.

Schneider believes the opportunity in L Brands is asymmetrical – with less of a potential downside than a potential upside – though admits that the short-term is likely to remain difficult, so advises patience. Given his success in investing in this industry, I defer to his opinion.

I have always been shy of retail – an industry that has proven itself to be the Bermuda Triangle of the hedge fund world (e.g., Bill Ackman, Eddie Lampert, Bruce Berkowitz) – but I’d like to run the company’s financials through the Framework model to see how closely my valuation agrees with Schneider’s.

If my opinion differs from that of a multi-billionaire contrarian retail genius and of one of the sharpest investors I’ve ever met, I’ll know that it’s my own view that needs recalibrating.